How Trump's tariffs could impact your wallet: What you need to know

By

Aubrey Razon

- Replies 0

In a surprising move, the Trump administration has imposed tariffs on imports from Canada and Mexico, which could affect your daily expenses. These tariffs are expected to raise the cost of essential products like cars and groceries.

How will these price hikes impact your budget and lifestyle?

Before we delve into the specifics, let's unpack what these tariffs really mean.

President Trump has introduced a 25% tariff on imports from Mexico and Canada, with an additional 10% on imports from China.

While tariffs are often described as a tax on foreign countries, the reality is quite different.

These costs are paid directly to the US federal government by American businesses that import goods.

These businesses, in turn, typically pass on the extra costs to consumers by raising prices.

The short answer is: you do.

Experts like Brian Peck, executive director of the University of Southern California's Center for Transnational Law and Business, warn that US consumers and businesses will likely bear the brunt of these increased costs.

From Canadian oil and lumber to Mexican agriculture, these tariffs could touch every corner of the American household.

Let's break down the potential price increases on everyday items:

1. Avocados, Beef, and Other Foods

Just in time for events like the Super Bowl, prices for Mexican imports such as avocados, strawberries, raspberries, tomatoes, and beef could surge.

The US imported over $45 billion in agricultural products from Mexico in 2023, not to mention beer, tequila, and other beverages.

Canadian imports, including beef, pork, grains, and canola oil, totaled about $40 billion. A 25% tariff on these goods could significantly inflate your grocery bill.

2. Cars

The automobile industry is deeply integrated across North American borders.

The US imported $69 billion worth of cars and light trucks from Mexico and $37 billion from Canada in 2023.

Additionally, auto parts imports were substantial, with $78 billion from Mexico and $20 billion from Canada.

For example, the engines in Ford's F-series pickup trucks are sourced from Canada.

These tariffs could add approximately $3,000 to the average vehicle price, a steep increase when new cars already average around $50,000 and used cars at $26,000.

3. Lumber

Around one-third of the softwood lumber used in the US comes from Canada.

A 25% tariff on these imports could lead to a supply shock, affecting everything from construction costs to homemade projects.

While the sluggish US housing market might temper the ability to pass these costs onto consumers, any increase in lumber prices could further burden an already strained market.

While American consumers prepare for these potential price hikes, the broader economic impact is also worth considering.

Economies of Canada and Mexico could suffer significant GDP losses, with estimates of a 3.6% and 2% decrease respectively, compared to a 0.3% decline for the US

This imbalance could lead to broader economic repercussions and strained international relations.

In light of these developments, it's more important than ever to be mindful of your spending and budgeting. Here are a few tips to help you navigate this new economic landscape:

Have you noticed price increases in your recent shopping trips? Are there strategies you've employed to mitigate the impact of tariffs on your budget? Share your experiences and tips in the comments below.

Have you noticed price increases in your recent shopping trips? Are there strategies you've employed to mitigate the impact of tariffs on your budget? Share your experiences and tips in the comments below.

How will these price hikes impact your budget and lifestyle?

Before we delve into the specifics, let's unpack what these tariffs really mean.

President Trump has introduced a 25% tariff on imports from Mexico and Canada, with an additional 10% on imports from China.

While tariffs are often described as a tax on foreign countries, the reality is quite different.

These costs are paid directly to the US federal government by American businesses that import goods.

These businesses, in turn, typically pass on the extra costs to consumers by raising prices.

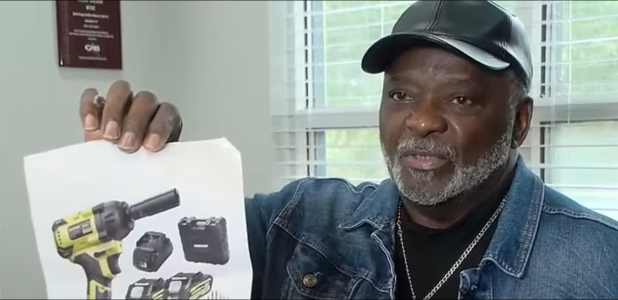

The Trump administration imposed tariffs on imports from Mexico and Canada. Image source: CBS Evening News/Youtube.

The short answer is: you do.

Experts like Brian Peck, executive director of the University of Southern California's Center for Transnational Law and Business, warn that US consumers and businesses will likely bear the brunt of these increased costs.

From Canadian oil and lumber to Mexican agriculture, these tariffs could touch every corner of the American household.

Let's break down the potential price increases on everyday items:

1. Avocados, Beef, and Other Foods

Just in time for events like the Super Bowl, prices for Mexican imports such as avocados, strawberries, raspberries, tomatoes, and beef could surge.

The US imported over $45 billion in agricultural products from Mexico in 2023, not to mention beer, tequila, and other beverages.

Canadian imports, including beef, pork, grains, and canola oil, totaled about $40 billion. A 25% tariff on these goods could significantly inflate your grocery bill.

2. Cars

The automobile industry is deeply integrated across North American borders.

The US imported $69 billion worth of cars and light trucks from Mexico and $37 billion from Canada in 2023.

Additionally, auto parts imports were substantial, with $78 billion from Mexico and $20 billion from Canada.

For example, the engines in Ford's F-series pickup trucks are sourced from Canada.

These tariffs could add approximately $3,000 to the average vehicle price, a steep increase when new cars already average around $50,000 and used cars at $26,000.

3. Lumber

Around one-third of the softwood lumber used in the US comes from Canada.

A 25% tariff on these imports could lead to a supply shock, affecting everything from construction costs to homemade projects.

While the sluggish US housing market might temper the ability to pass these costs onto consumers, any increase in lumber prices could further burden an already strained market.

While American consumers prepare for these potential price hikes, the broader economic impact is also worth considering.

Economies of Canada and Mexico could suffer significant GDP losses, with estimates of a 3.6% and 2% decrease respectively, compared to a 0.3% decline for the US

This imbalance could lead to broader economic repercussions and strained international relations.

In light of these developments, it's more important than ever to be mindful of your spending and budgeting. Here are a few tips to help you navigate this new economic landscape:

- Stay Informed: Keep an eye on news about tariffs and trade negotiations, as these can change rapidly.

- Shop Smart: Look for locally produced alternatives to imported goods, which may be cheaper and not subject to tariffs.

- Plan Ahead: If you're considering a major purchase like a car or home renovation, factor in the potential for increased costs due to tariffs.

- Voice Your Concerns: Contact your representatives to express how these tariffs could affect you personally.

Key Takeaways

- The Trump administration imposed tariffs on imports from Mexico and Canada, which could result in higher prices for American consumers.

- American businesses, not foreign countries, pay tariffs directly to the US government and often pass on the costs to consumers.

- Common goods such as avocados, beef, alcoholic beverages, and automobiles could become more expensive due to these tariffs.

- There could be significant negative impacts on the Canadian and Mexican economies, and some U.S. sectors like the automotive and construction industries might also encounter setbacks.