Is your bank branch gone for good? Find out which major US banks shut down 110+ locations over the holidays!

By

Veronica E.

- Replies 0

As the holiday season came to a close and the new year began, many Americans were preoccupied with family gatherings, festive celebrations, and setting resolutions for the year ahead.

But amid the cheer, a more concerning trend was unfolding behind the scenes in the banking industry. Between Thanksgiving and early January, several major U.S. banks revealed plans to close over 110 branches.

This move reflects an ongoing pattern of widespread shutdowns that have been steadily increasing over the past few years, raising questions about the future of in-person banking services and the growing shift toward digital banking.

As more customers embrace online services, traditional brick-and-mortar locations seem to be fading into the background, leaving many to wonder if physical bank branches will soon be a thing of the past.

The local bank branch: an endangered convenience?

For many, the local bank branch has been a cornerstone of financial life. It’s where we’ve deposited checks, sought advice, and managed our savings.

But the landscape is rapidly changing. Last year, a DailyMail.com investigation uncovered that about 1,000 branches were closed by major retail banks, and this new wave of closures shows that the trend is far from over.

Big banks leading the charge

The banks behind this latest round of closures include some of the nation's largest financial institutions—Wells Fargo, US Bank, PNC, and Bank of America.

UMB Bank, a smaller regional player with 89 branches across nine states, plans to close 28 locations, nearly a third of its total presence.

What does this mean for you?

These closures, though still pending, highlight a clear trajectory for the future of banking.

According to new research from Self Financial, if the current rate of branch closures continues, with an average of 1,646 closures annually since 2018, the last physical bank branch in the US could shut its doors by 2041.

The shift toward digital banking may be convenient, but it presents challenges, especially for older Americans who may struggle with mobile banking services.

Despite the rise of online banking, nearly two-thirds of Americans still prefer to make cash deposits at physical branches, and over half value the opportunity to speak with an advisor in person.

Trust and accessibility concerns

There’s also a trust factor at play. A survey by Self Financial found that 39% of respondents felt more confident in banks that maintain physical branches.

A brick-and-mortar presence can provide a sense of security and legitimacy that purely digital platforms struggle to replicate.

For banks, these closures make financial sense. Running a branch can cost around $2.6 million a year, and as more customers shift to online services, maintaining physical locations becomes less viable.

But the cost savings don't account for the human element—the closure of a local bank is more than just a financial decision. It can feel like the loss of a trusted neighbor.

States hardest hit by closures

California, New York, Pennsylvania, Texas, Ohio, Florida, and New Jersey have seen some of the hardest-hit closures.

If you live in one of these areas, you might have already noticed the changes.

Adapting to the new banking era

As the banking landscape continues to evolve, it's important to stay informed and adaptable. Here are some steps you can take to adjust:

As the banking world continues to evolve, it’s crucial to stay informed and take proactive steps in transitioning to digital banking. This shift offers convenience, but it’s important to ensure you’re comfortable with the changes.

Have you been affected by a bank branch closure? How has it impacted your financial routine? Do you have any tips for those making the transition to digital banking? We’d love to hear your experiences and advice in the comments below!

But amid the cheer, a more concerning trend was unfolding behind the scenes in the banking industry. Between Thanksgiving and early January, several major U.S. banks revealed plans to close over 110 branches.

This move reflects an ongoing pattern of widespread shutdowns that have been steadily increasing over the past few years, raising questions about the future of in-person banking services and the growing shift toward digital banking.

As more customers embrace online services, traditional brick-and-mortar locations seem to be fading into the background, leaving many to wonder if physical bank branches will soon be a thing of the past.

Bank closures continue to reshape the landscape of in-person banking services across the US. Image Source: Pexels / Photo By: Kaboompics.com.

The local bank branch: an endangered convenience?

For many, the local bank branch has been a cornerstone of financial life. It’s where we’ve deposited checks, sought advice, and managed our savings.

But the landscape is rapidly changing. Last year, a DailyMail.com investigation uncovered that about 1,000 branches were closed by major retail banks, and this new wave of closures shows that the trend is far from over.

Big banks leading the charge

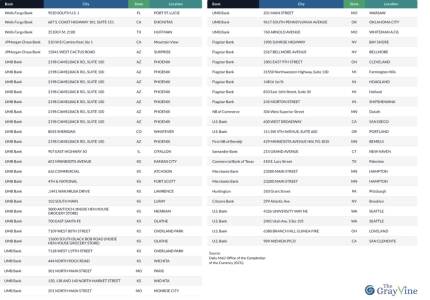

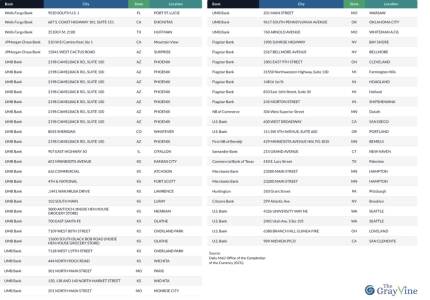

The banks behind this latest round of closures include some of the nation's largest financial institutions—Wells Fargo, US Bank, PNC, and Bank of America.

UMB Bank, a smaller regional player with 89 branches across nine states, plans to close 28 locations, nearly a third of its total presence.

Bank closures from November 30th to January 11th. Image Source: Daily Mail / Office of the Comptroller of the Currency (OCC).

What does this mean for you?

These closures, though still pending, highlight a clear trajectory for the future of banking.

According to new research from Self Financial, if the current rate of branch closures continues, with an average of 1,646 closures annually since 2018, the last physical bank branch in the US could shut its doors by 2041.

The shift toward digital banking may be convenient, but it presents challenges, especially for older Americans who may struggle with mobile banking services.

Despite the rise of online banking, nearly two-thirds of Americans still prefer to make cash deposits at physical branches, and over half value the opportunity to speak with an advisor in person.

Continuing closures from November 30th to January 11th. Image Source: Image Source: Daily Mail / Office of the Comptroller of the Currency (OCC).

Trust and accessibility concerns

There’s also a trust factor at play. A survey by Self Financial found that 39% of respondents felt more confident in banks that maintain physical branches.

A brick-and-mortar presence can provide a sense of security and legitimacy that purely digital platforms struggle to replicate.

For banks, these closures make financial sense. Running a branch can cost around $2.6 million a year, and as more customers shift to online services, maintaining physical locations becomes less viable.

But the cost savings don't account for the human element—the closure of a local bank is more than just a financial decision. It can feel like the loss of a trusted neighbor.

States hardest hit by closures

California, New York, Pennsylvania, Texas, Ohio, Florida, and New Jersey have seen some of the hardest-hit closures.

If you live in one of these areas, you might have already noticed the changes.

Adapting to the new banking era

As the banking landscape continues to evolve, it's important to stay informed and adaptable. Here are some steps you can take to adjust:

- Check the Status: Verify whether your local branch is one of those affected by the closures.

- Explore Digital Options: Familiarize yourself with online banking and mobile apps. Many banks offer tutorials and customer support to help you transition smoothly.

- Seek Alternatives: If your branch has closed, consider credit unions or community banks. They often provide a more personalized banking experience.

- Voice Your Concerns: If you’re not happy with the closures, let your bank know. Your feedback can help shape future decisions.

As the banking world continues to evolve, it’s crucial to stay informed and take proactive steps in transitioning to digital banking. This shift offers convenience, but it’s important to ensure you’re comfortable with the changes.

Key Takeaways

- Over the holiday period, more than 110 branches of major US banks were announced to be closing, continuing the trend of local bank branch closures.

- UMB Bank was identified as the institution with the highest number of planned closures within a six-week period, intending to close nearly a third of its 89 branches.

- Research indicates that the last physical bank branch in the US could potentially close by 2041, despite many Americans still preferring to use branches for certain services.

- Bank closures can result in significant cost savings for financial institutions, with the average freestanding branch costing around $2.6 million annually to operate.

Have you been affected by a bank branch closure? How has it impacted your financial routine? Do you have any tips for those making the transition to digital banking? We’d love to hear your experiences and advice in the comments below!