Could changes to Medicaid funding put your local hospital in danger?

By

Veronica E.

- Replies 0

Rural hospitals across the US continue to face financial challenges, and a new Senate proposal may affect how they’re funded.

Included in a 549-page domestic spending bill is a provision that would gradually reduce the provider tax, a tool states use to help fund their share of Medicaid.

Although the change may seem technical, it could result in less federal matching money for states.

Some health experts and hospital administrators have expressed concern that this could impact services in rural areas.

As the bill moves through Congress, many are watching closely to see how these proposed changes could affect local health care access.

The provider tax is a state-imposed fee on hospitals and other health care providers.

It helps states pay their share of Medicaid costs, which are then matched by the federal government, usually dollar for dollar or more.

This system brings more federal money into state health programs, helping to fund hospitals—especially those in rural areas that treat a high number of Medicaid patients.

“All states except Alaska have at least one provider tax,” said Edwin Park, a Medicaid policy expert and professor at Georgetown University’s McCourt School of Public Policy.

“It’s a key financing source for rural hospitals, which tend to have much thinner operating margins.”

States can have multiple provider taxes, including for services like nursing homes and ambulances.

But under the new proposal, the maximum rate states can charge would be gradually reduced from 6% to 3.5% by 2031.

Rural hospitals typically serve more Medicaid patients and already operate on tight budgets.

The current provider tax helps keep them afloat by bringing in crucial federal dollars.

If the allowed tax rate is lowered, states will have less money to spend on Medicaid, and thus receive less federal reimbursement—a funding gap that rural hospitals can’t afford to absorb.

A report from the Center for Healthcare Quality and Payment Reform found that one-third of all rural hospitals in the US are at risk of closure.

According to Pew Research, rural Americans already live, on average, twice as far from the nearest hospital as people in urban and suburban areas—about 17 minutes compared to 10.

“There’s no way around it,” said Dr. Adam Gaffney, a critical care physician and assistant professor at Harvard Medical School.

“It’s just basic math. It means more harm, and that more people will die from lack of care.”

In Hugo, Colorado, Kevin Stansbury, CEO of Lincoln Community Hospital, said the proposed cuts could be a breaking point.

His 25-bed hospital covers a region roughly the size of Connecticut, with only two providers per square mile.

Around 25% of his patients are on Medicaid, and the facility receives about $300,000 a month in provider tax reimbursements—just enough to break even.

If those funds are cut, he warned, staff layoffs, service reductions, or full closure could follow.

“Without the 6% provider tax rate, we’ll have to start cutting services—including long-term care,” Stansbury said.

“If I start crying, forgive me. It just breaks my heart.”

Yes. The proposal would not apply to nursing homes and intermediate care facilities for people with disabilities.

But it does apply to hospitals, which remain the backbone of rural health care.

States that did not expand Medicaid—like Florida and Texas—would be allowed to keep their existing provider tax rates.

Other states would face the gradual reduction under the bill.

The House version of the proposal aims to freeze provider tax rates where they are now and would ban states from introducing new ones.

Dr. Gaffney, who also authored a study published Monday, estimates the House’s proposed cuts alone could cause 7.6 million Americans to lose insurance coverage, leading to thousands of preventable deaths.

He believes the Senate version is even more aggressive.

“At the end of the day, hospitals that are in places where patients are poor tend to be poor and to be more at risk of closure,” Gaffney added.

Polling shows broad support for Medicaid in rural communities.

Robin Rudowitz, director of the Program on Medicaid and the Uninsured at KFF, says about three-quarters of rural residents believe Medicaid funding should stay the same or increase.

“Changes that would restrict or retrench coverage gains could have negative implications for these hospitals,” Rudowitz said.

Rural hospital groups and policy experts are pushing back against the proposed cuts.

Bruce Siegel, president and CEO of America’s Essential Hospitals, said the changes would “devastate health care access for millions of Americans and hollow out the vital role essential hospitals play in their communities.”

In a statement Tuesday, Senator Ron Wyden (D-Ore.), top Democrat on the Senate Finance Committee, criticized the proposal, saying it would pay for corporate tax breaks “by making even deeper cuts to Medicaid, slashing funding for rural hospitals and other essential health care providers and throwing cash-strapped states off a funding cliff.”

The proposal is still making its way through Congress and has not been finalized.

Lawmakers could revise or drop the changes before any final version reaches the president’s desk. Until then, rural hospital advocates are urging constituents to speak out.

If you live in a rural area and rely on a local hospital—or care about access to health care in your community—now is the time to call your elected representatives.

Share your story and let them know what rural health care means to you.

Read next: The truth about Medicaid cuts and the misinformation spreading online

Have you or someone you know been affected by a hospital closing or service cut? Are you concerned about how these proposed Medicaid changes could affect your community? Share your thoughts below—your story could help make a difference.

Included in a 549-page domestic spending bill is a provision that would gradually reduce the provider tax, a tool states use to help fund their share of Medicaid.

Although the change may seem technical, it could result in less federal matching money for states.

Some health experts and hospital administrators have expressed concern that this could impact services in rural areas.

As the bill moves through Congress, many are watching closely to see how these proposed changes could affect local health care access.

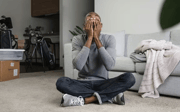

Lawmakers are considering changes to Medicaid funding that could affect rural hospitals across the country. Image Source: YouTube / KOMO News.

What is the provider tax?

The provider tax is a state-imposed fee on hospitals and other health care providers.

It helps states pay their share of Medicaid costs, which are then matched by the federal government, usually dollar for dollar or more.

This system brings more federal money into state health programs, helping to fund hospitals—especially those in rural areas that treat a high number of Medicaid patients.

“All states except Alaska have at least one provider tax,” said Edwin Park, a Medicaid policy expert and professor at Georgetown University’s McCourt School of Public Policy.

“It’s a key financing source for rural hospitals, which tend to have much thinner operating margins.”

States can have multiple provider taxes, including for services like nursing homes and ambulances.

But under the new proposal, the maximum rate states can charge would be gradually reduced from 6% to 3.5% by 2031.

Also read: Taxpayers stand to save $30 billion with Medicaid reform

Why are rural hospitals worried?

Rural hospitals typically serve more Medicaid patients and already operate on tight budgets.

The current provider tax helps keep them afloat by bringing in crucial federal dollars.

If the allowed tax rate is lowered, states will have less money to spend on Medicaid, and thus receive less federal reimbursement—a funding gap that rural hospitals can’t afford to absorb.

A report from the Center for Healthcare Quality and Payment Reform found that one-third of all rural hospitals in the US are at risk of closure.

According to Pew Research, rural Americans already live, on average, twice as far from the nearest hospital as people in urban and suburban areas—about 17 minutes compared to 10.

“There’s no way around it,” said Dr. Adam Gaffney, a critical care physician and assistant professor at Harvard Medical School.

“It’s just basic math. It means more harm, and that more people will die from lack of care.”

Also read: Medicaid rollbacks could quietly affect your housing and food support—what to know

One hospital’s story

In Hugo, Colorado, Kevin Stansbury, CEO of Lincoln Community Hospital, said the proposed cuts could be a breaking point.

His 25-bed hospital covers a region roughly the size of Connecticut, with only two providers per square mile.

Around 25% of his patients are on Medicaid, and the facility receives about $300,000 a month in provider tax reimbursements—just enough to break even.

If those funds are cut, he warned, staff layoffs, service reductions, or full closure could follow.

“Without the 6% provider tax rate, we’ll have to start cutting services—including long-term care,” Stansbury said.

“If I start crying, forgive me. It just breaks my heart.”

Also read: Trump leans toward Medicaid work mandates as Republicans eye $2 trillion in savings

Are any facilities exempt?

Yes. The proposal would not apply to nursing homes and intermediate care facilities for people with disabilities.

But it does apply to hospitals, which remain the backbone of rural health care.

States that did not expand Medicaid—like Florida and Texas—would be allowed to keep their existing provider tax rates.

Other states would face the gradual reduction under the bill.

Also read: Millions may lose Medicaid—see which states are most affected

How does this differ from the House version?

The House version of the proposal aims to freeze provider tax rates where they are now and would ban states from introducing new ones.

Dr. Gaffney, who also authored a study published Monday, estimates the House’s proposed cuts alone could cause 7.6 million Americans to lose insurance coverage, leading to thousands of preventable deaths.

He believes the Senate version is even more aggressive.

“At the end of the day, hospitals that are in places where patients are poor tend to be poor and to be more at risk of closure,” Gaffney added.

What do voters think?

Polling shows broad support for Medicaid in rural communities.

Robin Rudowitz, director of the Program on Medicaid and the Uninsured at KFF, says about three-quarters of rural residents believe Medicaid funding should stay the same or increase.

“Changes that would restrict or retrench coverage gains could have negative implications for these hospitals,” Rudowitz said.

What are advocates saying?

Rural hospital groups and policy experts are pushing back against the proposed cuts.

Bruce Siegel, president and CEO of America’s Essential Hospitals, said the changes would “devastate health care access for millions of Americans and hollow out the vital role essential hospitals play in their communities.”

In a statement Tuesday, Senator Ron Wyden (D-Ore.), top Democrat on the Senate Finance Committee, criticized the proposal, saying it would pay for corporate tax breaks “by making even deeper cuts to Medicaid, slashing funding for rural hospitals and other essential health care providers and throwing cash-strapped states off a funding cliff.”

What happens next?

The proposal is still making its way through Congress and has not been finalized.

Lawmakers could revise or drop the changes before any final version reaches the president’s desk. Until then, rural hospital advocates are urging constituents to speak out.

If you live in a rural area and rely on a local hospital—or care about access to health care in your community—now is the time to call your elected representatives.

Share your story and let them know what rural health care means to you.

Read next: The truth about Medicaid cuts and the misinformation spreading online

Key Takeaways

- A Senate proposal would lower the provider tax rate states use to fund Medicaid, potentially cutting off vital support for rural hospitals already at risk of closure.

- Experts warn this change would reduce federal matching dollars, forcing hospitals to cut staff or services—and in some cases, close entirely.

- States that didn’t expand Medicaid, like Florida and Texas, would be allowed to keep their current rates. Nursing homes and disability care facilities are exempt.

- Health leaders, researchers, and the public have expressed strong opposition, citing studies estimating millions could lose coverage and care access if these cuts are passed.

Have you or someone you know been affected by a hospital closing or service cut? Are you concerned about how these proposed Medicaid changes could affect your community? Share your thoughts below—your story could help make a difference.