A $35M fraud suspect made a wild move when agents closed in—here’s how it ended

- Replies 0

If you thought you’d heard every scam story under the sun, think again.

This one spiraled into a $35 million Ponzi scheme that left countless victims in its wake.

Somewhere along the way, there was a Yamaha underwater scooter, a lake escape attempt, and a disguise that involved more desperation than genius.

Even as federal agents closed in, the man behind it all seemed convinced he could vanish without a trace.

Meet Matthew Piercey, a California scam artist whose downfall reads like the script for a rejected Mission: Impossible sequel—minus the happy ending.

From 2015 to 2020, Piercey, now 48, ran an elaborate Ponzi scheme, luring investors into his companies with promises of “guaranteed returns.”

The truth? He was using money from new victims to pay off old ones—a textbook scam with devastating consequences.

Out of the $35 million he collected, he returned just $8.8 million. The rest? Gone—blown on personal luxuries, business fronts, legal fees, and even two homes.

Victims were left financially wrecked, many having handed over their life savings.

But what truly set Piercey apart was his attempted escape when the FBI closed in.

In November 2020, instead of surrendering, he led agents on a chaotic car chase through Redding, CA.

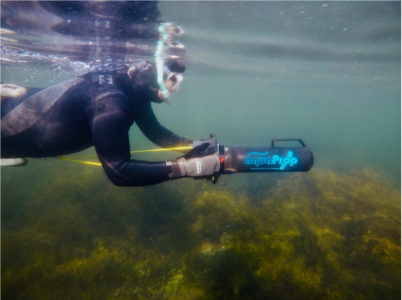

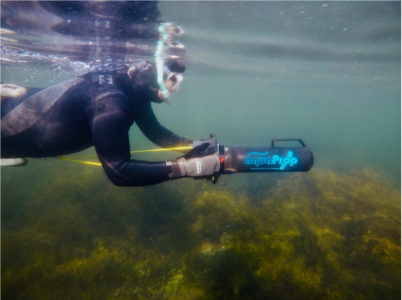

When that didn’t work, he jumped out, sprinted towards a lake and dove in—with a Yamaha 350LI underwater scooter in hand.

Yes, really. The submersible, meant for recreational divers, can glide underwater at around 4 mph. For 20 bizarre minutes, agents watched a trail of bubbles as Piercey vanished below the surface, clinging to his glorified sea toy in hopes of disappearing.

Spoiler alert: it didn’t work. He resurfaced cold, tired, and out of options—and was immediately arrested.

Even behind bars, Piercey kept scheming.

Using coded language in jailhouse conversations, he instructed two associates to “take actions” involving a U-Haul storage locker. The FBI got there first.

Also read: Is your phone at risk? 1.8 billion users warned to turn off this dangerous setting immediately

What did they find? A wig, likely for a disguise. ₣31,000 in Swiss francs — nearly $37,000 in foreign cash.

A clear sign Piercey was planning a longer, more permanent disappearance.

As outrageous as the story sounds, the damage isn’t fiction. FBI Special Agent Sid Patel put it plainly:

“Many invested their life savings with Matthew Piercey’s companies, not knowing that the claim of guaranteed returns were the empty promises of a Ponzi scheme.”

These weren’t hedge fund gamblers—they were regular people. Retirees. Families. Workers trying to grow their nest egg. And Piercey cashed in on their trust.

Piercey has pleaded guilty to wire fraud, money laundering, and witness tampering. His sentencing is scheduled for September, 2025.

He faces: Up to 20 years in prison and a $250,000 fine per count, or twice the total fraud amount—whichever is greater

Justice is finally catching up—no scooter required.

Read next: Elder fraud case: Personal assistant accused of stealing $10M—see the shocking thing she brought to court

Got a story to share? Ever been pitched a shady “can’t-miss” investment? We want to hear about it. Drop your experience, tips, or questions in the comments—and help keep the GrayVine community scam-savvy and sharp.

This one spiraled into a $35 million Ponzi scheme that left countless victims in its wake.

Somewhere along the way, there was a Yamaha underwater scooter, a lake escape attempt, and a disguise that involved more desperation than genius.

Even as federal agents closed in, the man behind it all seemed convinced he could vanish without a trace.

Meet Matthew Piercey, a California scam artist whose downfall reads like the script for a rejected Mission: Impossible sequel—minus the happy ending.

From 2015 to 2020, Piercey, now 48, ran an elaborate Ponzi scheme, luring investors into his companies with promises of “guaranteed returns.”

The truth? He was using money from new victims to pay off old ones—a textbook scam with devastating consequences.

Out of the $35 million he collected, he returned just $8.8 million. The rest? Gone—blown on personal luxuries, business fronts, legal fees, and even two homes.

This one spiraled into a $35 million Ponzi scheme that left countless victims in its wake. Image source: Espen Bierud / Unsplash

Victims were left financially wrecked, many having handed over their life savings.

But what truly set Piercey apart was his attempted escape when the FBI closed in.

In November 2020, instead of surrendering, he led agents on a chaotic car chase through Redding, CA.

When that didn’t work, he jumped out, sprinted towards a lake and dove in—with a Yamaha 350LI underwater scooter in hand.

Yes, really. The submersible, meant for recreational divers, can glide underwater at around 4 mph. For 20 bizarre minutes, agents watched a trail of bubbles as Piercey vanished below the surface, clinging to his glorified sea toy in hopes of disappearing.

Spoiler alert: it didn’t work. He resurfaced cold, tired, and out of options—and was immediately arrested.

Even behind bars, Piercey kept scheming.

Using coded language in jailhouse conversations, he instructed two associates to “take actions” involving a U-Haul storage locker. The FBI got there first.

Also read: Is your phone at risk? 1.8 billion users warned to turn off this dangerous setting immediately

What did they find? A wig, likely for a disguise. ₣31,000 in Swiss francs — nearly $37,000 in foreign cash.

A clear sign Piercey was planning a longer, more permanent disappearance.

As outrageous as the story sounds, the damage isn’t fiction. FBI Special Agent Sid Patel put it plainly:

“Many invested their life savings with Matthew Piercey’s companies, not knowing that the claim of guaranteed returns were the empty promises of a Ponzi scheme.”

These weren’t hedge fund gamblers—they were regular people. Retirees. Families. Workers trying to grow their nest egg. And Piercey cashed in on their trust.

Piercey has pleaded guilty to wire fraud, money laundering, and witness tampering. His sentencing is scheduled for September, 2025.

He faces: Up to 20 years in prison and a $250,000 fine per count, or twice the total fraud amount—whichever is greater

Justice is finally catching up—no scooter required.

Read next: Elder fraud case: Personal assistant accused of stealing $10M—see the shocking thing she brought to court

Key Takeaways

- Matthew Piercey pleaded guilty to wire fraud, money laundering, and witness tampering after orchestrating a $35 million Ponzi scheme from 2015–2020.

- When FBI agents moved in, he tried to escape using an underwater scooter in Lake Shasta before being caught.

- From jail, he attempted to cover his tracks by using code to instruct associates to retrieve items—including a wig and $37,000 in Swiss francs — from his storage unit.

- Piercey is due to be sentenced in September 2025 and could face 20 years in prison and massive fines.

Got a story to share? Ever been pitched a shady “can’t-miss” investment? We want to hear about it. Drop your experience, tips, or questions in the comments—and help keep the GrayVine community scam-savvy and sharp.