Are you making these 4 costly annuity mistakes? What retirement experts want every senior to know

- Replies 0

Retirement is supposed to be the golden era—a time to savor the fruits of your labor, travel, spoil the grandkids, and finally take up that hobby you’ve been putting off for decades.

But let’s be honest: with the cost of living climbing and the economy doing its best rollercoaster impression, it’s no wonder so many seniors are feeling the squeeze. If you’re living on a fixed income, every dollar counts, and the pressure to make your savings last is real.

That’s why annuities have become such a hot topic in retirement circles. On paper, they sound like a dream: guaranteed income for life, protection from outliving your savings, and a little peace of mind in a world that feels anything but peaceful.

But, as with most things in life, the devil is in the details. Annuities can be complex, and making the wrong move could cost you dearly.

Here at The GrayVine, we believe in empowering our readers with the knowledge to make smart, confident decisions. So, let’s break down the four most common annuity mistakes seniors make—and how you can sidestep them like a pro.

Surrender charges, recurring rider fees, withdrawal penalties—these are just a few of the costs that can catch you off guard. Patrick Huey, a seasoned retirement planner, puts it bluntly: “If you don’t understand how long your money is tied up or what it costs to get it back out, keep asking questions.”

Don’t be shy about grilling your advisor or the annuity provider. Ask for a clear, written breakdown of every fee, and don’t sign anything until you’re sure the contract fits your long-term goals.

If the contract reads like alphabet soup, get a second opinion from a trusted financial advisor or even a financially savvy friend. Remember, there’s no such thing as a silly question when your retirement security is on the line.

Melissa Caro, a Certified Financial Planner, says it best: “The decision will be different depending on your goals. If you need guaranteed income now, an immediate annuity works best. For growth with some downside protection, consider indexed annuities. Fixed annuities suit those wanting predictable, conservative growth.”

Before you buy, get crystal clear on what you want: Do you need income right away, or can you wait a few years? Are you looking for growth, or is safety your top priority?

Do you want to leave something behind for your loved ones? Write down your goals and discuss them with a professional who treats annuities as tools—not just products to sell.

Without a clear beneficiary, your annuity could get tangled up in probate court, causing delays, legal fees, and unnecessary headaches for your family. For married couples, failing to name your spouse as beneficiary can also mean losing valuable spousal continuation rights, which allow your partner to take over the contract and keep its tax-deferred status.

Review your annuity contracts and double-check your beneficiary designations. Update them after major life events—marriage, divorce, the birth of a grandchild—to keep everything current.

David Haas, another retirement expert, offers a memorable analogy: "Annuities are not piggy banks, they are more like hourglasses. They work properly when you take the amount out they are designed for. If you take larger withdrawals, the annuity will fail to do what it was designed for.”

Stick to the withdrawal guidelines set by your contract, and resist the urge to dip in for more than you need. If you anticipate needing extra cash, talk to your advisor about other options before raiding your annuity.

After decades of hard work, you deserve a retirement plan that’s as unique as you are. Annuities can be a powerful tool, but only if you use them wisely. Take your time, do your homework, and don’t be afraid to ask for help.

As Patrick Huey wisely says, “The products themselves aren’t inherently good or bad, it’s how and why you use them that counts.”

Also read:

Have you considered an annuity, or do you already have one? What questions or concerns do you have about these products? Have you run into any surprises with fees or contract terms? Share your experiences, tips, or questions in the comments below.

Have you considered an annuity, or do you already have one? What questions or concerns do you have about these products? Have you run into any surprises with fees or contract terms? Share your experiences, tips, or questions in the comments below.

But let’s be honest: with the cost of living climbing and the economy doing its best rollercoaster impression, it’s no wonder so many seniors are feeling the squeeze. If you’re living on a fixed income, every dollar counts, and the pressure to make your savings last is real.

That’s why annuities have become such a hot topic in retirement circles. On paper, they sound like a dream: guaranteed income for life, protection from outliving your savings, and a little peace of mind in a world that feels anything but peaceful.

But, as with most things in life, the devil is in the details. Annuities can be complex, and making the wrong move could cost you dearly.

Here at The GrayVine, we believe in empowering our readers with the knowledge to make smart, confident decisions. So, let’s break down the four most common annuity mistakes seniors make—and how you can sidestep them like a pro.

1. Not Understanding the Fees: The Hidden Costs That Can Eat Your Nest Egg

Let’s face it: financial contracts are rarely written in plain English. Annuity paperwork can be especially dense, and buried in the fine print are fees that can quietly chip away at your savings.Surrender charges, recurring rider fees, withdrawal penalties—these are just a few of the costs that can catch you off guard. Patrick Huey, a seasoned retirement planner, puts it bluntly: “If you don’t understand how long your money is tied up or what it costs to get it back out, keep asking questions.”

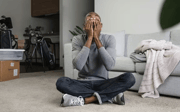

Annuities have become such a hot topic in retirement circles. Image source: Towfiqu Barbhuiya / Unsplash

Don’t be shy about grilling your advisor or the annuity provider. Ask for a clear, written breakdown of every fee, and don’t sign anything until you’re sure the contract fits your long-term goals.

If the contract reads like alphabet soup, get a second opinion from a trusted financial advisor or even a financially savvy friend. Remember, there’s no such thing as a silly question when your retirement security is on the line.

2. Choosing the Wrong Type of Annuity: One Size Does NOT Fit All

Annuities come in more flavors than your local ice cream shop: immediate, deferred, fixed, variable, indexed—the list goes on. Each type serves a different purpose, and picking the wrong one can leave you locked into a contract that doesn’t match your needs or risk tolerance.Melissa Caro, a Certified Financial Planner, says it best: “The decision will be different depending on your goals. If you need guaranteed income now, an immediate annuity works best. For growth with some downside protection, consider indexed annuities. Fixed annuities suit those wanting predictable, conservative growth.”

Before you buy, get crystal clear on what you want: Do you need income right away, or can you wait a few years? Are you looking for growth, or is safety your top priority?

Do you want to leave something behind for your loved ones? Write down your goals and discuss them with a professional who treats annuities as tools—not just products to sell.

3. Not Designating a Beneficiary: Don’t Let Your Money Get Stuck in Probate

It’s easy to overlook the beneficiary section of your annuity contract, but this small detail can have huge consequences. If you pass away before the annuity is fully paid out, a properly named beneficiary ensures your loved ones receive the remaining benefits—sometimes for years to come.Without a clear beneficiary, your annuity could get tangled up in probate court, causing delays, legal fees, and unnecessary headaches for your family. For married couples, failing to name your spouse as beneficiary can also mean losing valuable spousal continuation rights, which allow your partner to take over the contract and keep its tax-deferred status.

Review your annuity contracts and double-check your beneficiary designations. Update them after major life events—marriage, divorce, the birth of a grandchild—to keep everything current.

4. Withdrawing Excessive Funds: Don’t Turn Your Annuity Into a Piggy Bank

Annuities are designed to provide steady, reliable income over time—not to fund a spontaneous trip to Vegas or cover a new kitchen remodel. Taking out too much money too soon can trigger hefty penalties, reduce your future income, and even lower your death benefit.David Haas, another retirement expert, offers a memorable analogy: "Annuities are not piggy banks, they are more like hourglasses. They work properly when you take the amount out they are designed for. If you take larger withdrawals, the annuity will fail to do what it was designed for.”

Stick to the withdrawal guidelines set by your contract, and resist the urge to dip in for more than you need. If you anticipate needing extra cash, talk to your advisor about other options before raiding your annuity.

After decades of hard work, you deserve a retirement plan that’s as unique as you are. Annuities can be a powerful tool, but only if you use them wisely. Take your time, do your homework, and don’t be afraid to ask for help.

As Patrick Huey wisely says, “The products themselves aren’t inherently good or bad, it’s how and why you use them that counts.”

Also read:

- Maximize your retirement: 5 secret havens to grow your savings!

- The simple mistake that wiped out a man’s entire retirement savings

Key Takeaways

- Seniors should always read and understand the fine print of annuity contracts to avoid unexpected fees, surrender charges and withdrawal penalties.

- Choosing the wrong type of annuity for your personal circumstances can lock you into a contract that doesn’t suit your goals or risk tolerance, so it’s important to match the product to your needs.

- Not designating a beneficiary on your annuity could mean your loved ones miss out on benefits or face complications like probate, making it crucial to name beneficiaries clearly.

- Withdrawing excessive funds from an annuity early can trigger fees and reduce your future income, so it’s essential to withdraw only what was intended for sustainable, long-term retirement planning.