A major US bank to close all branches nationwide for 24 hours

- Replies 0

Planning to swing by your local Bank of America branch this Labor Day? You might want to hit pause.

The bank has confirmed that all 3,800 of its branches across the United States will shut their doors for a full 24 hours in recognition of the federal holiday.

That means no teller windows, no in-person services, and no quick visits to your safe deposit box.

Nearly every major US bank follows the same schedule—if you don’t plan ahead, you may find yourself caught without the financial access you need.

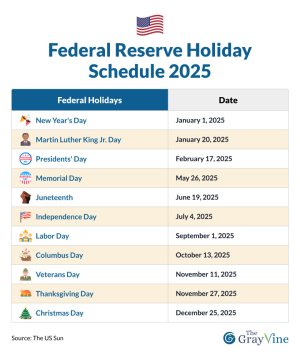

Since it’s a federally recognized holiday, banks must align with the Federal Reserve’s holiday calendar.

That means Bank of America, Chase, and Wells Fargo will all be closed on September 1 this year.

For Bank of America specifically, that closure will cover its entire national network of 3,800 branches, pausing in-person services for a full day.

Also read: These 39 bank branches are closing soon—Check if yours made the list!

Chase, Wells Fargo, and Bank of America will also close on September 1. Smaller credit unions and online banks might vary, but it’s rare to find a brick-and-mortar institution open on a Federal Reserve holiday.

Here’s the full schedule to help you plan ahead:

(Note: if a holiday falls on Saturday, banks open the Friday before. If it falls on Sunday, they’re closed the following Monday.)

Also read: Is your local bank next? 36 branches just closed—and more may be on the way

To qualify, you’ll need to set up direct deposits totaling at least $1,000 within the first 90 days. The offer ends October 15.

Holiday closures also tend to be prime time for overdrafts and fraud attempts.

Set up alerts for your balances and transactions, and watch out for phishing texts or emails pretending to be from your bank.

Read next: Something big is happening at the banks—and it’s not just business as usual

Have you ever been caught off guard by a bank holiday? Do you have tricks for staying ahead of closures—like auto-pay setups, cash budgeting, or using mobile wallets? And have you ever taken advantage of those new account bonuses? Share your tips, experiences, or questions in the comments!

The bank has confirmed that all 3,800 of its branches across the United States will shut their doors for a full 24 hours in recognition of the federal holiday.

That means no teller windows, no in-person services, and no quick visits to your safe deposit box.

Nearly every major US bank follows the same schedule—if you don’t plan ahead, you may find yourself caught without the financial access you need.

Why the big shutdown is happening

Labor Day, celebrated on the first Monday of September, honors the contributions and achievements of the American workforce.Since it’s a federally recognized holiday, banks must align with the Federal Reserve’s holiday calendar.

That means Bank of America, Chase, and Wells Fargo will all be closed on September 1 this year.

For Bank of America specifically, that closure will cover its entire national network of 3,800 branches, pausing in-person services for a full day.

Bank of America to close all branches nationwide for 24 hours. Image Source: ABC 7 Chicago / YouTube

What stays open (yes, you still have options)

Just because the branches are dark doesn’t mean you’re cut off from your cash. Here’s what remains available during the holiday:- ATMs: All Bank of America ATMs will remain fully functional, allowing withdrawals, deposits, and balance checks.

- Online & mobile banking: The Bank of America app and website won’t be affected, giving you access to bill pay, transfers, and account management.

- Deposits & transfers: You can still make them, but they’ll be marked pending until Tuesday, September 2.

Also read: These 39 bank branches are closing soon—Check if yours made the list!

What you can’t do during the closure

Certain services remain unavailable until September 2 (Tuesday), including:- In-branch assistance (loans, investments, safe deposit boxes).

- Same-day processing for certain payments and wire transfers.

Tips for a smooth labor day weekend

Want to avoid overdrafts, late fees, or weekend stress? Here’s how to stay ahead:- Pay bills early: Knock them out before September 1 to avoid “pending” surprises.

- Schedule transfers ahead: Ensure inter-account or third-party transfers process on time.

- Withdraw cash in advance: Holiday weekends often mean long ATM lines and limited bills.

- Mark your calendar: More bank holidays are coming, including Columbus Day (October 13), Veterans Day (November 11), Thanksgiving (November 27), and Christmas (December 25).

Chase, Wells Fargo, and Bank of America will also close on September 1. Smaller credit unions and online banks might vary, but it’s rare to find a brick-and-mortar institution open on a Federal Reserve holiday.

Here’s the full schedule to help you plan ahead:

(Note: if a holiday falls on Saturday, banks open the Friday before. If it falls on Sunday, they’re closed the following Monday.)

Also read: Is your local bank next? 36 branches just closed—and more may be on the way

Bonus: Current Bank of America promotions

If you’re considering opening a new account, Bank of America is currently offering a $325 cash bonus for new Everyday Checking accounts.To qualify, you’ll need to set up direct deposits totaling at least $1,000 within the first 90 days. The offer ends October 15.

Holiday closures also tend to be prime time for overdrafts and fraud attempts.

Set up alerts for your balances and transactions, and watch out for phishing texts or emails pretending to be from your bank.

Read next: Something big is happening at the banks—and it’s not just business as usual

Key Takeaways

- Bank of America will close all 3,800 branches nationwide on Monday, September 1, in observance of Labor Day.

- Customers will still have access to ATMs, mobile banking, and online banking, but transactions won’t process until Tuesday, September 2.

- Other major banks (Bank of America, Chase, and Wells Fargo) will also be closed on the holiday.

- Bank of America is offering a $325 bonus for new Everyday Checking accounts through October 15, 2025, with qualifying direct deposits.