A single text message cost this retiree $27,000—how to avoid the same trap

By

Veronica E.

- Replies 0

It started like any ordinary day.

Dave, a retiree from Peoria, Arizona, was enjoying a quiet morning when a text arrived on his phone.

It claimed to be from his bank, asking about a $399 charge he didn’t recognize.

Doing what most of us would, he replied “NO.”

But what happened next unraveled into a financial nightmare—and a stark reminder of how easy it can be to fall victim to today’s sophisticated scams.

A convincing message—and a costly mistake

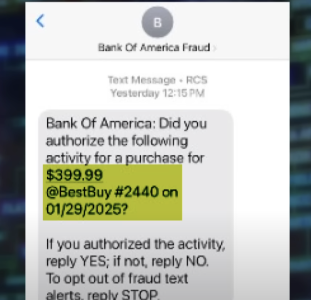

The text looked official.

It referenced a purchase at Best Buy and gave Dave the option to confirm or deny the charge.

After replying “NO,” he received a phone call from someone claiming to be from Bank of America’s fraud department.

The caller was calm, professional, and even shared a fake employee ID.

Then came the real damage: the scammer urged Dave to withdraw his life savings and move it to a “secure account” using Apple Wallet to prevent supposed theft by a rogue bank employee.

Also read: TSA PreCheck scam warning: Travelers urged to watch for fake renewal websites

Manipulated into his own scam

Under pressure and afraid of losing his money, Dave followed instructions.

He stayed on the line with the scammer while withdrawing $27,000—everything he had—and depositing it into an account that turned out to be completely fake.

By the time he realized something was wrong, the money was gone.

According to Detective Michael Finney, the fraudsters “basically turned his phone into a weapon to hold him hostage.”

Also read: Watch out for this "how are you" message—It could be a scam in disguise

One rare recovery—thanks to swift action

Most victims in cases like this never see their money again.

But Dave got lucky.

Thanks to an extended police investigation, about 90% of his funds were recovered five months later.

Authorities traced the fraud to Florida, but the investigation is still ongoing. Dave’s case is the exception, not the rule—most scam losses are irreversible, especially after the first 72 hours.

Also read: That letter about missing money might not be a scam—here’s what to know

How scammers win: urgency, fear, and fake authority

What makes this kind of scam so effective is how real it all feels.

The text mimics the tone and style of genuine bank alerts.

The caller pretends to be helpful, building trust quickly.

And everything moves fast—so fast that victims don’t have time to stop and think.

The scam depends on panic, confusion, and the illusion of official authority.

Also read: Maryland man loses $40K to convincing scam—here’s how to protect yourself

How to protect yourself from text-based scams

Fraud experts and major banks say the best defense is caution.

Here are some of the most important tips to stay safe:

1. Always verify with official sources

If you get a suspicious message, don’t reply or use the number it provides.

Instead, call your bank using the number on the back of your card or sign in to your official banking app.

2. Never share sensitive info

Don’t give out your Social Security number, PINs, passwords, or account details unless you initiated the call and know exactly who you’re speaking with.

3. Slow down and think

Scammers create a false sense of urgency. Take a moment to breathe, step away, and call someone you trust before acting.

4. Consider freezing your credit

This extra step can prevent new accounts from being opened in your name, especially if your personal data has been compromised in the past.

5. Break the silence

Talk about scams with friends and family.

Sharing what happened to you—or hearing what happened to others—can help everyone stay more alert.

6. Know the classic warning signs

Any message urging you to transfer money to a “secure account” or stay on the phone during transactions is almost certainly a scam.

Trust your instincts—if it feels off, it probably is.

Also read: Amazon warns Prime customers of rise in scam attempts: What to know and how to stay safe

What to do if you think you’ve been scammed

If you ever find yourself in a similar situation, quick action matters.

Contact your bank immediately.

Report the scam to the Federal Trade Commission and your local police.

Change your passwords and monitor your bank and credit accounts for suspicious activity.

You can also place a fraud alert or freeze your credit with Equifax, Experian, and TransUnion.

In a world where our phones are always within reach, they can be both a convenience and a vulnerability.

Stories like Dave’s are unsettling—but they’re also powerful reminders that knowledge and caution go a long way.

Read next: She lost $51K to a home repair scam—what happened and how to protect yourself

Have you or someone you know ever dealt with a scam like this? Share your experiences or safety tips in the comments so others can stay one step ahead.

Dave, a retiree from Peoria, Arizona, was enjoying a quiet morning when a text arrived on his phone.

It claimed to be from his bank, asking about a $399 charge he didn’t recognize.

Doing what most of us would, he replied “NO.”

But what happened next unraveled into a financial nightmare—and a stark reminder of how easy it can be to fall victim to today’s sophisticated scams.

Dave, a retiree from Arizona, shared his story to help others avoid falling for phone-based scams. Image source: YouTube / 12 News.

A convincing message—and a costly mistake

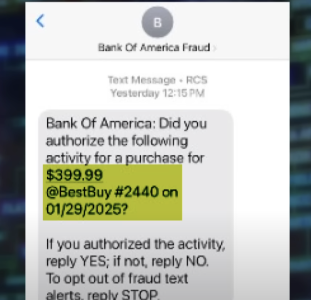

The text looked official.

It referenced a purchase at Best Buy and gave Dave the option to confirm or deny the charge.

After replying “NO,” he received a phone call from someone claiming to be from Bank of America’s fraud department.

The caller was calm, professional, and even shared a fake employee ID.

Then came the real damage: the scammer urged Dave to withdraw his life savings and move it to a “secure account” using Apple Wallet to prevent supposed theft by a rogue bank employee.

Also read: TSA PreCheck scam warning: Travelers urged to watch for fake renewal websites

Manipulated into his own scam

Under pressure and afraid of losing his money, Dave followed instructions.

He stayed on the line with the scammer while withdrawing $27,000—everything he had—and depositing it into an account that turned out to be completely fake.

By the time he realized something was wrong, the money was gone.

According to Detective Michael Finney, the fraudsters “basically turned his phone into a weapon to hold him hostage.”

Also read: Watch out for this "how are you" message—It could be a scam in disguise

One rare recovery—thanks to swift action

Most victims in cases like this never see their money again.

But Dave got lucky.

Thanks to an extended police investigation, about 90% of his funds were recovered five months later.

Authorities traced the fraud to Florida, but the investigation is still ongoing. Dave’s case is the exception, not the rule—most scam losses are irreversible, especially after the first 72 hours.

A single fake text message, disguised as a fraud alert, was all it took to trigger the scam. Image source: YouTube / 12 News.

Also read: That letter about missing money might not be a scam—here’s what to know

How scammers win: urgency, fear, and fake authority

What makes this kind of scam so effective is how real it all feels.

The text mimics the tone and style of genuine bank alerts.

The caller pretends to be helpful, building trust quickly.

And everything moves fast—so fast that victims don’t have time to stop and think.

The scam depends on panic, confusion, and the illusion of official authority.

Also read: Maryland man loses $40K to convincing scam—here’s how to protect yourself

How to protect yourself from text-based scams

Fraud experts and major banks say the best defense is caution.

Here are some of the most important tips to stay safe:

1. Always verify with official sources

If you get a suspicious message, don’t reply or use the number it provides.

Instead, call your bank using the number on the back of your card or sign in to your official banking app.

2. Never share sensitive info

Don’t give out your Social Security number, PINs, passwords, or account details unless you initiated the call and know exactly who you’re speaking with.

3. Slow down and think

Scammers create a false sense of urgency. Take a moment to breathe, step away, and call someone you trust before acting.

Take a moment to pause and think—scammers rely on panic to push you into quick decisions. Image source: Pexels / Kampus Production.

4. Consider freezing your credit

This extra step can prevent new accounts from being opened in your name, especially if your personal data has been compromised in the past.

5. Break the silence

Talk about scams with friends and family.

Sharing what happened to you—or hearing what happened to others—can help everyone stay more alert.

6. Know the classic warning signs

Any message urging you to transfer money to a “secure account” or stay on the phone during transactions is almost certainly a scam.

Trust your instincts—if it feels off, it probably is.

Also read: Amazon warns Prime customers of rise in scam attempts: What to know and how to stay safe

What to do if you think you’ve been scammed

If you ever find yourself in a similar situation, quick action matters.

Contact your bank immediately.

Report the scam to the Federal Trade Commission and your local police.

Change your passwords and monitor your bank and credit accounts for suspicious activity.

You can also place a fraud alert or freeze your credit with Equifax, Experian, and TransUnion.

In a world where our phones are always within reach, they can be both a convenience and a vulnerability.

Stories like Dave’s are unsettling—but they’re also powerful reminders that knowledge and caution go a long way.

Read next: She lost $51K to a home repair scam—what happened and how to protect yourself

Key Takeaways

- A retiree in Arizona lost $27,000 after receiving a scam text and following instructions from a fake bank representative over the phone.

- The scammers convinced him to withdraw his money and deposit it into a fraudulent account, all while staying on the phone with him.

- Thanks to swift police work, about 90% of his savings were recovered—a rare outcome for scam victims.

- Experts recommend verifying suspicious messages with your bank directly, never sharing sensitive information, and staying alert to red flags like urgent money transfer requests.

Have you or someone you know ever dealt with a scam like this? Share your experiences or safety tips in the comments so others can stay one step ahead.