Major Banks Shutter 11 Branches in a Shocking Week – Are Your Finances at Risk?

- Replies 0

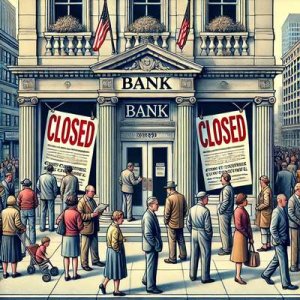

In a move that underscores the rapidly changing landscape of personal banking, major financial institutions including Citibank and Chase have closed a combined total of 11 branches in a single week, leaving many customers wondering about the future of their local banking services. This trend is not isolated; it's part of a larger shift that has seen hundreds of branches disappear from the American streetscape in recent months.

The Impact of Branch Closures

The closures, which spanned from New York to Florida, included branches of Fifth Third Bank, Bonvenu, Landmark, and Trustco, among others. For many Americans, particularly those over 60 who may prefer face-to-face interactions for their financial needs, these closures could signal a significant shift in how they manage their money.

Chase led the pack in the number of closures, with seven branches closing their doors in the span of a week. This trend is not new; U.S. banks have closed 539 branches in just the first half of the year, with California and New York being the hardest hit states. The closures are part of a strategic move by banks to cut costs, as maintaining a physical branch can be expensive, with the average freestanding branch costing around $2.6 million a year to operate.

The Rise of Online Banking

The shift away from brick-and-mortar branches is largely driven by the growing preference for online banking. Andrew Murray, Lead Data Content Researcher at GoBankingRates, notes that 'online banking is quickly becoming the standard for how people bank.' A GoBankingRates survey found that nearly 70 percent of customers between 25 and 34 preferred online banking, and even seniors are increasingly turning to digital services for their banking needs.

Financial experts like Jessica Morgan, founder of Canadian Budget, encourage those transitioning to online banking to utilize support services offered by banks to help with the change. Online banking can also be more cost-effective for consumers, as many online-only banks offer lower or no fees and higher interest rates on savings due to lower overhead costs.

What This Means for You

If you're accustomed to visiting your local bank branch, these closures might feel unsettling. However, it's important to recognize that your finances are not necessarily at risk due to a branch closure. Banks are investing heavily in their online platforms to ensure that customers can manage their accounts securely and conveniently from anywhere.

Here are some steps you can take to adapt to the changing banking environment:

1. Embrace Online Banking: If you haven't already, set up online banking for your accounts. Most banks offer tutorials and customer support to help you navigate their digital platforms.

2. Use Mobile Banking Apps: Many banks have mobile apps that allow you to deposit checks, transfer money, and pay bills directly from your smartphone.

3. Consider Online-Only Banks: Online-only banks often offer competitive rates and lower fees. Research to find one that fits your needs.

4. Stay Informed: Keep an eye on communications from your bank about branch closures or changes to services so you can plan accordingly.

5. Protect Your Information: As you move to online banking, ensure you use strong, unique passwords and enable two-factor authentication for added security.

The GrayVine community understands the value of staying connected and informed. As we navigate these changes together, we encourage you to share your experiences and tips for adapting to online banking in the comments below. Your insights could be invaluable to someone making the transition.

While the closure of local bank branches may be a sign of the times, it doesn't have to compromise your financial well-being. By staying proactive and embracing the tools and technology available, you can continue to manage your finances with confidence and security.

The Impact of Branch Closures

The closures, which spanned from New York to Florida, included branches of Fifth Third Bank, Bonvenu, Landmark, and Trustco, among others. For many Americans, particularly those over 60 who may prefer face-to-face interactions for their financial needs, these closures could signal a significant shift in how they manage their money.

Chase led the pack in the number of closures, with seven branches closing their doors in the span of a week. This trend is not new; U.S. banks have closed 539 branches in just the first half of the year, with California and New York being the hardest hit states. The closures are part of a strategic move by banks to cut costs, as maintaining a physical branch can be expensive, with the average freestanding branch costing around $2.6 million a year to operate.

The Rise of Online Banking

The shift away from brick-and-mortar branches is largely driven by the growing preference for online banking. Andrew Murray, Lead Data Content Researcher at GoBankingRates, notes that 'online banking is quickly becoming the standard for how people bank.' A GoBankingRates survey found that nearly 70 percent of customers between 25 and 34 preferred online banking, and even seniors are increasingly turning to digital services for their banking needs.

Financial experts like Jessica Morgan, founder of Canadian Budget, encourage those transitioning to online banking to utilize support services offered by banks to help with the change. Online banking can also be more cost-effective for consumers, as many online-only banks offer lower or no fees and higher interest rates on savings due to lower overhead costs.

What This Means for You

If you're accustomed to visiting your local bank branch, these closures might feel unsettling. However, it's important to recognize that your finances are not necessarily at risk due to a branch closure. Banks are investing heavily in their online platforms to ensure that customers can manage their accounts securely and conveniently from anywhere.

Here are some steps you can take to adapt to the changing banking environment:

1. Embrace Online Banking: If you haven't already, set up online banking for your accounts. Most banks offer tutorials and customer support to help you navigate their digital platforms.

2. Use Mobile Banking Apps: Many banks have mobile apps that allow you to deposit checks, transfer money, and pay bills directly from your smartphone.

3. Consider Online-Only Banks: Online-only banks often offer competitive rates and lower fees. Research to find one that fits your needs.

4. Stay Informed: Keep an eye on communications from your bank about branch closures or changes to services so you can plan accordingly.

5. Protect Your Information: As you move to online banking, ensure you use strong, unique passwords and enable two-factor authentication for added security.

The GrayVine community understands the value of staying connected and informed. As we navigate these changes together, we encourage you to share your experiences and tips for adapting to online banking in the comments below. Your insights could be invaluable to someone making the transition.

While the closure of local bank branches may be a sign of the times, it doesn't have to compromise your financial well-being. By staying proactive and embracing the tools and technology available, you can continue to manage your finances with confidence and security.