How this woman lost her $500,000 nest egg just years after early retirement—could it happen to you?

- Replies 0

Retiring early is the dream, right? Picture it: the alarm clock is a thing of the past, your mortgage is paid off, and you’ve got a healthy $500,000 nest egg to see you through the golden years.

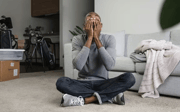

That’s exactly where Misty Miller found herself at 58. But just a few years later, her savings had all but vanished, and she was left scrambling to rebuild her life—financially and emotionally.

Misty’s story is a cautionary tale for anyone considering early retirement. It’s not just about the numbers in your bank account; it’s about having a plan, a purpose, and a clear-eyed view of what life after work really looks like.

So, let’s dig into what happened, what went wrong, and what we can all learn from Misty’s experience.

The Dream: Early Retirement with a Solid Cushion

Misty did what many of us strive for: she paid off her mortgage, whittled her monthly expenses down to $800, and built up over half a million dollars in retirement savings. On paper, she was set.

Her pension would bring in $3,000 a month—more than enough to cover her needs without even touching her savings for years.

So, at 58, she handed in her retirement paperwork, ready to embrace a life of leisure, travel, and freedom. But within a week, regret set in.

The Reality: Purpose, Structure, and the Unexpected Void

What Misty hadn’t planned for was the loss of daily structure and social connection that work provided.

“I had enough money, that was the part I planned out, but I hadn’t planned out what I was going to do all day, and that was the problem,” she admitted.

Without work, she felt adrift. The days stretched out, empty and unfulfilling. Her job had been more than a paycheck—it was her social network, her sense of purpose, and her reason to get up in the morning. Suddenly, her biggest decision was what to have for breakfast.

The Panic: Trying to Turn Back Time

Just a week into retirement, Misty realized she’d made a mistake. She called her old office, hoping to reclaim her job, but it was too late. Her position had already been eliminated. The door to her old life was closed.

Her husband, seeing her distress, suggested a trip to the beach. In a moment of impulse—perhaps fueled by regret, perhaps by a desire for a fresh start—Misty bought a house there. To make the down payment, she cashed out her entire 401(k).

The Costly Mistake: Cashing Out the 401(k)

Here’s where things went from bad to worse. By withdrawing her entire 401(k) at once, Misty triggered a massive tax bill—45% of her savings went straight to the IRS. She was left with just 55% of what she’d worked so hard to save.

“I regret withdrawing that money from my 401(k),” she said. And who wouldn’t? That one decision wiped out years of careful saving and planning.

Also read: Tearful plea takes a dark turn—the truth behind this missing person’s case

The Beach House Blues

The new house didn’t bring the happiness Misty hoped for. Retirement at the beach turned out to be just as lonely and unfulfilling as retirement in Sacramento.

She tried working at a local newspaper for $19 an hour, but it wasn’t the same. Eventually, she left that job, too.

When she decided to move back to Sacramento, she bought a new home with what little money she had left—paying cash, since she was unemployed and couldn’t qualify for a loan. But the beach house didn’t sell for a year, leaving her cash-strapped and living month-to-month on her pension.

“For the first time in my life, I was groveling every single month, having to watch what I ate,” Misty recalled. The financial security she’d always enjoyed was gone.

Source: Business Insider / Youtube.

The Struggle: Starting Over in Her 60s

Determined to rebuild, Misty set her sights on returning to work. But finding a job in her 60s was no easy feat. Despite her college degree and office skills, employers seemed to prefer younger candidates.

After years of searching, she finally landed a full-time job with a California state agency at age 63.

Now, at 65, Misty earns $8,650 a month, has rebuilt her retirement savings to $450,000, and has no plans to fully retire again. Work gives her structure, fulfillment, and peace of mind. She’s even considering partial retirement—working part-time while collecting a portion of her pension—but full retirement? “Never again,” she says.

Read next: Ananda Lewis, voice of a generation on MTV and BET, has died

Have you thought about what retirement will look like for you? Do you have a plan for both your finances and your time? Have you faced challenges re-entering the workforce or made a big financial decision you regret? We’d love to hear your stories, advice, and questions in the comments below!

That’s exactly where Misty Miller found herself at 58. But just a few years later, her savings had all but vanished, and she was left scrambling to rebuild her life—financially and emotionally.

Misty’s story is a cautionary tale for anyone considering early retirement. It’s not just about the numbers in your bank account; it’s about having a plan, a purpose, and a clear-eyed view of what life after work really looks like.

So, let’s dig into what happened, what went wrong, and what we can all learn from Misty’s experience.

The Dream: Early Retirement with a Solid Cushion

Misty did what many of us strive for: she paid off her mortgage, whittled her monthly expenses down to $800, and built up over half a million dollars in retirement savings. On paper, she was set.

Her pension would bring in $3,000 a month—more than enough to cover her needs without even touching her savings for years.

Misty Miller retired early at 58, thinking her $500,000 in savings and a pension would be enough, but she hadn’t planned how she’d spend her days. Image source: Business Insider / Youtube.

So, at 58, she handed in her retirement paperwork, ready to embrace a life of leisure, travel, and freedom. But within a week, regret set in.

The Reality: Purpose, Structure, and the Unexpected Void

What Misty hadn’t planned for was the loss of daily structure and social connection that work provided.

“I had enough money, that was the part I planned out, but I hadn’t planned out what I was going to do all day, and that was the problem,” she admitted.

Without work, she felt adrift. The days stretched out, empty and unfulfilling. Her job had been more than a paycheck—it was her social network, her sense of purpose, and her reason to get up in the morning. Suddenly, her biggest decision was what to have for breakfast.

The Panic: Trying to Turn Back Time

Just a week into retirement, Misty realized she’d made a mistake. She called her old office, hoping to reclaim her job, but it was too late. Her position had already been eliminated. The door to her old life was closed.

Her husband, seeing her distress, suggested a trip to the beach. In a moment of impulse—perhaps fueled by regret, perhaps by a desire for a fresh start—Misty bought a house there. To make the down payment, she cashed out her entire 401(k).

The Costly Mistake: Cashing Out the 401(k)

Here’s where things went from bad to worse. By withdrawing her entire 401(k) at once, Misty triggered a massive tax bill—45% of her savings went straight to the IRS. She was left with just 55% of what she’d worked so hard to save.

“I regret withdrawing that money from my 401(k),” she said. And who wouldn’t? That one decision wiped out years of careful saving and planning.

Also read: Tearful plea takes a dark turn—the truth behind this missing person’s case

The Beach House Blues

The new house didn’t bring the happiness Misty hoped for. Retirement at the beach turned out to be just as lonely and unfulfilling as retirement in Sacramento.

She tried working at a local newspaper for $19 an hour, but it wasn’t the same. Eventually, she left that job, too.

When she decided to move back to Sacramento, she bought a new home with what little money she had left—paying cash, since she was unemployed and couldn’t qualify for a loan. But the beach house didn’t sell for a year, leaving her cash-strapped and living month-to-month on her pension.

“For the first time in my life, I was groveling every single month, having to watch what I ate,” Misty recalled. The financial security she’d always enjoyed was gone.

Source: Business Insider / Youtube.

The Struggle: Starting Over in Her 60s

Determined to rebuild, Misty set her sights on returning to work. But finding a job in her 60s was no easy feat. Despite her college degree and office skills, employers seemed to prefer younger candidates.

After years of searching, she finally landed a full-time job with a California state agency at age 63.

Now, at 65, Misty earns $8,650 a month, has rebuilt her retirement savings to $450,000, and has no plans to fully retire again. Work gives her structure, fulfillment, and peace of mind. She’s even considering partial retirement—working part-time while collecting a portion of her pension—but full retirement? “Never again,” she says.

Read next: Ananda Lewis, voice of a generation on MTV and BET, has died

Key Takeaways

- Misty Miller retired early at 58, thinking her $500,000 in savings and a pension would be enough, but she hadn’t planned how she’d spend her days.

- After regretting her decision, she tried to get her job back but the position was already gone, leaving her feeling isolated and without a sense of purpose.

- She made a financial misstep by cashing out her entire 401(k) to buy a beach house, which led to hefty taxes and significant loss of her retirement funds.

- Finding it hard to re-enter the workforce in her 60s, Miller eventually secured a new job, rebuilt her savings, and now advises others to keep working for purpose and financial stability rather than retiring early.

Have you thought about what retirement will look like for you? Do you have a plan for both your finances and your time? Have you faced challenges re-entering the workforce or made a big financial decision you regret? We’d love to hear your stories, advice, and questions in the comments below!