“It’s coming”: Wall Street titan sounds alarm on economic outlook

- Replies 0

In the intricate dance of global economics, every step, every policy shift, can send ripples across the world's financial markets.

For Americans over 60, who have seen their fair share of economic ups and downs, the words “trade war” can sound an alarm bell that resonates with the echoes of past financial crises.

Jamie Dimon, the seasoned CEO of JPMorgan Chase, has recently voiced his concerns about the potential economic impact of ongoing trade tensions, and it's a topic that demands our attention.

Trade wars are not just about the immediate impact of tariffs on goods; they have deeper, more insidious effects that can undermine the very foundations of economic stability.

Dimon, a titan in the banking industry, has warned that tariffs can lead to lasting negative consequences that go beyond the price tags on imported goods.

"The economy is facing considerable turbulence," Dimon said. "We are likely to see inflationary outcomes ... Whether or not the menu of tariffs causes a recession remains in question, but it will slow down growth."

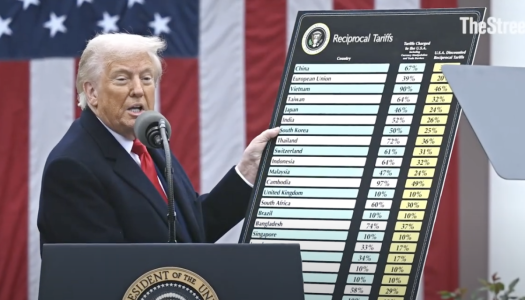

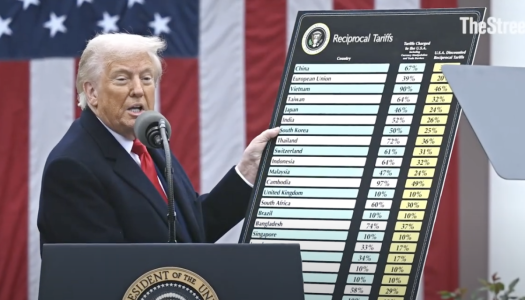

Jamie Dimon's annual shareholder letter came shortly after a sharp global stock market downturn erased trillions in value, triggered by President Donald Trump’s newly imposed tariffs.

According to a source familiar with the matter, Dimon and other top banking executives met with Howard Lutnick in Washington the day after the tariffs were announced to discuss the policy and raise concerns.

The meeting was organized by the Financial Services Forum, a financial industry lobbying group, and was confirmed by both an administration official and the group itself.

At 69, Dimon remains one of the most influential figures in corporate America and has frequently been a go-to adviser for government leaders during periods of economic turmoil.

During the 2024 election cycle, his name was even floated for high-level roles such as Treasury Secretary, though he ultimately chose to remain at JPMorgan Chase.

Several other prominent Wall Street figures voiced concern amid the market downturn. On Monday, BlackRock CEO Larry Fink warned that stocks might drop another 20%, citing a general consensus among fellow executives that the U.S. economy is likely "already in a recession."

Billionaire investor Bill Ackman, a Trump supporter during the presidential race, described the tariff move as potentially triggering an "economic nuclear winter."

Meanwhile, hedge fund founder Boaz Weinstein told Bloomberg that an economic "avalanche" may have just been set in motion.

Ackman urged the president to delay the tariffs while renegotiating trade agreements, warning on social media that the tariffs could hinder business investment and consumer spending, ultimately "severely damaging" the United States' reputation for years.

Weinstein, citing the potential for economic uncertainty, warned that credit spreads could widen, possibly leading to a severe recession. "I'm very concerned about a crash," he stated.

Investor Stanley Druckenmiller expressed on social media that he did not support tariffs higher than 10%. Hedge fund manager James Chanos called the threat of escalation a "very big deal" after Trump mentioned the possibility of additional tariffs on China.

Following Trump's announcement of the trade barriers, JPMorgan economists raised the likelihood of a US and global recession this year from 40% to 60%.

Dimon emphasized, "The quicker this issue is resolved, the better because some of the negative effects increase cumulatively over time and would be hard to reverse."

Dimon also highlighted risks from the tariffs, including ongoing inflation, large fiscal deficits, and the potential damage to economic confidence, investments, capital flows, corporate profits, and the dollar.

Separately, Dimon and Bank of America's CEO Brian Moynihan, along with other major bank executives, held a call on Sunday to discuss the tariffs, according to sources familiar with the matter.

The call was organized by the Bank Policy Institute, a group representing large US lenders.

Source: CNBC Television / Youtube.

JPMorgan will release its first-quarter results on Friday after posting a record annual profit last year.

Dimon cautioned that expectations for the US to avoid a recession could be upended, writing, "Markets still seem to be pricing assets with the assumption that we will continue to have a fairly soft landing. I am not so sure."

In earlier news: "Liberation Day" shock: Discover the 2 surprising tariffs Trump just unveiled on April 2nd!

Have you felt the impact of the trade war on your wallet or investments? Share your thoughts and experiences in the comments below!

For Americans over 60, who have seen their fair share of economic ups and downs, the words “trade war” can sound an alarm bell that resonates with the echoes of past financial crises.

Jamie Dimon, the seasoned CEO of JPMorgan Chase, has recently voiced his concerns about the potential economic impact of ongoing trade tensions, and it's a topic that demands our attention.

Trade wars are not just about the immediate impact of tariffs on goods; they have deeper, more insidious effects that can undermine the very foundations of economic stability.

Dimon, a titan in the banking industry, has warned that tariffs can lead to lasting negative consequences that go beyond the price tags on imported goods.

"The economy is facing considerable turbulence," Dimon said. "We are likely to see inflationary outcomes ... Whether or not the menu of tariffs causes a recession remains in question, but it will slow down growth."

JPMorgan Chase CEO Jamie Dimon has warned about the economic impact of a trade war and the potential for it to lead to a recession. Image source: TheStreet / Youtube.

Jamie Dimon's annual shareholder letter came shortly after a sharp global stock market downturn erased trillions in value, triggered by President Donald Trump’s newly imposed tariffs.

According to a source familiar with the matter, Dimon and other top banking executives met with Howard Lutnick in Washington the day after the tariffs were announced to discuss the policy and raise concerns.

The meeting was organized by the Financial Services Forum, a financial industry lobbying group, and was confirmed by both an administration official and the group itself.

At 69, Dimon remains one of the most influential figures in corporate America and has frequently been a go-to adviser for government leaders during periods of economic turmoil.

During the 2024 election cycle, his name was even floated for high-level roles such as Treasury Secretary, though he ultimately chose to remain at JPMorgan Chase.

Several other prominent Wall Street figures voiced concern amid the market downturn. On Monday, BlackRock CEO Larry Fink warned that stocks might drop another 20%, citing a general consensus among fellow executives that the U.S. economy is likely "already in a recession."

Billionaire investor Bill Ackman, a Trump supporter during the presidential race, described the tariff move as potentially triggering an "economic nuclear winter."

Meanwhile, hedge fund founder Boaz Weinstein told Bloomberg that an economic "avalanche" may have just been set in motion.

Dimon cautions that tariffs can have lasting negative consequences on economic confidence and investments. Image source: TheStreet / Youtube.

Ackman urged the president to delay the tariffs while renegotiating trade agreements, warning on social media that the tariffs could hinder business investment and consumer spending, ultimately "severely damaging" the United States' reputation for years.

Weinstein, citing the potential for economic uncertainty, warned that credit spreads could widen, possibly leading to a severe recession. "I'm very concerned about a crash," he stated.

Investor Stanley Druckenmiller expressed on social media that he did not support tariffs higher than 10%. Hedge fund manager James Chanos called the threat of escalation a "very big deal" after Trump mentioned the possibility of additional tariffs on China.

Following Trump's announcement of the trade barriers, JPMorgan economists raised the likelihood of a US and global recession this year from 40% to 60%.

Dimon emphasized, "The quicker this issue is resolved, the better because some of the negative effects increase cumulatively over time and would be hard to reverse."

Dimon also highlighted risks from the tariffs, including ongoing inflation, large fiscal deficits, and the potential damage to economic confidence, investments, capital flows, corporate profits, and the dollar.

Separately, Dimon and Bank of America's CEO Brian Moynihan, along with other major bank executives, held a call on Sunday to discuss the tariffs, according to sources familiar with the matter.

The call was organized by the Bank Policy Institute, a group representing large US lenders.

Source: CNBC Television / Youtube.

JPMorgan will release its first-quarter results on Friday after posting a record annual profit last year.

Dimon cautioned that expectations for the US to avoid a recession could be upended, writing, "Markets still seem to be pricing assets with the assumption that we will continue to have a fairly soft landing. I am not so sure."

In earlier news: "Liberation Day" shock: Discover the 2 surprising tariffs Trump just unveiled on April 2nd!

Key Takeaways

- JPMorgan Chase CEO Jamie Dimon has warned about the economic impact of a trade war and the potential for it to lead to a recession.

- Dimon cautions that tariffs can have lasting negative consequences on economic confidence and investments.

- He expresses a desire for the trade disputes to be resolved quickly for the benefit of the economy.

- US bank CEOs, including Dimon, met with Commerce Secretary Lutnick after tariffs were announced, highlighting the financial sector's concern over the policy.

Have you felt the impact of the trade war on your wallet or investments? Share your thoughts and experiences in the comments below!