2025 Social Security check sizes to be revealed soon—what you need to know

By

Aubrey Razon

- Replies 0

With 2025 fast approaching, key changes to Social Security and Medicare could impact your finances. Staying ahead of these updates is crucial for anyone relying on benefits.

At The GrayVine, we’re here to help you navigate what’s ahead and how it could affect your financial future.

These notices will be available both online for those with My Social Security accounts and via traditional mail.

This year, the SSA is streamlining the process with a one-page notice that will clearly state the new benefit amounts, including any deductions, and the exact dates you can expect to receive them.

You can read about the finalized payment schedule of Social Security benefits here.

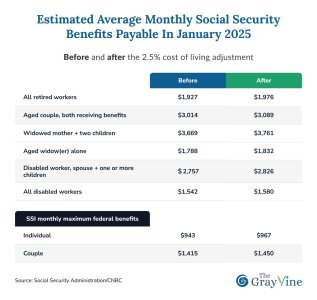

More than 72.5 million Americans will see a 2.5% increase in their Social Security and Supplemental Security Income checks.

While a 2.5% increase may seem modest, especially compared to the 8.7% COLA in 2023 and 5.9% in 2022, it reflects the ebb and flow of the economy.

The COLA is based on government inflation data, and as inflation rates have decreased, so too has the COLA.

However, should inflation rates climb again, future COLAs may increase accordingly.

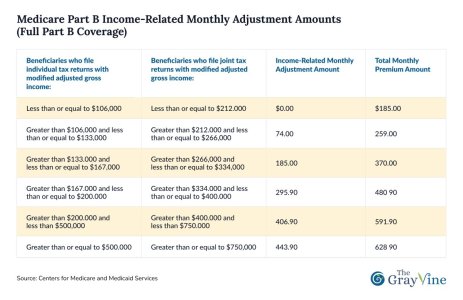

The standard monthly Part B premium will rise to $185, a $10.30 increase from the previous year. Additionally, the annual deductible will increase to $257, up $17 from 2024.

These premiums are based on your modified adjusted gross income (MAGI) from two years prior.

For 2025, individuals with a MAGI of $106,000 or less, or married couples with $212,000 or less, will pay the standard premium.

Those with higher incomes will face income-related adjustment amounts (IRMAA), which could further increase monthly premiums.

In related news, Social Security is shifting benefits away from some retirees. Read more about this story here.

Benefits are taxed based on a formula that includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits.

Depending on your combined income, you may not owe taxes on your benefits, or you could be taxed on up to 85% of them.

With the Federal Reserve's recent rate hikes, retirees with significant savings in money market accounts or certificates of deposit may see increased interest payments, potentially pushing them into a higher tax bracket for their benefits.

Proactive tax planning, such as investing in tax-deferred annuities or adjusting IRA withdrawals, can help manage this tax impact.

Discover more little-known ways to keep your Social Security tax-free here.

The SSA allows beneficiaries to report life-changing events that affect income and Medicare premiums by submitting Form SSA-44.

This can ensure that your premiums reflect your current financial situation.

In a related story, find out when exactly you will receive your Social Security payments in December.

Have you received your benefit notice yet? Are there strategies you've found helpful in managing the tax impact on your benefits? Share your experiences and tips in the comments below.

At The GrayVine, we’re here to help you navigate what’s ahead and how it could affect your financial future.

Anticipating your 2025 Social Security benefits

The Social Security Administration (SSA) is set to send out notices detailing the changes in benefit amounts for 2025.These notices will be available both online for those with My Social Security accounts and via traditional mail.

This year, the SSA is streamlining the process with a one-page notice that will clearly state the new benefit amounts, including any deductions, and the exact dates you can expect to receive them.

You can read about the finalized payment schedule of Social Security benefits here.

Understanding the cost-of-living adjustment (COLA)

One of the most significant changes for 2025 is the cost-of-living adjustment (COLA).More than 72.5 million Americans will see a 2.5% increase in their Social Security and Supplemental Security Income checks.

While a 2.5% increase may seem modest, especially compared to the 8.7% COLA in 2023 and 5.9% in 2022, it reflects the ebb and flow of the economy.

The COLA is based on government inflation data, and as inflation rates have decreased, so too has the COLA.

However, should inflation rates climb again, future COLAs may increase accordingly.

Medicare Part B premiums and deductibles on the rise

For retirees enrolled in Medicare Part B, which covers a range of medical services, it's important to note that monthly premiums and annual deductibles will also see an uptick in 2025.The standard monthly Part B premium will rise to $185, a $10.30 increase from the previous year. Additionally, the annual deductible will increase to $257, up $17 from 2024.

These premiums are based on your modified adjusted gross income (MAGI) from two years prior.

For 2025, individuals with a MAGI of $106,000 or less, or married couples with $212,000 or less, will pay the standard premium.

Those with higher incomes will face income-related adjustment amounts (IRMAA), which could further increase monthly premiums.

In related news, Social Security is shifting benefits away from some retirees. Read more about this story here.

Tax considerations for Social Security benefits

It's also essential to consider the tax implications of your Social Security benefits.Benefits are taxed based on a formula that includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits.

Depending on your combined income, you may not owe taxes on your benefits, or you could be taxed on up to 85% of them.

With the Federal Reserve's recent rate hikes, retirees with significant savings in money market accounts or certificates of deposit may see increased interest payments, potentially pushing them into a higher tax bracket for their benefits.

Proactive tax planning, such as investing in tax-deferred annuities or adjusting IRA withdrawals, can help manage this tax impact.

Discover more little-known ways to keep your Social Security tax-free here.

What to do if your income has changed

If your income has changed significantly in the past couple of years, your Medicare Part B premium rate may need an update.The SSA allows beneficiaries to report life-changing events that affect income and Medicare premiums by submitting Form SSA-44.

This can ensure that your premiums reflect your current financial situation.

In a related story, find out when exactly you will receive your Social Security payments in December.

Key Takeaways

- Social Security beneficiaries will receive notices with details of their 2025 benefit checks, reflecting a 2.5% cost-of-living adjustment and new Medicare Part B premium rates.

- Notices will be available online and mailed out in December, featuring a new streamlined one-page format including specific payment and deduction information.

- The cost-of-living adjustment of 2.5% for 2025 is the lowest since 2021, with the trend reflecting moderated inflation rates.

- Changes in Medicare Part B will see the standard monthly premium rise to $185, and individuals with higher incomes will face increased premium payments due to income-related adjustments.

Last edited: