Cancer-stricken senior targeted in alleged fraud; local woman faces charges

- Replies 0

Financial fraud is a nightmare scenario for anyone, but when it targets our most vulnerable—elderly individuals battling serious illnesses—it strikes a particularly raw nerve.

This week, Gainesville, Georgia, became the latest community to confront this unsettling reality when a 29-year-old woman was arrested for allegedly exploiting a 74-year-old cancer patient in a calculated card fraud scheme.

A Crime That Hits Close to Home

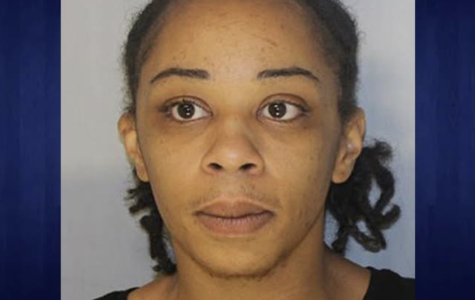

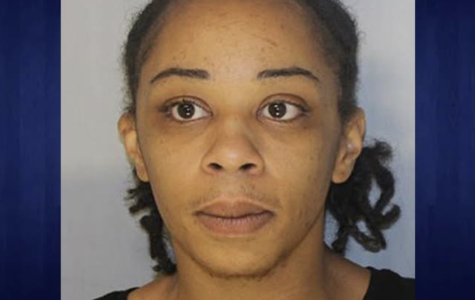

According to the Hall County Sheriff’s Office (HCSO), Daja LaPrincess Hill was taken into custody on Tuesday after a two-week investigation.

The charges are for felony financial transaction card fraud and exploitation of an elderly person—serious accusations that underscore the gravity of the situation.

The ordeal began on May 13, when a Hall County deputy met with the victim, a 74-year-old man undergoing cancer treatment.

He and his wife had noticed suspicious activity on their bank account—unauthorized transactions that quickly added up to a staggering $2,720.95.

After a thorough review with their bank, it became clear that the money had been siphoned off and funneled into a PayPal account.

Through diligent detective work, the HCSO traced the PayPal account back to Hill, who, authorities say, was known to the victim.

She was arrested at a hotel on Lanier Islands Parkway and is currently being held in the Hall County Jail on a $12,700 bond, with an additional hold for Newton County.

Why Are Seniors So Often Targeted?

Sadly, this story is far from unique. Financial exploitation of older adults is a growing problem across the United States. According to the National Council on Aging, seniors lose an estimated $2.6 billion annually to financial abuse and fraud.

Also read: A misspelled name led to two wrongful arrests—could it happen to you?

The reasons are complex: older adults may be more trusting, less familiar with digital banking, or physically and emotionally vulnerable due to illness or isolation.

In this case, the victim’s battle with cancer likely made him an even easier target. Medical treatments can be exhausting, and the stress of illness can make it harder to keep a close eye on finances.

Worse still, the perpetrator was someone the victim knew—a painful reminder that fraudsters are often people we trust.

How Can You Protect Yourself and Your Loved Ones?

Here at The GrayVine, we believe knowledge is power. If you or someone you care about is in a similar situation, here are some practical steps to help safeguard against financial exploitation:

1. Monitor Accounts Regularly: Check bank and credit card statements frequently for unfamiliar transactions. Many banks offer text or email alerts for large or unusual purchases.

2. Limit Access: Be cautious about who has access to your financial information. Even trusted acquaintances can sometimes betray that trust.

3. Use Strong Passwords and Two-Factor Authentication: Especially for online accounts like PayPal, always use unique, complex passwords and enable two-factor authentication.

4. Set Up Account Alerts: Most banks allow you to set up notifications for withdrawals, transfers, or purchases over a certain amount.

5. Review Powers of Attorney and Account Authorizations: Make sure only trusted individuals have legal access to your accounts, and review these arrangements regularly.

Also read: Shocking footage reveals healthcare worker's appalling act over disabled patient – see why she's facing charges!

What to Do If You Suspect Fraud

If you notice suspicious activity, act quickly:

Related story: Maryland man loses $40K to convincing scam—here’s how to protect yourself

Have you or a loved one ever experienced financial exploitation? What steps do you take to protect your finances? Do you have tips or resources to share with our community? We invite you to join the conversation in the comments below. Your experiences and advice could help someone else avoid becoming a victim.

This week, Gainesville, Georgia, became the latest community to confront this unsettling reality when a 29-year-old woman was arrested for allegedly exploiting a 74-year-old cancer patient in a calculated card fraud scheme.

A Crime That Hits Close to Home

According to the Hall County Sheriff’s Office (HCSO), Daja LaPrincess Hill was taken into custody on Tuesday after a two-week investigation.

The charges are for felony financial transaction card fraud and exploitation of an elderly person—serious accusations that underscore the gravity of the situation.

The ordeal began on May 13, when a Hall County deputy met with the victim, a 74-year-old man undergoing cancer treatment.

He and his wife had noticed suspicious activity on their bank account—unauthorized transactions that quickly added up to a staggering $2,720.95.

A Gainesville woman, Daja LaPrincess Hill, has been arrested over alleged card fraud and exploitation of an elderly cancer patient. Image source: AccessWDUN / Facebook.

After a thorough review with their bank, it became clear that the money had been siphoned off and funneled into a PayPal account.

Through diligent detective work, the HCSO traced the PayPal account back to Hill, who, authorities say, was known to the victim.

She was arrested at a hotel on Lanier Islands Parkway and is currently being held in the Hall County Jail on a $12,700 bond, with an additional hold for Newton County.

Why Are Seniors So Often Targeted?

Sadly, this story is far from unique. Financial exploitation of older adults is a growing problem across the United States. According to the National Council on Aging, seniors lose an estimated $2.6 billion annually to financial abuse and fraud.

Also read: A misspelled name led to two wrongful arrests—could it happen to you?

The reasons are complex: older adults may be more trusting, less familiar with digital banking, or physically and emotionally vulnerable due to illness or isolation.

In this case, the victim’s battle with cancer likely made him an even easier target. Medical treatments can be exhausting, and the stress of illness can make it harder to keep a close eye on finances.

Worse still, the perpetrator was someone the victim knew—a painful reminder that fraudsters are often people we trust.

How Can You Protect Yourself and Your Loved Ones?

Here at The GrayVine, we believe knowledge is power. If you or someone you care about is in a similar situation, here are some practical steps to help safeguard against financial exploitation:

1. Monitor Accounts Regularly: Check bank and credit card statements frequently for unfamiliar transactions. Many banks offer text or email alerts for large or unusual purchases.

2. Limit Access: Be cautious about who has access to your financial information. Even trusted acquaintances can sometimes betray that trust.

3. Use Strong Passwords and Two-Factor Authentication: Especially for online accounts like PayPal, always use unique, complex passwords and enable two-factor authentication.

4. Set Up Account Alerts: Most banks allow you to set up notifications for withdrawals, transfers, or purchases over a certain amount.

5. Review Powers of Attorney and Account Authorizations: Make sure only trusted individuals have legal access to your accounts, and review these arrangements regularly.

Also read: Shocking footage reveals healthcare worker's appalling act over disabled patient – see why she's facing charges!

What to Do If You Suspect Fraud

If you notice suspicious activity, act quickly:

- Contact Your Bank Immediately: They can freeze your account and help recover lost funds.

- Report to Local Authorities: As in this case, law enforcement can investigate and potentially bring perpetrators to justice.

- Reach Out to Adult Protective Services: They can provide resources and support for victims of elder abuse.

Related story: Maryland man loses $40K to convincing scam—here’s how to protect yourself

Key Takeaways

- A Gainesville woman, Daja LaPrincess Hill, has been arrested over alleged card fraud and exploitation of an elderly cancer patient.

- The 29-year-old is accused of making unauthorized transactions totalling $2,720.95, after the victim, a 74-year-old man, noticed the fraudulent activity.

- Police were able to trace the stolen money, which was transferred via PayPal, back to Hill, leading to her arrest at a local hotel.

- Hill, who knew the victim, remains in custody at Hall County Jail on a $12,700 bond and is also being held for Newton County.

Have you or a loved one ever experienced financial exploitation? What steps do you take to protect your finances? Do you have tips or resources to share with our community? We invite you to join the conversation in the comments below. Your experiences and advice could help someone else avoid becoming a victim.