Americans fear a new kind of retirement—here’s what’s behind the growing anxiety

- Replies 0

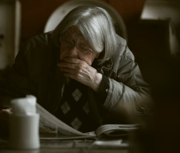

Retirement used to conjure up images of sandy beaches, leisurely mornings, and finally having the time to pursue hobbies and grandkids.

But for many Americans today, the golden years are looking a little more… well, tarnished.

If you’re feeling more anxious than excited about retirement, you’re not alone—and you’re certainly not imagining things.

A new wave of uncertainty is sweeping across the country, and it’s changing the way Americans think about life after work.

Even though 61% expect their retirement to last at least 15 years, only 58% believe their savings will last that long. And a staggering 81% say retiring today is harder than it was for their parents.

Why all the worry? It’s not just about the numbers in your bank account. Adam Spiegelman, a seasoned wealth advisor, says even his clients with millions in savings are plagued by the same fear: “Will I run out of money?”

The transition from a steady paycheck to living off your own nest egg is a psychological leap that can trigger a scarcity mindset—even for the well-off.

Add in inflation, rising healthcare costs, and the rollercoaster of the stock market, and it’s no wonder so many of us are feeling uneasy.

But here’s the twist: the fear of “unretiring”—having to go back to work out of necessity—may be more myth than reality.

Spiegelman notes that in over two decades of advising, only one client actually tried to re-enter the workforce, and it wasn’t easy.

Most retirees who do return to work do so for reasons beyond money: they crave structure, purpose, and social connection.

Those who do return to work often do so on their own terms—consulting, volunteering, or picking up part-time gigs that bring them joy and meaning.

Personal finance expert Bobbi Rebell points out that for many, working in retirement isn’t about financial desperation. It’s about staying active, engaged, and connected.

In fact, a 2023 Pew Research Center report found that nearly one in five Americans over 65 is still working—almost double the rate from 35 years ago.

Many are still physically and mentally sharp, and they miss the routine and challenge of work.

Spiegelman’s advice? Plan as if you’ll live to 100. It might sound extreme, but it’s better to be safe than sorry.

Underestimating your longevity can leave you in a financial pinch just when you should be enjoying life the most.

Also read: Getting ready for retirement: Tips to handle this major life shift

Yes, it’s not glamorous. But knowing exactly where your money goes is the foundation of any solid retirement plan. Go through your statements, tally up your expenses, and be honest with yourself.

Most people underestimate what they spend, so add a little cushion for unexpected costs—especially healthcare, travel, and inflation.

Once you have a clear picture, stress-test your plan. Where will your income come from? How will you handle market downturns or rising costs?

There are plenty of online tools to help, or you can work with a professional if you prefer. The key is to be proactive, not reactive.

Read next:

Are you feeling anxious about retirement? Have you considered “unretiring,” or do you know someone who has? What steps are you taking to prepare for a longer, more uncertain retirement?

But for many Americans today, the golden years are looking a little more… well, tarnished.

If you’re feeling more anxious than excited about retirement, you’re not alone—and you’re certainly not imagining things.

A new wave of uncertainty is sweeping across the country, and it’s changing the way Americans think about life after work.

A New Kind of Retirement Anxiety

According to the 2025 US Bank Wealth Report, a whopping 63% of Americans worry they’ll need to return to work after retiring. That’s not just a blip on the radar—it’s a seismic shift in how we view retirement.Even though 61% expect their retirement to last at least 15 years, only 58% believe their savings will last that long. And a staggering 81% say retiring today is harder than it was for their parents.

Why all the worry? It’s not just about the numbers in your bank account. Adam Spiegelman, a seasoned wealth advisor, says even his clients with millions in savings are plagued by the same fear: “Will I run out of money?”

The transition from a steady paycheck to living off your own nest egg is a psychological leap that can trigger a scarcity mindset—even for the well-off.

Why Retirement Feels Riskier Than Ever

Gone are the days of guaranteed pensions and rock-solid social safety nets. Today, most Americans are responsible for funding their own retirements, and confidence in programs like Social Security is shaky at best.Add in inflation, rising healthcare costs, and the rollercoaster of the stock market, and it’s no wonder so many of us are feeling uneasy.

But here’s the twist: the fear of “unretiring”—having to go back to work out of necessity—may be more myth than reality.

Spiegelman notes that in over two decades of advising, only one client actually tried to re-enter the workforce, and it wasn’t easy.

Most retirees who do return to work do so for reasons beyond money: they crave structure, purpose, and social connection.

The Reality of “Unretiring”

So, will you really have to go back to work? The data says probably not. While the fear is real, the reality is that most retirees stay retired.Those who do return to work often do so on their own terms—consulting, volunteering, or picking up part-time gigs that bring them joy and meaning.

Personal finance expert Bobbi Rebell points out that for many, working in retirement isn’t about financial desperation. It’s about staying active, engaged, and connected.

In fact, a 2023 Pew Research Center report found that nearly one in five Americans over 65 is still working—almost double the rate from 35 years ago.

Many are still physically and mentally sharp, and they miss the routine and challenge of work.

Living Longer, Planning Smarter

In 1987, the average life expectancy was about 75 years. Today, it’s nearly 80—and many of us will live well into our 90s or beyond. That means your retirement savings need to stretch further than ever before.Spiegelman’s advice? Plan as if you’ll live to 100. It might sound extreme, but it’s better to be safe than sorry.

Underestimating your longevity can leave you in a financial pinch just when you should be enjoying life the most.

Also read: Getting ready for retirement: Tips to handle this major life shift

Taking Control: The Power of the “B-Word”

If you’re feeling overwhelmed, take heart—there are steps you can take right now to regain control. The first (and perhaps most dreaded) step? The B-word: Budget.Yes, it’s not glamorous. But knowing exactly where your money goes is the foundation of any solid retirement plan. Go through your statements, tally up your expenses, and be honest with yourself.

Most people underestimate what they spend, so add a little cushion for unexpected costs—especially healthcare, travel, and inflation.

Once you have a clear picture, stress-test your plan. Where will your income come from? How will you handle market downturns or rising costs?

There are plenty of online tools to help, or you can work with a professional if you prefer. The key is to be proactive, not reactive.

Read next:

- If you get SNAP benefits, you could be missing out on these hidden freebies

- Could you be sitting on a forgotten retirement fortune? The $2.1 trillion mystery

- Are you missing out on these 10 easy retirement payouts? See what extra money you could be claiming!

Key Takeaways

- Many Americans are anxious about retirement, with 63 percent fearing they’ll need to return to work after retiring due to doubts about their financial security and the rising cost of living.

- The shift from employer-funded pensions to largely self-funded retirement, combined with limited social safety nets in the United States, has increased concerns, even among those with substantial savings.

- While the fear of “unretiring” is common, most retirees rarely return to full-time work; instead, some may take on part-time roles, consulting, or volunteering for social connection and purpose rather than out of financial necessity.

- Experts recommend early financial planning, regularly reviewing budgets, accounting for longer life expectancies, and stress-testing income sources to help retirees feel more confident and in control of their financial future.