Are Social Security increases really keeping up with your expenses?

By

Veronica E.

- Replies 0

If your Social Security check feels smaller than it used to, you’re not imagining things.

Between rising food prices, higher rent, and steeper health care costs, many older Americans are finding it harder to make ends meet.

Each year brings a small cost-of-living adjustment (COLA), but for some, it barely scratches the surface.

Now, more seniors and advocacy groups are calling for change—arguing that the current formula used to calculate COLA simply doesn’t reflect what older adults actually spend their money on.

Could new proposals finally give retirees a fairer deal?

Every fall, the Social Security Administration announces the upcoming year’s cost-of-living adjustment, based on inflation data.

But that number is calculated using the CPI-W, a measure that tracks the spending habits of younger urban workers—not retirees.

This means expenses like gas and electronics might be factored in, while essentials for older adults—like prescription drugs and housing—get less attention.

For many seniors, this gap between the formula and reality adds up over time.

Groceries cost more, rents keep climbing, and out-of-pocket health care expenses are stretching fixed incomes thin.

The result? Annual increases that often feel out of touch.

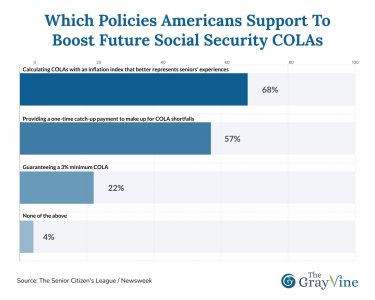

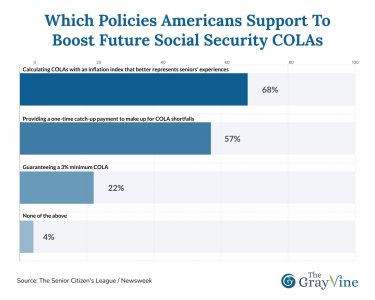

A recent survey by The Senior Citizens League (TSCL) found that 34% of seniors ranked updating the COLA formula as their top priority.

In particular, 68% said they support switching to the CPI-E—a different inflation index designed specifically to reflect the spending patterns of people aged 62 and older.

The CPI-E gives greater weight to rising costs in areas like medical care and housing—two of the biggest budget items for retirees.

Supporters say this switch would make yearly adjustments more realistic and better aligned with what seniors actually need to cover.

The Consumer Price Index for the Elderly (CPI-E) was created by the US Bureau of Labor Statistics to more accurately reflect inflation as experienced by older Americans.

Colin Ruggiero of DisabilityGuidance.org says it clearly: “CPI-E is designed to better reflect the spending habits of people aged 62 and older... Switching to CPI-E would make COLAs more relevant and responsive.”

Financial analyst Chris Motola agrees, noting that the CPI-E would “more heavily weight health care and housing costs,” both of which continue to rise faster than general inflation.

Though it may not lead to huge increases overnight, even modest improvements could add up for retirees over time.

Another proposal gaining support is a catch-up COLA—a one-time adjustment to make up for years when benefits didn’t keep pace with actual costs.

According to TSCL, 57% of surveyed seniors back this idea.

It wouldn’t be a permanent change, but rather a one-off correction to acknowledge past shortfalls.

Ruggiero says this approach could gain political traction if framed as a fairness issue rather than a new entitlement.

“While it’s feasible, it would require congressional approval and carry a hefty budgetary cost,” he explains.

Most experts agree that updating the COLA formula—while helpful—won’t solve every issue facing Social Security.

The long-term solvency of the program remains a concern, and many seniors are entering retirement with fewer savings and no access to pensions.

“Adjusting the COLA is a great start, but it’s not the cure-all,” Ruggiero cautions.

Motola adds, “We’ve made it very difficult for people to save money for retirement, and the loss of pensions has placed enormous stress on the system. Social Security isn’t meant to carry the entire load.”

If you’re worried about how COLA affects your monthly income, there are still ways to get involved and plan ahead:

It may take time for policy to change, but staying engaged is an important part of advocating for a more secure future.

Read next: Where does Social Security stretch the furthest? A new report ranks the best—and worst—cities for retirees

Have you noticed your monthly check falling behind your real-life costs? Do you think the COLA formula needs to change—or would a catch-up payment help more?

Share your thoughts in the comments and join the conversation. Your voice can help shape the future of Social Security!

Between rising food prices, higher rent, and steeper health care costs, many older Americans are finding it harder to make ends meet.

Each year brings a small cost-of-living adjustment (COLA), but for some, it barely scratches the surface.

Now, more seniors and advocacy groups are calling for change—arguing that the current formula used to calculate COLA simply doesn’t reflect what older adults actually spend their money on.

Could new proposals finally give retirees a fairer deal?

Rising costs have many seniors rethinking how Social Security keeps pace with real-life expenses. Image source: YouTube / CBS News.

Why the current COLA formula falls short

Every fall, the Social Security Administration announces the upcoming year’s cost-of-living adjustment, based on inflation data.

But that number is calculated using the CPI-W, a measure that tracks the spending habits of younger urban workers—not retirees.

This means expenses like gas and electronics might be factored in, while essentials for older adults—like prescription drugs and housing—get less attention.

For many seniors, this gap between the formula and reality adds up over time.

Groceries cost more, rents keep climbing, and out-of-pocket health care expenses are stretching fixed incomes thin.

The result? Annual increases that often feel out of touch.

Also read: Paper Social Security checks are here to stay—for now

What seniors are asking for

A recent survey by The Senior Citizens League (TSCL) found that 34% of seniors ranked updating the COLA formula as their top priority.

In particular, 68% said they support switching to the CPI-E—a different inflation index designed specifically to reflect the spending patterns of people aged 62 and older.

The CPI-E gives greater weight to rising costs in areas like medical care and housing—two of the biggest budget items for retirees.

Supporters say this switch would make yearly adjustments more realistic and better aligned with what seniors actually need to cover.

Also read: Boost your Social Security income in retirement with these three smart strategies

What is the CPI-E, and would it help?

The Consumer Price Index for the Elderly (CPI-E) was created by the US Bureau of Labor Statistics to more accurately reflect inflation as experienced by older Americans.

Colin Ruggiero of DisabilityGuidance.org says it clearly: “CPI-E is designed to better reflect the spending habits of people aged 62 and older... Switching to CPI-E would make COLAs more relevant and responsive.”

Financial analyst Chris Motola agrees, noting that the CPI-E would “more heavily weight health care and housing costs,” both of which continue to rise faster than general inflation.

Though it may not lead to huge increases overnight, even modest improvements could add up for retirees over time.

Also read: Important Social Security news: benefit recipients face new changes

Could a one-time "catch-up" COLA payment help?

Another proposal gaining support is a catch-up COLA—a one-time adjustment to make up for years when benefits didn’t keep pace with actual costs.

According to TSCL, 57% of surveyed seniors back this idea.

It wouldn’t be a permanent change, but rather a one-off correction to acknowledge past shortfalls.

Ruggiero says this approach could gain political traction if framed as a fairness issue rather than a new entitlement.

“While it’s feasible, it would require congressional approval and carry a hefty budgetary cost,” he explains.

A majority of Americans support using a more accurate inflation index and offering a one-time catch-up payment to improve future Social Security COLAs. Source: The Senior Citizens League / Newsweek.

Also read: Is your Social Security check about to get smaller? Here’s what’s unfolding

A fix—but not the full solution

Most experts agree that updating the COLA formula—while helpful—won’t solve every issue facing Social Security.

The long-term solvency of the program remains a concern, and many seniors are entering retirement with fewer savings and no access to pensions.

“Adjusting the COLA is a great start, but it’s not the cure-all,” Ruggiero cautions.

Motola adds, “We’ve made it very difficult for people to save money for retirement, and the loss of pensions has placed enormous stress on the system. Social Security isn’t meant to carry the entire load.”

Also read: Bigger benefits, smaller payoff? Medicare costs may cut into your next Social Security raise

What seniors can do now

If you’re worried about how COLA affects your monthly income, there are still ways to get involved and plan ahead:

- Stay informed by following updates from groups like TSCL, AARP, and The GrayVine.

- Contact your elected officials to express your support for COLA reform—your voice matters.

- Review your finances regularly, and explore other income sources or assistance programs if needed.

It may take time for policy to change, but staying engaged is an important part of advocating for a more secure future.

Read next: Where does Social Security stretch the furthest? A new report ranks the best—and worst—cities for retirees

Key Takeaways

- Many American seniors are frustrated with how Social Security’s cost-of-living adjustment (COLA) is calculated and want the formula updated to better match their real expenses.

- A majority of survey respondents support replacing the current CPI-W inflation measure, which is based on younger workers’ spending, with the CPI-E, which tracks the actual costs faced by retirees, especially focusing more on healthcare and housing.

- More than half of those surveyed would like a one-off “catch-up” COLA payment to compensate for years when their Social Security benefits didn’t keep up with the true cost of living.

- Experts say that while reforming the COLA formula would help, broader changes are needed to fully support retirees, including measures to strengthen benefit adequacy, solvency and support for low-income seniors.

Have you noticed your monthly check falling behind your real-life costs? Do you think the COLA formula needs to change—or would a catch-up payment help more?

Share your thoughts in the comments and join the conversation. Your voice can help shape the future of Social Security!