Are you saying goodbye to the 2025 COLA? Retirees struck by check increase announcement for next year

- Replies 0

As the golden years roll in, so do the concerns about financial stability. For many American retirees, Social Security benefits are the bedrock of their post-work life.

It's a monthly check that's supposed to keep up with the cost of living, but the latest news on the 2025 Cost-of-Living Adjustment (COLA) has left many feeling more vulnerable than secure.

Let’s unpack the recent announcement and what it means for you.

In October, the Social Security Administration announced a 2.5% COLA increase based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

This increase was calculated through the index and the inflation data of the 3rd trimester of the year. There have been efforts to lower inflation by then, and it has been successful.

Lower inflation means a lower COLA, therefore the economy is experiencing more stability and prices will avoid soaring. However, this also means less funds for retirees to cover the already high expenses.

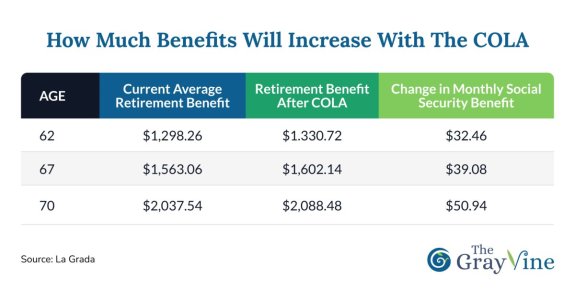

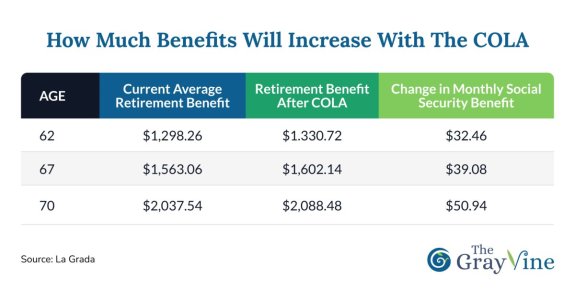

Here's a snapshot of what the 2025 COLA increase looks like for different age groups:

At first glance, these numbers might seem like a step in the right direction. However, many experts and retirees alike are questioning the use of the CPI-W to calculate COLA.

Critics argue that this index doesn't accurately reflect the spending habits of seniors, who often face higher medical expenses and different consumption patterns than the general working population.

Advocates, including Shannon Benton of The Senior Citizens League (TSCL), are pushing for a switch to the Consumer Price Index for the Elderly (CPI-E), which would more closely align with the financial realities of older Americans.

She said, “This year represents another lost opportunity to grant seniors the financial relief they deserve by changing the COLA calculation from the CPI-W to the CPI-E, which would better reflect seniors’ changing expenses.”

“Seniors and TSCL demand that Congress takes immediate action to strengthen COLAs to ensure Americans can retire with dignity, such as instituting a minimum COLA of 3 percent and changing the COLA calculation from the CPI-W to the CPI-E,” she continued in a statement.

Congressman Larson from Connecticut also agreed with the negative impact of the small COLA, saying, “The annual COLA is vital for Social Security beneficiaries to make ends meet, but 2.5% is not nearly enough for seniors living on fixed incomes.”

Adding to the COLA concerns is the announcement of increased Medicare premiums and deductibles for 2025.

With most beneficiaries having their Medicare premiums deducted directly from their Social Security checks, these hikes could negate much of the COLA increase.

For example, Medicare Part B's standard monthly premium will jump to $185.00, up $10.30 from the previous year. The annual deductible will also rise by $17.

When combined with the general increase in living costs, such as groceries and housing, the financial picture for many seniors becomes increasingly grim.

This increase is not alone on its rise, as other prices have also shot up last year, such as gas, groceries, and housing. Despite the good news of a lower COLA giving the benefit of prices not rising as quickly, these hearty adjustments occur after the increase that has already happened.

Have you felt the impact of the COLA increase on your finances? Share your thoughts and advice in the comments below!

It's a monthly check that's supposed to keep up with the cost of living, but the latest news on the 2025 Cost-of-Living Adjustment (COLA) has left many feeling more vulnerable than secure.

Let’s unpack the recent announcement and what it means for you.

In October, the Social Security Administration announced a 2.5% COLA increase based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

This increase was calculated through the index and the inflation data of the 3rd trimester of the year. There have been efforts to lower inflation by then, and it has been successful.

Retirees may see the negligible benefit from the COLA increase. Image source: Pexels / Kampus Production.

Lower inflation means a lower COLA, therefore the economy is experiencing more stability and prices will avoid soaring. However, this also means less funds for retirees to cover the already high expenses.

Here's a snapshot of what the 2025 COLA increase looks like for different age groups:

The 2025 cost-of-living adjustment (COLA) increase of 2.5% for Social Security benefits has been announced, which many retirees find insufficient to cover increased expenses. Source: La Grada.

At first glance, these numbers might seem like a step in the right direction. However, many experts and retirees alike are questioning the use of the CPI-W to calculate COLA.

Critics argue that this index doesn't accurately reflect the spending habits of seniors, who often face higher medical expenses and different consumption patterns than the general working population.

Advocates, including Shannon Benton of The Senior Citizens League (TSCL), are pushing for a switch to the Consumer Price Index for the Elderly (CPI-E), which would more closely align with the financial realities of older Americans.

She said, “This year represents another lost opportunity to grant seniors the financial relief they deserve by changing the COLA calculation from the CPI-W to the CPI-E, which would better reflect seniors’ changing expenses.”

“Seniors and TSCL demand that Congress takes immediate action to strengthen COLAs to ensure Americans can retire with dignity, such as instituting a minimum COLA of 3 percent and changing the COLA calculation from the CPI-W to the CPI-E,” she continued in a statement.

Congressman Larson from Connecticut also agreed with the negative impact of the small COLA, saying, “The annual COLA is vital for Social Security beneficiaries to make ends meet, but 2.5% is not nearly enough for seniors living on fixed incomes.”

Adding to the COLA concerns is the announcement of increased Medicare premiums and deductibles for 2025.

With most beneficiaries having their Medicare premiums deducted directly from their Social Security checks, these hikes could negate much of the COLA increase.

For example, Medicare Part B's standard monthly premium will jump to $185.00, up $10.30 from the previous year. The annual deductible will also rise by $17.

When combined with the general increase in living costs, such as groceries and housing, the financial picture for many seniors becomes increasingly grim.

This increase is not alone on its rise, as other prices have also shot up last year, such as gas, groceries, and housing. Despite the good news of a lower COLA giving the benefit of prices not rising as quickly, these hearty adjustments occur after the increase that has already happened.

Key Takeaways

- The 2025 cost-of-living adjustment (COLA) increase of 2.5% for Social Security benefits has been announced, which many retirees find insufficient to cover increased expenses.

- The COLA is based on the CPI-W index, but there is a proposal to switch to the CPI-E, which would be more reflective of the expenses faced by older Americans.

- Retirees may see a negligible benefit from the COLA increase due to the rising Medicare premiums and deductibles, which are likely to consume much of the adjustment.

- Calls for action have been made to Congress to strengthen COLAs for retirees, including the establishment of a minimum COLA of 3 percent and changing the calculation from CPI-W to CPI-E to ensure retirees can live with dignity.

Have you felt the impact of the COLA increase on your finances? Share your thoughts and advice in the comments below!

Last edited: