Imagine standing at your local bank, withdrawal slip in hand, about to hand over $15,000 of your hard-earned savings—all because someone on the other end of the phone convinced you it was the only way to protect your money.

That’s exactly where one Tampa resident found himself, caught in a sophisticated “cash bag” scam. If not for one quick-thinking move, he could have lost it all.

Let’s break down how this scam works, the red flags you need to watch for, and the simple steps you can take to keep your money safe.

A close call that could happen to anyone

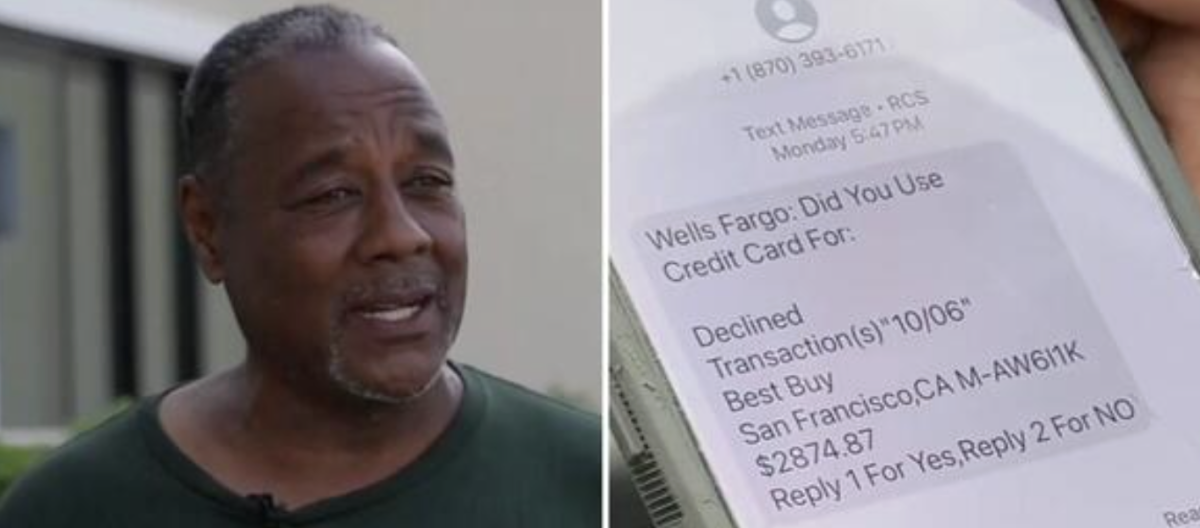

Moses Harmon, a hardworking landscaping business owner, received a text message asking if he made a $2,800 purchase at Best Buy. The message looked official, and, like many, he replied to clarify the charge. That’s when the real trouble began.

Within minutes, Harmon got a call from someone claiming to be a Wells Fargo representative. The caller seemed legitimate—they even rattled off a list of his recent transactions, making the story sound all the more convincing. How did they know this information? Scammers today can buy stolen personal data on the dark web and use it to access your banking details, making their lies sound like the truth.

The caller told Harmon his account was compromised and that the only way to protect his money was to withdraw $15,000 in cash and hand it over for “safekeeping.” They even instructed him to keep his phone on speaker so they could listen in as he spoke to the bank teller.

Standing at the counter, Harmon felt a nagging sense of doubt. Instead of saying anything out loud, he quietly flipped over the withdrawal slip and wrote, “I think I’m being scammed.” The teller immediately called the bank manager, who told Harmon to turn off his phone and confirmed his suspicions. That simple note saved him from losing every cent.

Also read: The new debit card scam that follows you home: Why fraudsters are now stealing from your porch

How the “cash bag” scam traps victims

This scam is a masterclass in psychological manipulation. Here’s how it typically plays out:

1. The Bait: You receive a text or email about a suspicious charge on your account. It looks real, and the sender’s number may even match your bank’s.

[B2. The Hook:[/B] If you respond, the scammers call you, posing as bank employees. They may know your name, address, and even your recent transactions.

[B3. The Pressure:[/B] They create a sense of urgency, insisting your account is at risk and you must act immediately to “protect” your money.

[B4. The Sting:[/B] You’re told to withdraw cash or buy prepaid cards or cryptocurrency, then hand it over to a “bank representative” or send it to a “secure” account. Once the money is gone, it’s almost impossible to recover.

Why these scams keep working

Scammers are no longer the bumbling amateurs of yesteryear. Today, they’re part of organized crime rings, using technology and stolen data to make their stories airtight. According to the Pew Research Center, as of July 2025, a staggering 73% of US adults have experienced some form of online scam or attack. In 2024 alone, Americans lost $12.5 billion to fraud—a 25% jump from the previous year.

Banks are fighting back, training staff to spot scams and warn customers. But as Florida Bankers Association president Kathy Kraninger points out, “This is organized crime now. This is not individual, one-off scammers.”

Also read: How one scam drained a senior’s savings—and what you can do to stay safe

How to spot the red flags and protect your money

So, how can you avoid falling victim to a cash bag scam or any other financial con? Here are the key warning signs and steps to stay safe:

1. Never share personal or financial information with anyone who contacts you unexpectedly. Even if the caller ID looks legitimate, numbers can be spoofed.

2. Don’t respond to suspicious texts or emails. If you get a message about a questionable charge, don’t reply or click any links. Instead, contact your bank directly using the phone number on your card or their official website.

3. Be wary of urgent requests to withdraw or transfer money. Banks will never ask you to hand over cash, buy gift cards, or send cryptocurrency to “protect” your account.

4. If you feel pressured or rushed, pause and consult someone you trust. A second opinion can make all the difference.

5. Report suspicious activity. Whether you fall for the scam or not, notify your bank and the Federal Trade Commission. Your report could help prevent others from being targeted.

Moses Harmon’s story is a powerful reminder that even the savviest person can be caught off guard. But it’s also proof that trusting your gut—and reaching out for help—can save you from disaster.

As Harmon himself put it, “It was too hard to get the money in there to just walk in there and get it and bring it out and give it to somebody.” If something feels off, it probably is.

Read next:

- Are you owed money? Wells Fargo to send out checks up to $5,000 after major settlement

- A chilling “Phantom Hacker” scam has surfaced—local man charged after seniors targeted

- 7 sneaky scams draining bank accounts—how to protect yourself now

Have you or someone you know ever been targeted by a scam? What tipped you off, or what do you wish you’d known sooner? Share your stories and tips in the comments below—your experience could be the warning someone else needs.