Is your money at risk? A bank’s sudden closures could be just the beginning!

- Replies 0

The American banking landscape is shifting rapidly, and for many of us at The GrayVine, it’s a change that hits close to home.

One of the country’s largest financial institutions has announced the closure of 38 branches across 10 states, raising concerns about the future of physical banking access.

The closures span multiple states, including:

However, this wave of closures is part of a much larger trend, as major US banks shuttered over 1,000 branches in 2023 alone, and experts warn that 2025 could see even more drastic cuts.

Investigations found that drug traffickers even bribed TD employees to help launder money from illicit activities like fentanyl and narcotics trafficking.

Following these scandals, TD was hit with strict regulatory penalties, including a cap on its assets and other business limitations—a rare and serious consequence for a bank of this size.

The recent leadership shake-up—with Raymond Chun replacing Bharat Masrani as CEO—suggests the bank is tightening operations, potentially cutting costs through branch closures.

However, TD has not explicitly confirmed that the shutdowns are part of its financial restructuring. Instead, the bank stated that it is “regularly evaluating its physical store network” to align with customer needs and the shift toward digital banking services.

While online banking continues to rise, many Americans still prefer in-person banking. A GoBankingRates survey found that:

Have you been affected by a TD Bank closure or noticed fewer banking options in your area? How has your experience with banking changed over the years? Drop a comment below and let’s discuss how these shifts impact our communities and financial security.

Have you been affected by a TD Bank closure or noticed fewer banking options in your area? How has your experience with banking changed over the years? Drop a comment below and let’s discuss how these shifts impact our communities and financial security.

Also read:

One of the country’s largest financial institutions has announced the closure of 38 branches across 10 states, raising concerns about the future of physical banking access.

What’s Happening with TD Bank?

TD Bank, ranked seventh in the US for branch numbers, has officially filed notice with the Office of the Comptroller of the Currency (OCC) to shut down locations by June 5.The closures span multiple states, including:

- New Jersey & Massachusetts – 6 branches each

- New York – 5 branches

- New Hampshire & Maine – 4 branches each

- Pennsylvania & Florida – 3 branches each

- Connecticut, Virginia & South Carolina – 2 branches each

- Washington D.C. – 1 branch

However, this wave of closures is part of a much larger trend, as major US banks shuttered over 1,000 branches in 2023 alone, and experts warn that 2025 could see even more drastic cuts.

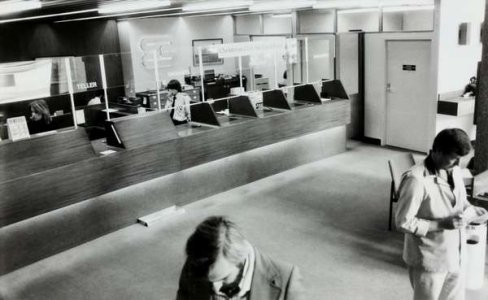

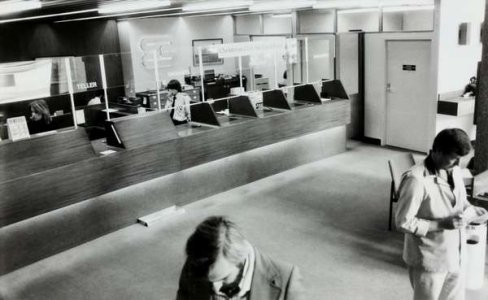

TD Bank has recently announced the closure of 38 branches. Image source: Museums Victoria / Unsplash

The Reason Behind the Closures

TD Bank has faced major financial and legal setbacks in recent years, including a $3.2 billion fine for anti-money laundering failures that allowed criminals to funnel millions through its accounts.Investigations found that drug traffickers even bribed TD employees to help launder money from illicit activities like fentanyl and narcotics trafficking.

Following these scandals, TD was hit with strict regulatory penalties, including a cap on its assets and other business limitations—a rare and serious consequence for a bank of this size.

The recent leadership shake-up—with Raymond Chun replacing Bharat Masrani as CEO—suggests the bank is tightening operations, potentially cutting costs through branch closures.

However, TD has not explicitly confirmed that the shutdowns are part of its financial restructuring. Instead, the bank stated that it is “regularly evaluating its physical store network” to align with customer needs and the shift toward digital banking services.

A Larger Trend in Banking

TD Bank’s decision is just one piece of a much bigger puzzle. The US banking industry is experiencing a rapid decline in physical branches, with:- 1,043 closures in 2023

- 107 closures within the first three weeks of 2024

- Predictions of an additional 4.11% decrease in branches by the end of 2025

While online banking continues to rise, many Americans still prefer in-person banking. A GoBankingRates survey found that:

- 45% of Americans still prefer handling financial matters face-to-face

- More than half of respondents are worried about the growing number of branch closures

- 76% believe the current banking system needs reforms

Key Takeaways

- TD Bank is set to close 38 branches across the United States, raising concerns about accessibility to banking services in affected communities.

- The bank's decision to close branches comes after it faced a $3.2 billion fine due to failures in anti-money laundering compliance.

- Closures of bank branches in the US are part of a trend that is expected to continue, with predictions that 2025 could see a significant decrease in the number of local bank outlets.

- Despite the shift to online banking, surveys indicate that a significant proportion of Americans still prefer in-person banking services, causing concerns about the impact of branch closures.

Also read: