IRS mistake leaves 92-year-old woman unable to cash $11K tax refund—here’s what happened

By

Veronica E.

- Replies 0

Tax season can be stressful, but imagine waiting months for your hard-earned refund, only to realize you can’t cash it.

That’s exactly what happened to Myrna Hoffman, a 92-year-old woman whose $11,000 tax refund became trapped in bureaucratic limbo—all because of a simple but costly mistake by the IRS.

For Myrna and her daughter Debra, this wasn’t just an inconvenience.

With Myrna living with dementia and relying on her daughter to manage her finances, getting the money wasn’t just about fixing a typo—it was about ensuring her well-being.

But what should have been a straightforward correction turned into a frustrating year-long battle.

When Debra attempted to deposit her mother’s 2023 tax refund check, she was met with an unexpected obstacle: the check was printed without Myrna’s last name.

Instead, it displayed only her first name followed by a percent sign—an error that rendered it completely unusable.

With her mother’s funds locked away due to a clerical mistake, Debra reached out to the IRS for a resolution.

What followed was months of back-and-forth, empty promises, and mounting frustration.

Living on Long Island, New York, Debra spent nearly a year trying to correct the issue.

Despite multiple calls and reassurances that a corrected check would be sent within 30 days, nothing happened. Each delay only added to the stress, especially as Myrna’s health declined.

Like many Americans, Debra expected the IRS—a government agency responsible for handling millions of tax returns—to promptly fix the mistake.

Instead, she faced dead ends, long wait times, and no clear answers.

Frustrated by the lack of progress, Debra turned to WABC-TV, hoping that media attention would force the IRS to take action. And it worked.

Soon after the news station covered Myrna’s ordeal, the IRS finally reissued the check—this time with the correct name—allowing Myrna to access her long-overdue refund.

While this was a relief for Debra and her mother, it raised an important question: Why did it take media intervention for the IRS to correct such a simple mistake?

With the 2025 tax season already underway, this situation serves as a cautionary tale for all taxpayers. Even minor errors—whether by the filer or the IRS—can lead to frustrating delays.

Here are some key takeaways:

Myrna and Debra’s ordeal is a frustrating reminder of how even small errors can cause major headaches, especially for those relying on their hard-earned refunds.

While their story had a resolution, many others continue to face similar struggles.

As tax season approaches, staying informed and double-checking all documents can help avoid unnecessary delays.

Read next: IRS employee’s data access request raises concerns over taxpayer privacy

Myrna’s story is just one example of how tax season can go wrong. Have you ever experienced an issue with your tax refund? How did you resolve it? Do you have tips for avoiding tax filing headaches? Join the conversation in the comments below—we’d love to hear your thoughts!

That’s exactly what happened to Myrna Hoffman, a 92-year-old woman whose $11,000 tax refund became trapped in bureaucratic limbo—all because of a simple but costly mistake by the IRS.

For Myrna and her daughter Debra, this wasn’t just an inconvenience.

With Myrna living with dementia and relying on her daughter to manage her finances, getting the money wasn’t just about fixing a typo—it was about ensuring her well-being.

But what should have been a straightforward correction turned into a frustrating year-long battle.

Debra Hoffman fought tirelessly for a year to correct the IRS mistake that left her 92-year-old mother unable to access her tax refund. Image Source: YouTube / Eyewitness News ABC7NY.

The Tax Refund Fiasco

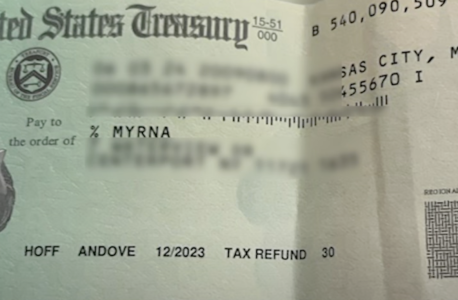

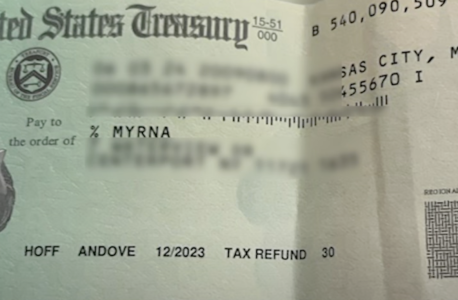

When Debra attempted to deposit her mother’s 2023 tax refund check, she was met with an unexpected obstacle: the check was printed without Myrna’s last name.

Instead, it displayed only her first name followed by a percent sign—an error that rendered it completely unusable.

With her mother’s funds locked away due to a clerical mistake, Debra reached out to the IRS for a resolution.

What followed was months of back-and-forth, empty promises, and mounting frustration.

A Year-Long Struggle with the IRS

Living on Long Island, New York, Debra spent nearly a year trying to correct the issue.

Despite multiple calls and reassurances that a corrected check would be sent within 30 days, nothing happened. Each delay only added to the stress, especially as Myrna’s health declined.

Like many Americans, Debra expected the IRS—a government agency responsible for handling millions of tax returns—to promptly fix the mistake.

Instead, she faced dead ends, long wait times, and no clear answers.

Also read: Get ready for a surprise–Here's why your tax refund could be the biggest one yet!

A Breakthrough Thanks to Media Intervention

Frustrated by the lack of progress, Debra turned to WABC-TV, hoping that media attention would force the IRS to take action. And it worked.

Soon after the news station covered Myrna’s ordeal, the IRS finally reissued the check—this time with the correct name—allowing Myrna to access her long-overdue refund.

While this was a relief for Debra and her mother, it raised an important question: Why did it take media intervention for the IRS to correct such a simple mistake?

The IRS-issued tax refund check that contained a critical typo, preventing 92-year-old Myrna Hoffman from cashing her $11,000 refund. Image Source: YouTube / Eyewitness News ABC7NY

Also read: Want your tax refund faster than everyone else? Follow this IRS process now!

Lessons for Taxpayers as the 2025 Season Begins

With the 2025 tax season already underway, this situation serves as a cautionary tale for all taxpayers. Even minor errors—whether by the filer or the IRS—can lead to frustrating delays.

Here are some key takeaways:

- Double-check your tax return before submitting it to ensure all personal details are correct.

- If you’re owed a refund, track it using the IRS tool "Where’s My Refund?", available within 24 hours of e-filing and within four weeks of mailing a paper return.

- Due to recent staffing cuts, IRS processing times may be slower, so filing early can help prevent delays.

- If you run into issues, be persistent—but if all else fails, media attention may help get results.

Myrna and Debra’s ordeal is a frustrating reminder of how even small errors can cause major headaches, especially for those relying on their hard-earned refunds.

While their story had a resolution, many others continue to face similar struggles.

As tax season approaches, staying informed and double-checking all documents can help avoid unnecessary delays.

Read next: IRS employee’s data access request raises concerns over taxpayer privacy

Key Takeaways

- A 92-year-old woman named Myrna Hoffman, suffering from dementia, was blocked from cashing her $11,000 tax refund due to a typo by the IRS that omitted her last name from the check.

- Myrna's daughter Debra faced a year-long battle with the IRS, which was unresponsive and failed to correct the error in a timely manner.

- After reaching out to WABC-TV for help with her situation, the IRS finally resent a corrected check to Myrna.

- Tax season deadlines and the importance of accuracy when filing returns were highlighted, with options for extensions detailed, including the use of Form 4868 for an automatic extension until October 15.

Myrna’s story is just one example of how tax season can go wrong. Have you ever experienced an issue with your tax refund? How did you resolve it? Do you have tips for avoiding tax filing headaches? Join the conversation in the comments below—we’d love to hear your thoughts!