Falling for the “transfer it to protect it” scam? FTC warns this scheme is targeting older Americans

By

Veronica E.

- Replies 0

You’re having your morning coffee when the phone rings.

The person on the other end says they’re from your bank, the IRS, or Social Security—and your money is in danger.

They sound urgent, maybe even a little panicked.

The solution, they claim, is simple: transfer your money to a “safe” account, or use Apple Cash or cryptocurrency to keep it from being stolen.

But according to the Federal Trade Commission (FTC), this rising scam is anything but safe—and it’s already cost older Americans hundreds of millions of dollars.

This scam usually begins with a call, email, or pop-up from someone pretending to be an official—often from a bank, government agency, or even a tech support team.

They tell you your financial accounts are compromised or that your Social Security number has been used in a crime.

To fix it, they say you need to act fast by transferring your money to a different account, or converting it into cryptocurrency.

They might ask you to use apps like Apple Cash or send payments via wire transfer or a crypto ATM.

The request sounds convincing, and the caller may even have information about you.

That’s all part of the scam.

The FTC reports that scams like this have surged dramatically over the past four years.

In 2020, Americans lost about $55 million to “transfer it to protect it” scams.

By 2024, that number had grown to $445 million—nearly half a billion dollars in losses.

The majority of these reports come from adults over 60, many of whom lost over $10,000, and in some heartbreaking cases, their entire life savings.

In 2024 alone, over 8,200 older adults reported losing $10,000 or more to scammers impersonating businesses or government officials.

These scams can hit anyone, anywhere.

Here are a few cases that highlight just how sophisticated—and devastating—they can be:

Scammers rely on manipulation and urgency to get victims to act without thinking. Here’s what they often do:

Scammers often focus on seniors because they’re more likely to answer phone calls and may be unfamiliar with new payment technologies or digital threats.

Many older adults also have more retirement savings than younger people, which makes them especially appealing targets.

But it’s not just seniors—this scam has also affected younger victims, including recent graduates and new workers.

If any of the following happen, it’s likely a scam:

Keep in mind, legitimate banks, agencies, or companies will never:

You can stay safe—and help others avoid falling for these scams—by following these steps:

If you think you’ve been scammed, here’s how to act quickly:

Scams like these thrive on fear and confusion—but with the right knowledge, we can all stay one step ahead.

Whether it’s sharing this article, talking with a loved one, or simply pausing before taking action, every small step helps protect our community.

Stay cautious, stay informed, and remember: if something feels off, it probably is.

Read next: Discover the smart scam alert that could protect your bank account!

Have you or someone you know encountered this scam? Sharing your experience might help protect someone else from losing their savings.

Whether you’ve spotted warning signs, avoided a scam, or unfortunately been a victim, your insight matters.

The person on the other end says they’re from your bank, the IRS, or Social Security—and your money is in danger.

They sound urgent, maybe even a little panicked.

The solution, they claim, is simple: transfer your money to a “safe” account, or use Apple Cash or cryptocurrency to keep it from being stolen.

But according to the Federal Trade Commission (FTC), this rising scam is anything but safe—and it’s already cost older Americans hundreds of millions of dollars.

Stay alert—scammers often pretend to be from banks, the IRS, or even Social Security to steal your money. Image Source: Pexels / Thirdman.

What is the “transfer it to protect it” scam?

This scam usually begins with a call, email, or pop-up from someone pretending to be an official—often from a bank, government agency, or even a tech support team.

They tell you your financial accounts are compromised or that your Social Security number has been used in a crime.

To fix it, they say you need to act fast by transferring your money to a different account, or converting it into cryptocurrency.

They might ask you to use apps like Apple Cash or send payments via wire transfer or a crypto ATM.

The request sounds convincing, and the caller may even have information about you.

That’s all part of the scam.

Also read: Got a text about an Amazon refund? Don’t click—it’s a scam

Older adults are the top targets—and the losses are massive

The FTC reports that scams like this have surged dramatically over the past four years.

In 2020, Americans lost about $55 million to “transfer it to protect it” scams.

By 2024, that number had grown to $445 million—nearly half a billion dollars in losses.

The majority of these reports come from adults over 60, many of whom lost over $10,000, and in some heartbreaking cases, their entire life savings.

In 2024 alone, over 8,200 older adults reported losing $10,000 or more to scammers impersonating businesses or government officials.

Also read: Police warn: Self-checkout scam preying on seniors in San Mateo

Real-life examples from recent reports

These scams can hit anyone, anywhere.

Here are a few cases that highlight just how sophisticated—and devastating—they can be:

- Michigan teen scammed out of $4,800: An 18-year-old received an email about supposed fraud on his bank account. Shortly after, he was called by someone posing as a bank employee who convinced him to transfer the money via Apple Cash. The funds were sent overseas and lost.

- Crypto ATM fraud: A woman was told by someone impersonating her credit union that she needed to move $17,500 into a “security” account. She followed their instructions to a local bitcoin ATM—and never saw the money again.

- Fake government agent: In other cases, scammers claim there’s a warrant out for your arrest or that your assets will be frozen unless you act quickly. They may “transfer” you to another official who tells you to deposit funds into a cryptocurrency kiosk with the promise of a certified check. The check never arrives.

Also read: Watch out for this "how are you" message—It could be a scam in disguise

Common scam tactics used to create panic

Scammers rely on manipulation and urgency to get victims to act without thinking. Here’s what they often do:

- Create fear: They say your identity has been stolen, or you’re under criminal investigation.

- Pretend to be trusted figures: Bankers, government agents, tech support, even the FTC.

- Use complex stories: Elaborate lies about hacked accounts or investigations.

- Request unusual payment methods: Apple Cash, crypto, gift cards, or wire transfers.

- Keep you on the phone: They stay on the line while you complete the transaction, so you won’t reach out to anyone else for help.

Also read: Could your next hotel reservation be at risk? What travelers need to know about this growing scam

Why scammers target older adults

Scammers often focus on seniors because they’re more likely to answer phone calls and may be unfamiliar with new payment technologies or digital threats.

Many older adults also have more retirement savings than younger people, which makes them especially appealing targets.

But it’s not just seniors—this scam has also affected younger victims, including recent graduates and new workers.

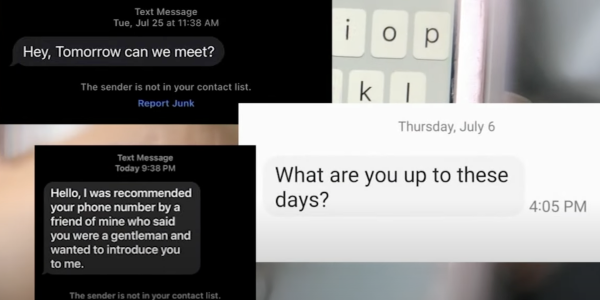

Scammers often target older adults with convincing phone calls or emails—knowing they may be more trusting or unfamiliar with new tech. Stay alert and spread the word. Image Source: Pexels / Photo By: Kaboompics.com.

Also read: Bitcoin scam nearly cost a 73-year-old $20,000—here’s how she was saved

Warning signs to watch for

If any of the following happen, it’s likely a scam:

- You’re told to move money to a new account to keep it “safe.”

- You’re asked to pay with cryptocurrency, Apple Cash, or gift cards.

- The caller claims to be from a government agency or business and pressures you to act fast.

- You’re warned not to tell anyone else what you’re doing.

- You get a computer pop-up with a phone number for “tech support.”

Also read: A warning text led to this costly mistake—how one couple lost over $80K in a shocking scam

What real organizations will never do

Keep in mind, legitimate banks, agencies, or companies will never:

- Ask you to transfer money to “protect it.”

- Demand payment via crypto, Apple Cash, or gift cards.

- Threaten arrest or asset seizure over the phone.

- Rush you through a payment or insist you stay on the phone.

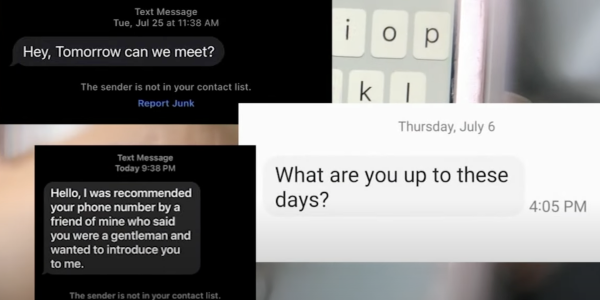

Scam texts often start with casual, friendly messages from unknown numbers—designed to spark conversation and build trust before asking for money. Image Source: YouTube / ABC 7 Chicago.

Also read: Maryland man loses $40K to convincing scam—here’s how to protect yourself

How to protect yourself and others

You can stay safe—and help others avoid falling for these scams—by following these steps:

- Pause: Take a deep breath. Don’t act while panicking.

- Verify: Hang up and contact the organization directly using a number you trust.

- Guard your info: Never give out your Social Security number or banking details to unsolicited contacts.

- Avoid strange payment methods: No real business will ask for crypto or gift cards.

- Talk to someone: Ask a family member, friend, or advisor before making any financial moves.

- Report it: Visit ReportFraud.ftc.gov to notify the FTC, and also alert local law enforcement if needed.

Also read: She lost $51K to a home repair scam—what happened and how to protect yourself

What to do if you’ve already sent money

If you think you’ve been scammed, here’s how to act quickly:

- Contact your bank or payment app immediately to try to stop or reverse the transaction.

- Report the scam to the FTC and your state attorney general.

- Don’t isolate: Scams are emotionally stressful—lean on loved ones or support groups for help.

Scams like these thrive on fear and confusion—but with the right knowledge, we can all stay one step ahead.

Whether it’s sharing this article, talking with a loved one, or simply pausing before taking action, every small step helps protect our community.

Stay cautious, stay informed, and remember: if something feels off, it probably is.

Read next: Discover the smart scam alert that could protect your bank account!

Key Takeaways

- The FTC reports that losses from “transfer it to protect it” scams jumped from $55 million in 2020 to $445 million in 2024, mostly affecting older adults.

- Scammers often pose as trusted figures and use urgency, fear, and fake threats to convince victims to transfer funds via crypto, Apple Cash, or wire.

- Examples include a Michigan teen losing $4,800 and a woman directed to a bitcoin ATM to “protect” her savings.

- To stay safe, experts urge people to hang up, verify claims independently, avoid unusual payment methods, and report scams to the FTC and local authorities.

Have you or someone you know encountered this scam? Sharing your experience might help protect someone else from losing their savings.

Whether you’ve spotted warning signs, avoided a scam, or unfortunately been a victim, your insight matters.