Get your tax refunds: Discover the exact dates IRS is releasing 2025 stimulus checks!

By

Veronica E.

- Replies 0

Who doesn’t love the feeling of seeing that tax refund hit your bank account?

For many of us, it’s like a financial breath of fresh air, especially when it comes at just the right time.

Whether it’s for boosting your savings, covering unexpected expenses, or simply treating yourself, knowing when you’ll get your hands on that extra cash is key.

Here at The GrayVine, we understand just how important it is for you to have all the details, so let’s explore the specifics of the 2025 stimulus checks and how you can make sure you get your refund as quickly as possible!

Stay tuned as we break down everything you need to know to ensure you're ready when that refund hits your account.

Understanding the IRS Tax Refund Timeline

First things first, let’s clear up some confusion. The term "stimulus check" might be floating around, but what we’re really talking about here is your tax refund.

It’s that money you’ve overpaid throughout the year that the IRS returns to you. Who doesn’t enjoy getting their own money back, right?

The IRS is often known for being a little slower with refunds than we’d like. But don’t worry—there are some general guidelines and dates to keep in mind to help you predict when your refund will arrive.

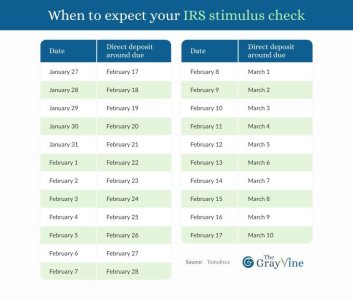

Mark your calendars: Estimated refund dates

While the IRS usually starts issuing refunds a few weeks after tax season begins, here’s a rough guide for when you might see your refund for the 2025 tax season, which ends on April 15th. Depending on when you file, your refund could be available as early as mid-February.

This is just an estimated timeline. Your refund could arrive earlier or later depending on a few factors, including how you file (e-filing with direct deposit is the fastest), the complexity of your return, and any issues the IRS needs to resolve before processing.

Tips for a speedier refund

Want to get that refund into your hands as quickly as possible? Here are some tips to help speed things up:

Also read: The ultimate guide to an anti-inflammatory diet – eat this, not that!

Extensions and special circumstances

Sometimes life happens, and you might need a little extra time to file your taxes. If so, the IRS offers an extension until October, but keep in mind that this is an extension to file, not to pay.

If you owe taxes, you'll still need to estimate and pay what you owe by April 15 to avoid any penalties.

For retirees managing multiple income sources or anyone with a more complex situation, it might be wise to get help from a tax professional to ensure your return is accurate and that you’re taking full advantage of any credits or deductions available.

Getting your tax refund faster is all about staying informed and taking the right steps. We hope these tips help you get your refund in hand without delay!

Related articles:

Get your tax refund faster: 3 simple steps to track it right now!

Experts reveal tax filing trick to put thousands back in your wallet

Unlock hidden savings on your taxes with this guide to federal tax credits

Now that you know when to expect your 2025 tax refund, what are your plans? Are you saving for something big, or maybe taking a well-deserved vacation? We’d love to hear from you! Share your plans in the comments below and let’s talk about how to make the most of our refunds.

Read next: Shocking discovery: One man's extreme diet reveals the dangers of high cholesterol buildup

For many of us, it’s like a financial breath of fresh air, especially when it comes at just the right time.

Whether it’s for boosting your savings, covering unexpected expenses, or simply treating yourself, knowing when you’ll get your hands on that extra cash is key.

Here at The GrayVine, we understand just how important it is for you to have all the details, so let’s explore the specifics of the 2025 stimulus checks and how you can make sure you get your refund as quickly as possible!

Stay tuned as we break down everything you need to know to ensure you're ready when that refund hits your account.

Stay informed: Understanding the timeline for your 2025 IRS tax refund. Image Source: Pexels / Alex P.

Understanding the IRS Tax Refund Timeline

First things first, let’s clear up some confusion. The term "stimulus check" might be floating around, but what we’re really talking about here is your tax refund.

It’s that money you’ve overpaid throughout the year that the IRS returns to you. Who doesn’t enjoy getting their own money back, right?

The IRS is often known for being a little slower with refunds than we’d like. But don’t worry—there are some general guidelines and dates to keep in mind to help you predict when your refund will arrive.

Mark your calendars: Estimated refund dates

While the IRS usually starts issuing refunds a few weeks after tax season begins, here’s a rough guide for when you might see your refund for the 2025 tax season, which ends on April 15th. Depending on when you file, your refund could be available as early as mid-February.

This is just an estimated timeline. Your refund could arrive earlier or later depending on a few factors, including how you file (e-filing with direct deposit is the fastest), the complexity of your return, and any issues the IRS needs to resolve before processing.

Tips for a speedier refund

Want to get that refund into your hands as quickly as possible? Here are some tips to help speed things up:

- File Early: The earlier you file, the sooner you’re in line for your refund. Plus, filing early helps protect you from tax identity theft.

- E-file with Direct Deposit: This is the fastest method. Paper returns and checks can slow things down.

- Double-Check Your Return: Mistakes on your tax return can cause delays. Be sure everything is correct before you submit.

- Stay Informed: Use the IRS’s "Where’s My Refund?" tool to track the status of your refund.

Enjoying the simplicity of filing taxes online: An easier way for seniors to track their refund without the hassle of paper forms. Image Source: Pexels / SHVETS production.

Also read: The ultimate guide to an anti-inflammatory diet – eat this, not that!

Extensions and special circumstances

Sometimes life happens, and you might need a little extra time to file your taxes. If so, the IRS offers an extension until October, but keep in mind that this is an extension to file, not to pay.

If you owe taxes, you'll still need to estimate and pay what you owe by April 15 to avoid any penalties.

For retirees managing multiple income sources or anyone with a more complex situation, it might be wise to get help from a tax professional to ensure your return is accurate and that you’re taking full advantage of any credits or deductions available.

Getting your tax refund faster is all about staying informed and taking the right steps. We hope these tips help you get your refund in hand without delay!

Related articles:

Get your tax refund faster: 3 simple steps to track it right now!

Experts reveal tax filing trick to put thousands back in your wallet

Unlock hidden savings on your taxes with this guide to federal tax credits

Key Takeaways

- United States citizens can receive a stimulus check from the IRS as part of their Tax Refund.

- The receipt of the Tax Refund depends on several factors, including the timing of Tax Return submission and the correctness of the submitted documentation.

- There are approximate dates provided for when taxpayers might expect to receive their direct deposit from the IRS, but these are only guidelines and not guarantees.

- The IRS Tax Season in 2025 will close on April 15th, with a potential extension allowing for document submission until October, although these dates are not confirmed.

Now that you know when to expect your 2025 tax refund, what are your plans? Are you saving for something big, or maybe taking a well-deserved vacation? We’d love to hear from you! Share your plans in the comments below and let’s talk about how to make the most of our refunds.

Read next: Shocking discovery: One man's extreme diet reveals the dangers of high cholesterol buildup