Financial planning can be filled with hidden pitfalls that may not be obvious until it’s too late. Small oversights can ripple into long-term consequences, affecting both your heirs and your finances.

Retirement accounts are meant to provide security, but one common misstep could undo years of careful planning.

Understanding what can go wrong before it happens can help protect your wealth and your loved ones.

Why beneficiary designations matter

Millions of US households hold individual retirement accounts, yet many investors overlook a critical detail: the beneficiary designation.

Brandon Buckingham, vice president for Prudential Retirement Strategies’ advanced planning group, calls it “the biggest mistake people make.”

Some account holders fail to name a beneficiary, while others leave outdated information that can result in unintended heirs receiving the funds.

Beneficiary designations take precedence over your will, so keeping them current is essential to ensure your IRA goes to the intended person.

Also read: Get ready for a surprise–Here's why your tax refund could be the biggest one yet!

Common errors and their consequences

“I can’t tell you how many times I’ve seen an ex-spouse inherit an IRA or 401(k) account,” Buckingham said. When no beneficiary is named, the account typically defaults to the estate, triggering probate, which can be lengthy and costly.

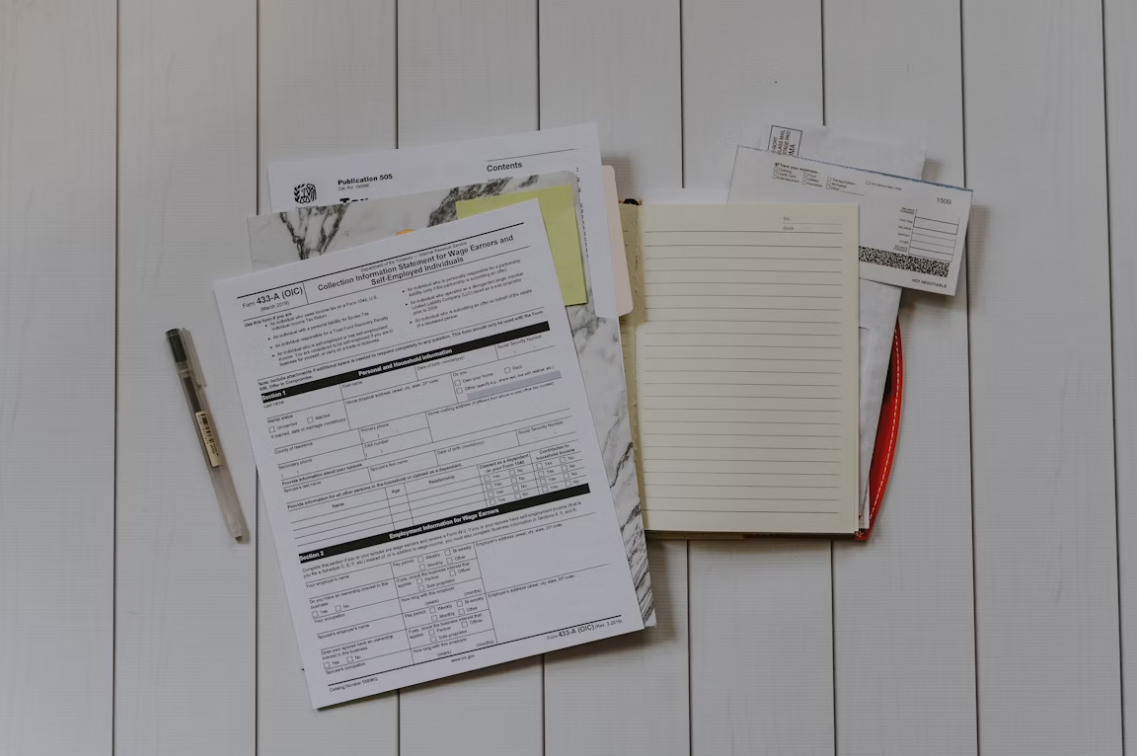

Income generated by an estate-owned IRA is subject to highly compressed tax brackets, hitting 37% at just $15,650 of earnings for 2025. By comparison, married couples filing jointly only reach that rate at $750,000 of taxable income, making estate-owned IRAs significantly less tax-efficient.

IRA growth and rollover trends

As of mid-2024, nearly 58 million US households, or about 44%, owned IRAs, collectively holding $16.2 trillion in assets.

This growth has been driven largely by rollovers from employer retirement plans, such as 401(k)s, with nearly 60% of traditional IRAs including rollovers in 2024.

With multiple accounts, keeping track of beneficiary designations becomes even more important. Overlooking them could result in unnecessary taxes, rushed distributions, or passing assets to unintended heirs.

Also read: IRS mistake leaves 92-year-old woman unable to cash $11K tax refund—here’s what happened

The worst beneficiary and planning tips

“The worst beneficiary you can ever have for a retirement account is the estate, whether it’s on purpose or by default,” Buckingham said.

Without a designated beneficiary, an IRA must go through probate and is subject to accelerated payout rules, requiring estate-owned IRAs to be emptied within five years.

Non-spouse heirs, by contrast, typically have 10 years to withdraw funds, giving more flexibility for tax planning. Keeping beneficiary designations current is a simple step that can prevent costly mistakes and ensure your retirement savings benefit the right people.

Read next:

- .Want your tax refund faster than everyone else? Follow this IRS process now!

- IRS employee’s data access request raises concerns over taxpayer privacy

Ensuring your IRA is set up correctly can prevent significant headaches for your family later. Have you checked your beneficiary designations recently to make sure they’re up to date? It may be a simple step with a big impact. Share your thoughts or experiences with IRA planning in the comments below.