Don’t miss your chance: How to get money from TransUnion’s $23 million settlement

By

Veronica E.

- Replies 0

If you've ever felt powerless dealing with large corporations, this might be your chance to see some accountability—and maybe receive a little money in the process.

TransUnion, one of the three major credit reporting agencies in the US, has agreed to pay a $23 million settlement to resolve claims that it failed to properly remove disputed hard inquiries from consumer credit reports.

If you’re eligible, you could receive a payment of up to $160.

Here’s a full breakdown of what happened, who qualifies, and how to claim your share.

The lawsuit—filed in December 2018—alleged that TransUnion violated the Fair Credit Reporting Act by failing to properly investigate or remove hard inquiries that consumers disputed between 2016 and 2025.

These “hard inquiries” can negatively affect a person's credit score and are typically recorded when someone applies for a loan, credit card, or other form of credit.

According to the plaintiffs, when consumers raised concerns about these inquiries, TransUnion responded with standard “502 Letters,” which explained the inquiries and advised consumers to contact the creditor directly.

The lawsuit claimed TransUnion should have handled the disputes themselves, including contacting the third parties and removing invalid inquiries.

TransUnion has not admitted to wrongdoing, but has agreed to settle and stated that it will improve its process for handling these kinds of consumer disputes.

Hard inquiries are credit checks performed by lenders when you apply for credit—like a mortgage, credit card, or car loan.

Unlike soft inquiries, which do not impact your credit score, hard inquiries can reduce your score by about five points.

For individuals with short credit histories or fewer accounts, the impact may be even more significant.

Multiple hard inquiries in a short period can compound the damage, potentially making it harder to get approved for loans or secure favorable interest rates.

This is why the issue matters—if these hard inquiries were added in error and not properly addressed, they could have caused real financial harm.

You may be eligible to receive money if you meet the following conditions:

According to the settlement documents, more than 485,000 consumers could be eligible to participate.

There are two possible payout tiers under the settlement:

The final payout will depend on how many valid claims are submitted and approved.

If you want to request the larger payment or if your mailing address has changed since receiving your 502 Letter, you’ll need to take additional steps:

This is also the deadline to request exclusion from the settlement or file an objection to its terms.

If there are no delays, payments are expected to be distributed within 90 days after the final approval hearing, which is scheduled for July 21, 2025.

However, like with many class action settlements, the timeline could be pushed back if appeals or other legal complications arise.

While the payouts may seem modest, this case is about more than just a few dollars.

It serves as a reminder of the importance of credit accuracy and the responsibility that reporting agencies have to consumers.

A hard inquiry may seem minor, but when left unaddressed, it can create long-term financial consequences—raising interest rates, limiting access to credit, or even resulting in loan denials.

By holding TransUnion accountable, this settlement may also encourage better consumer protection practices moving forward.

To avoid similar issues in the future, here are a few tips for protecting your credit:

This settlement is a reminder of how important it is to monitor your credit and take action when something doesn’t look right.

While the payouts may vary, the broader impact lies in holding major credit agencies accountable for how they handle consumer disputes.

If you’re eligible, don’t miss your chance to file a claim and take part in the resolution.

Read next: Your credit card interest rates could change—here’s what you need to know

Have you ever had issues with incorrect hard inquiries on your credit report? Are you planning to file a claim in the TransUnion settlement?

We’d love to hear your experiences and thoughts in the comments below. Whether you’ve faced similar challenges or just want to help others stay informed, your story matters!

TransUnion, one of the three major credit reporting agencies in the US, has agreed to pay a $23 million settlement to resolve claims that it failed to properly remove disputed hard inquiries from consumer credit reports.

If you’re eligible, you could receive a payment of up to $160.

Here’s a full breakdown of what happened, who qualifies, and how to claim your share.

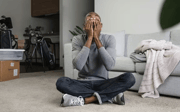

A recent class action settlement offers compensation to consumers affected by credit reporting issues. Image Source: Pexels / Photo By: Kaboompics.com.

Why is TransUnion paying a settlement?

The lawsuit—filed in December 2018—alleged that TransUnion violated the Fair Credit Reporting Act by failing to properly investigate or remove hard inquiries that consumers disputed between 2016 and 2025.

These “hard inquiries” can negatively affect a person's credit score and are typically recorded when someone applies for a loan, credit card, or other form of credit.

According to the plaintiffs, when consumers raised concerns about these inquiries, TransUnion responded with standard “502 Letters,” which explained the inquiries and advised consumers to contact the creditor directly.

The lawsuit claimed TransUnion should have handled the disputes themselves, including contacting the third parties and removing invalid inquiries.

TransUnion has not admitted to wrongdoing, but has agreed to settle and stated that it will improve its process for handling these kinds of consumer disputes.

Also read: Don’t miss out: You could get up to $1,000 from this $14 million robocall settlement—here’s how to claim it

What is a hard inquiry, and why does it matter?

Hard inquiries are credit checks performed by lenders when you apply for credit—like a mortgage, credit card, or car loan.

Unlike soft inquiries, which do not impact your credit score, hard inquiries can reduce your score by about five points.

For individuals with short credit histories or fewer accounts, the impact may be even more significant.

Multiple hard inquiries in a short period can compound the damage, potentially making it harder to get approved for loans or secure favorable interest rates.

This is why the issue matters—if these hard inquiries were added in error and not properly addressed, they could have caused real financial harm.

Also read: Get your slice of a $3.6 million settlement—no receipts required

Who is eligible for compensation?

You may be eligible to receive money if you meet the following conditions:

- You disputed a hard inquiry on your TransUnion credit report between December 5, 2016, and January 31, 2025.

- You received a “502 Letter” from TransUnion in response to your dispute.

According to the settlement documents, more than 485,000 consumers could be eligible to participate.

How much money could you receive?

There are two possible payout tiers under the settlement:

- Automatic Minimum Payment

If you received a 502 Letter, you’re automatically entitled to a minimum payout of $20 to $30. You do not need to file a claim—this payment will be sent to the same address where the letter was mailed. - Larger Payout (Up to $160)

If you experienced specific financial harm as a result of the disputed inquiry, you may qualify for a larger payment of up to $160. To receive this, you must submit a claim form and confirm that one of the following applies to you:- Your TransUnion credit score dropped due to the inquiry.

- TransUnion sent a credit report containing the disputed inquiry to a third party.

- You were denied credit, in part, due to the disputed inquiry.

The final payout will depend on how many valid claims are submitted and approved.

Consumers can submit a claim online or by mail to request their settlement payment. Image Source: Pexels / SHVETS production.

Also read: Living on credit: The tough choices many seniors face today

How to file a claim

If you want to request the larger payment or if your mailing address has changed since receiving your 502 Letter, you’ll need to take additional steps:

- Visit the official class action settlement website and complete the claim form by June 24, 2025.

- You can also mail your completed claim form to:

Norman v. Trans Union, LLC

c/o Settlement Administrator

PO Box 23489

Jacksonville, FL 32241

This is also the deadline to request exclusion from the settlement or file an objection to its terms.

When will payments go out?

If there are no delays, payments are expected to be distributed within 90 days after the final approval hearing, which is scheduled for July 21, 2025.

However, like with many class action settlements, the timeline could be pushed back if appeals or other legal complications arise.

Also read: Are gas stations charging you more than advertised? The credit card trick catching drivers off guard

Why this settlement matters

While the payouts may seem modest, this case is about more than just a few dollars.

It serves as a reminder of the importance of credit accuracy and the responsibility that reporting agencies have to consumers.

A hard inquiry may seem minor, but when left unaddressed, it can create long-term financial consequences—raising interest rates, limiting access to credit, or even resulting in loan denials.

By holding TransUnion accountable, this settlement may also encourage better consumer protection practices moving forward.

How to protect your credit moving forward

To avoid similar issues in the future, here are a few tips for protecting your credit:

- Monitor your credit reports: You’re entitled to a free credit report from each of the three major bureaus every year. Check regularly for inaccuracies or unauthorized activity.

- Dispute errors quickly: If you find something incorrect, act fast. Contact the bureau in writing and provide documentation if needed.

- Be cautious with credit applications: Only apply for new credit when necessary to minimize hard inquiries.

- Consider credit monitoring or identity theft protection: These services can alert you to unauthorized inquiries or suspicious activity on your accounts.

This settlement is a reminder of how important it is to monitor your credit and take action when something doesn’t look right.

While the payouts may vary, the broader impact lies in holding major credit agencies accountable for how they handle consumer disputes.

If you’re eligible, don’t miss your chance to file a claim and take part in the resolution.

Read next: Your credit card interest rates could change—here’s what you need to know

Key Takeaways

- TransUnion has agreed to a $23 million class action settlement after being accused of failing to properly investigate and remove disputed hard inquiries from consumers’ credit reports between 2016 and 2025.

- Eligible consumers who received a "502 Letter" after disputing a hard inquiry on their TransUnion report between December 2016 and January 2025 will automatically receive a minimum payout of at least $20 to $30, with the potential for up to $160 if additional financial harm can be proven.

- To claim a higher payment, class members must submit a form by 24 June 2025, attesting to specific financial impacts such as a dropped credit score, denial of credit, or their report being shared with a third party.

- Payments are expected to be distributed within 90 days of the final approval hearing on 21 July 2025, although appeals may cause delays.

Have you ever had issues with incorrect hard inquiries on your credit report? Are you planning to file a claim in the TransUnion settlement?

We’d love to hear your experiences and thoughts in the comments below. Whether you’ve faced similar challenges or just want to help others stay informed, your story matters!