If you rely on disability benefits to help cover your monthly expenses, you’re not alone—millions of older Americans count on Social Security Disability Insurance (SSDI) for vital support. As part of the current administration’s focus on government reform, a regulatory proposal from within the Social Security Administration is drawing renewed attention.

The plan, originally developed during President Trump’s first term and now moving forward under his leadership, could significantly change how SSDI eligibility is assessed.

While nothing is final yet, the proposal has sparked questions from policy experts, advocates, and concerned beneficiaries alike.

What’s being proposed—and why are people concerned?

The Social Security Administration (SSA) is considering a new rule change listed in the federal regulatory agenda as RIN 0960-AI67.

This proposal originated under President Donald Trump's first term and is now being revisited as part of a broader plan to streamline government programs.

If finalized, it could mark one of the most significant reductions in SSDI and Supplemental Security Income (SSI) eligibility in decades.

The most notable change? The proposed rule would update how eligibility decisions are made by revising the medical-vocational guidelines.

These are the rules that allow officials to consider a person’s age, education, and past work experience when deciding if someone can adjust to a different job.

Currently, people aged 50 and over are often granted additional consideration due to the increased difficulty of retraining or changing careers later in life.

But the new plan would raise that threshold to 60, making it harder for many older workers to qualify.

Also read: White House responds to Social Security change concerns

How would the changes affect people applying—or already receiving benefits?

According to analysis from the Urban Institute, the new rule could result in up to 750,000 people losing SSDI benefits over the next ten years.

Those already receiving SSDI would face stricter reviews during periodic reevaluations.

New applicants could be impacted by narrower definitions of disability and changes to how “transferable skills” are assessed.

The plan also includes updated occupational data, replacing outdated information from 1991 to better reflect today’s job market.

Supporters argue this would help modernize the system and reduce fraud, but critics warn it could overlook real barriers faced by older adults with limited work flexibility.

Also read: Social Security after retirement: 6 Smart moves to make

Who could be most affected?

While the proposal is national in scope, its impact would likely be felt unevenly.

Nearly 80% of SSDI recipients are over 50, and regions that rely heavily on physical labor—such as the South, Appalachia, the Rust Belt (including Michigan, Ohio, and Pennsylvania), and rural areas like Maine—are expected to be disproportionately affected.

For many in these communities, SSDI isn’t just a check—it’s a lifeline. Losing it could mean more than just financial hardship.

After 24 months on SSDI, recipients typically gain access to Medicare. Without SSDI, that coverage may be lost.

For those receiving SSI, it could also mean losing Medicaid access, which many rely on for chronic or disabling conditions.

Others may be forced to take early retirement, resulting in a permanent reduction of up to 30% in their monthly Social Security benefit.

Additional supports like food stamps (SNAP) may also become harder to access if recipients are no longer classified as disabled under the new criteria.

Also read: New lawsuit demands answers on Social Security changes and transparency

Are there other changes connected to this proposal?

Yes. This plan is part of a broader push for government efficiency and would reportedly be backed by the Department of Government Efficiency (DOGE).

In addition to the rule changes, it includes a proposal to cut 7,000 positions at the SSA—the largest workforce reduction in agency history. Some public service access points may also be affected.

While a similar version of the rule was close to being implemented at the end of Trump’s first term, it was ultimately delayed. Its revival now has reignited debate.

Also read: Government shutdown impacts Social Security offices nationwide—what beneficiaries need to know

What do disability advocates say?

Organizations such as the Center on Budget and Policy Priorities and the Center for American Progress have raised alarms, saying the rule would unfairly impact older and lower-income Americans.

They warn that these cuts could reverse decades of progress in poverty reduction and health outcomes for disabled adults—especially in underserved or medically vulnerable populations.

Also read: Are you making this huge Social Security mistake? 90% of Americans ignore this crucial advice

When would this happen—and what should you do now?

As of now, the proposal is still working its way through the federal rulemaking process.

It’s not final, and it could face legal, administrative, or public opposition. Any final version would take time to implement and could evolve along the way.

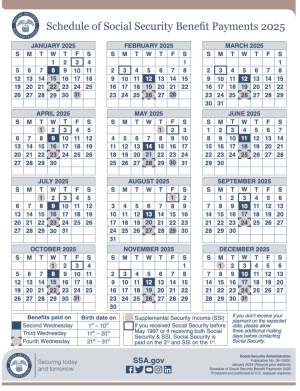

In the meantime, SSDI payments for November 2025 will go out on the usual schedule.

Payment dates are:

- Wednesday, November 12 – for those born 1st to 10th

- Wednesday, November 19 – for those born 11th to 20th

- Wednesday, November 26 – for those born 21st to 31st

Still, it's a good idea to take a few basic steps now in case reviews or changes occur in the future.

Also read: Trump’s new tariffs could bring bigger Social Security checks—but there’s a catch

How to protect yourself and stay prepared

If you're currently receiving SSDI—or plan to apply—you don’t need to panic. But it’s smart to stay proactive.

Here are a few ways to prepare:

- Keep your records organized. Make sure your medical history and documentation are up to date.

- Check the SSA website. Visit ssa.gov for any official updates.

- Get expert help if needed. Disability attorneys or advocates can help you navigate any rule changes or appeals.

- Understand your other benefits. Know how changes to SSDI or SSI might affect your access to Medicare, Medicaid, or SNAP.

This proposal is just one part of the national conversation around Social Security reform. Other ideas being floated include raising the retirement age or adjusting payroll tax limits.

Whether or not this rule moves forward, SSDI—and the broader Social Security system—is likely to remain a key issue in the coming year.

Read next:

- What Social Security really looks like at 72 in 2025

- Big changes are coming to Social Security work rules in 2026—could they affect your benefits?

- Don’t overlook these 3 Spousal Social Security secrets every retired couple should know

What are your thoughts on these potential changes to SSDI? Have you or someone you know been through a disability review or faced challenges with benefit eligibility? We’d love to hear your experiences, concerns, or questions.

Whether you’re currently receiving SSDI or simply want to stay ahead of the curve, your voice helps others feel seen, supported, and better informed.