Missing these Medicare deadlines could drain your wallet—here’s how to stay on track

- Replies 0

Turning 65 is a milestone worth celebrating—retirement parties, senior discounts, and, for many, the long-awaited switch to Medicare.

But before you toss your old insurance card in the shredder and start planning that cross-country road trip, there’s a crucial detail you can’t afford to overlook: Medicare’s deadlines. Miss them, and you could be paying the price for the rest of your life—literally.

At The GrayVine, we know that navigating Medicare can feel like trying to read the fine print on a prescription bottle without your glasses.

But don’t worry—we’re here to make sense of the maze, help you avoid costly mistakes, and maybe even save you enough to splurge on that extra dessert at dinner.

Before we dive into the deadlines, let’s quickly review the building blocks of Medicare:

Your Initial Enrollment Period is your golden ticket. It starts three months before your 65th birthday, includes your birthday month, and ends three months after.

That’s a seven-month window to sign up for Parts A and B (and D, if you want drug coverage).

Miss this window, and you could be stuck waiting until the next General Enrollment Period.

Worse, you’ll likely face a lifetime penalty on your Part B premium—10% for every 12 months you delay. That’s not a one-time fee; it’s a monthly surcharge for as long as you have Medicare.

Real-World Example:

Still working at 65 and covered by an employer plan? Good news: You can delay enrolling in Part B without penalty.

But once your employer coverage ends, the clock starts ticking. You have an eight-month Special Enrollment Period to sign up for Part B.

Miss this SEP, and you’re back in penalty territory—plus you could face a gap in coverage. Remember, COBRA and retiree health plans don’t count as “creditable” coverage for Medicare, so don’t get caught off guard.

Also read: Why reviewing your Medicare plan every year could save you money and stress

Already on Medicare but want to make changes? The Annual Enrollment Period runs from October 15 to December 7 each year. During this time, you can:

Part D Penalty Example:

If you missed your IEP and don’t qualify for an SEP, you can sign up during the General Enrollment Period (January 1 to March 31).

Coverage starts the month after you enroll, but you’ll still pay those lifetime penalties. Not ideal, but better late than never.

Here’s how to stay on track (and out of the penalty box):

Also read: Medicare scams are spreading fast—here’s how to protect your benefits before fraudsters strike

Common pitfalls to avoid:

Have you navigated the Medicare enrollment maze? Did you stumble on a deadline or find a helpful resource?

But before you toss your old insurance card in the shredder and start planning that cross-country road trip, there’s a crucial detail you can’t afford to overlook: Medicare’s deadlines. Miss them, and you could be paying the price for the rest of your life—literally.

At The GrayVine, we know that navigating Medicare can feel like trying to read the fine print on a prescription bottle without your glasses.

But don’t worry—we’re here to make sense of the maze, help you avoid costly mistakes, and maybe even save you enough to splurge on that extra dessert at dinner.

Before we dive into the deadlines, let’s quickly review the building blocks of Medicare:

- Part A: Hospital insurance. Covers inpatient care, skilled nursing, hospice, and some home health services. Most people get this premium-free if they (or their spouse) paid Medicare taxes for at least 10 years.

- Part B: Medical insurance. Think doctor visits, outpatient care, preventive services, and medical equipment. This one comes with a monthly premium.

- Part C: Medicare Advantage. These are private plans that bundle Parts A and B (and often Part D), sometimes tossing in extras like dental, vision, or hearing coverage.

- Part D: Prescription drug coverage. Helps pay for your medications, with plans and costs varying by provider.

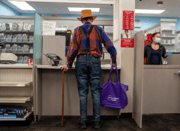

Medicare comes in several parts, each covering different aspects of care. Image source: Getty Images / Unsplash

Your Initial Enrollment Period is your golden ticket. It starts three months before your 65th birthday, includes your birthday month, and ends three months after.

That’s a seven-month window to sign up for Parts A and B (and D, if you want drug coverage).

Miss this window, and you could be stuck waiting until the next General Enrollment Period.

Worse, you’ll likely face a lifetime penalty on your Part B premium—10% for every 12 months you delay. That’s not a one-time fee; it’s a monthly surcharge for as long as you have Medicare.

Real-World Example:

- If you’re 12 months late, you’ll pay an extra $18.50 per month (based on the 2025 average premium of $185).

- Wait 36 months? That’s $55.50 extra every month, forever.

Still working at 65 and covered by an employer plan? Good news: You can delay enrolling in Part B without penalty.

But once your employer coverage ends, the clock starts ticking. You have an eight-month Special Enrollment Period to sign up for Part B.

Miss this SEP, and you’re back in penalty territory—plus you could face a gap in coverage. Remember, COBRA and retiree health plans don’t count as “creditable” coverage for Medicare, so don’t get caught off guard.

Also read: Why reviewing your Medicare plan every year could save you money and stress

Already on Medicare but want to make changes? The Annual Enrollment Period runs from October 15 to December 7 each year. During this time, you can:

- Switch between Original Medicare and Medicare Advantage

- Change or drop your Part D prescription plan

- Make other adjustments to your coverage

Part D Penalty Example:

- 12 months late = $4.41 extra per month (2025 base premium: $36.78)

- 24 months late = $8.83 extra per month

If you missed your IEP and don’t qualify for an SEP, you can sign up during the General Enrollment Period (January 1 to March 31).

Coverage starts the month after you enroll, but you’ll still pay those lifetime penalties. Not ideal, but better late than never.

Here’s how to stay on track (and out of the penalty box):

- Mark Your Calendar: Set reminders for your IEP, AEP, and any other relevant periods.

- Talk to a Pro: Consider consulting a Medicare advisor or financial planner. They can help you map out your options and avoid costly missteps.

- Keep Records: Save documentation of your employer coverage if you’re delaying Medicare. You’ll need it to qualify for an SEP.

- Review Annually: Even if you’re happy with your plan, review your coverage every year. Drug formularies and provider networks can change.

Also read: Medicare scams are spreading fast—here’s how to protect your benefits before fraudsters strike

Common pitfalls to avoid:

- Assuming your employer coverage is “creditable” without checking

- Missing the 8-month SEP after leaving a job

- Forgetting to enroll in Part D if you need prescription coverage

- Ignoring annual plan changes that could affect your costs or coverage

Key Takeaways

- If you miss your Medicare Initial Enrollment Period around your 65th birthday, you could face a 10% lifetime penalty on your Part B premiums for every 12 months you delay, costing you hundreds or even thousands over your lifetime.

- There’s a Special Enrollment Period for Medicare Part B if you had employer coverage, but it only lasts for eight months after your workplace coverage ends—missing it triggers the same steep penalties and coverage gaps as missing your initial enrollment.

- If you delay signing up for Medicare Part D (prescription drugs), you’ll face a permanent monthly penalty of about 1% of the national base premium for each month you went without coverage after becoming eligible.

- Missing key Medicare enrollment deadlines—whether for Part B or Part D—means you’ll pay higher premiums for life, so it’s essential to keep track of enrollment periods and seek advice if you’re unsure.