Is your Bank of America ATM withholding your cash? The invisible device you need to watch out for

- Replies 0

Imagine this: You’re standing at a Bank of America ATM, the familiar whirring sound of cash being counted fills the air, and you’re already planning how you’ll spend those crisp bills.

But when you reach for your money—nothing. The slot is empty. You check your balance, and the funds are gone. What just happened?

For many unsuspecting customers, that moment of confusion has turned into a devastating loss.

Authorities say a nearly invisible device may be to blame, one that allows scammers to quietly take money before it ever leaves the machine.

Recently, Bank of America customers like Jonathan Hogue and Ray McCormick found themselves victims of a scam that’s as simple as it is devious. Both tried to withdraw money—$700 and $100, respectively—but walked away empty-handed, assuming the ATM had simply malfunctioned.

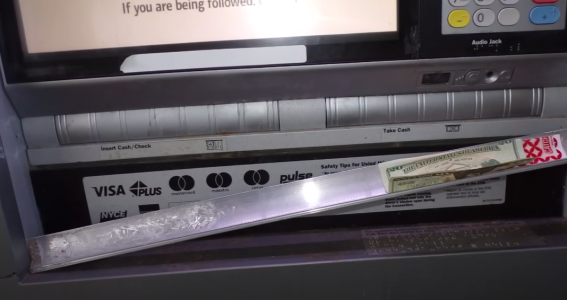

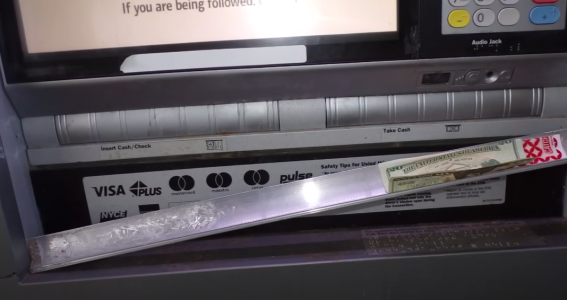

In reality, their cash was being held hostage by a device so well-camouflaged, even the most eagle-eyed customer would struggle to spot it. Police investigating the incidents discovered a barely visible metal plate fitted over the ATM’s cash dispenser.

This “cash trapping” is designed to look like a normal part of the machine, but it acts as a barrier, catching the bills before they reach your hand. The scammer then waits for you to leave, returns, and removes the device—along with your money.

Plano Police Officer Jerry Milton explained that these traps are attached with double-sided tape and can be removed with a special, handmade tool.

Surveillance footage even caught the culprit in the act, calmly retrieving the device and the stolen cash after each victim walked away.

The man behind this particular string of thefts was identified as Ionuț Aurel Iova, a Romanian national with a rap sheet that reads like a crime novel—wanted in Hungary, Maryland, and Canada for various offenses.

His arrest near Houston was a win for law enforcement, but the scam itself is far from over. Police believe there are more victims who never realized what happened.

Cash traps, on the other hand, are all about the physical cash. They don’t steal your information, just your money, and they’re often even harder to spot.

Both scams rely on the same principle: blending in. The devices are designed to look like they belong on the ATM, making them nearly invisible to the untrained eye.

Also read: Stop getting duped: The secret trick to outsmarting skimming scams revealed!

Have you ever encountered a suspicious ATM or lost money in a similar way? Do you have tips for spotting scams or stories to share?

But when you reach for your money—nothing. The slot is empty. You check your balance, and the funds are gone. What just happened?

For many unsuspecting customers, that moment of confusion has turned into a devastating loss.

Authorities say a nearly invisible device may be to blame, one that allows scammers to quietly take money before it ever leaves the machine.

Recently, Bank of America customers like Jonathan Hogue and Ray McCormick found themselves victims of a scam that’s as simple as it is devious. Both tried to withdraw money—$700 and $100, respectively—but walked away empty-handed, assuming the ATM had simply malfunctioned.

In reality, their cash was being held hostage by a device so well-camouflaged, even the most eagle-eyed customer would struggle to spot it. Police investigating the incidents discovered a barely visible metal plate fitted over the ATM’s cash dispenser.

This “cash trapping” is designed to look like a normal part of the machine, but it acts as a barrier, catching the bills before they reach your hand. The scammer then waits for you to leave, returns, and removes the device—along with your money.

Plano Police Officer Jerry Milton explained that these traps are attached with double-sided tape and can be removed with a special, handmade tool.

Surveillance footage even caught the culprit in the act, calmly retrieving the device and the stolen cash after each victim walked away.

Cash trapping—a sneaky, invisible scam that’s been quietly robbing unsuspecting ATM users of their hard-earned money. Image source: WUSA9 / YouTube

The man behind this particular string of thefts was identified as Ionuț Aurel Iova, a Romanian national with a rap sheet that reads like a crime novel—wanted in Hungary, Maryland, and Canada for various offenses.

His arrest near Houston was a win for law enforcement, but the scam itself is far from over. Police believe there are more victims who never realized what happened.

Cash Trapping vs. Skimming: What’s the difference?

You may have heard of “skimming”—another ATM scam where a device is placed over the card slot to steal your card information and PIN. Skimmers are like digital pickpockets, copying your data for later use.Cash traps, on the other hand, are all about the physical cash. They don’t steal your information, just your money, and they’re often even harder to spot.

Both scams rely on the same principle: blending in. The devices are designed to look like they belong on the ATM, making them nearly invisible to the untrained eye.

Other ATM and payment scams to watch for

Cash trapping is just one of many tricks in the scammer’s playbook. Here are a few others to keep on your radar:- Gas Pump Skimmers: Devices hidden inside or over card readers at gas stations, stealing your card info as you fill up.

- Retail Skimmers: Found at self-checkouts or payment terminals in stores like Walgreens and CVS.

- Phishing Calls and Emails: Scammers posing as bank officials, tricking you into sharing personal information or transferring money.

- Romance and Prize Scams: Fraudsters build trust online or by phone, then ask for money or access to your accounts.

How to protect yourself at the ATM

The good news? A little vigilance goes a long way. Here’s how to outsmart the scammers:- Inspect Before You Insert: Before using any ATM, take a close look at the card slot and cash dispenser. Does anything look loose, misaligned, or unusual? Tug gently on the slot and the area where cash comes out—if something moves, walk away and report it.

- Shield Your PIN: Always cover the keypad with your hand when entering your PIN, even if you’re alone. Skimmers often come with hidden cameras.

- Be Wary of “Helpful” Strangers: Never accept assistance from someone you don’t know at an ATM. If you have trouble, go inside the bank or call customer service.

- Check Your Account Regularly: Monitor your bank statements and set up alerts for withdrawals. The sooner you spot suspicious activity, the faster you can act.

- Report Problems Immediately: If your cash doesn’t dispense but your account is debited, contact your bank right away and file a police report. The faster you act, the better your chances of recovering your money.

- Use ATMs in Well-Lit, Secure Locations: Prefer machines inside bank branches or busy areas over isolated or outdoor ATMs.

Also read: Stop getting duped: The secret trick to outsmarting skimming scams revealed!

Bank tips for avoiding scams

As technology evolves, so do the scams. Here are some additional tips from major banks and law enforcement:- Be skeptical of deals that seem too good to be true, especially online.

- Don’t let anyone rush you into making a decision—scammers thrive on panic.

- Never return unexpected funds or send money to someone you’ve only met online.

- Don’t give remote access to your device unless you’re absolutely sure who you’re talking to.

- Never click on suspicious links or respond to messages claiming you’ve won a prize.

Key Takeaways

- Bank of America customers have fallen victim to “cash trapping” devices, which are hidden over ATM dispenser slots and prevent cash withdrawals from reaching users while sounding and appearing as if the machine is working normally.

- The devices are almost invisible and are designed to look like part of the ATM, making them hard to detect; police advise customers to check ATMs carefully and report any suspicious issues or failed withdrawals.

- A Romanian national, Ionuț Aurel Iova, was arrested as the alleged perpetrator, caught on CCTV removing the device and collecting stolen cash; he is wanted for multiple offenses in several countries.

- Authorities warn the public to be alert for ATM scams and skimming devices, never accept help from strangers at ATMs, always shield their PIN, and be wary of online scams that pressure for urgent action or personal information.