As the year moves toward its end, families and business owners in Texas are looking at significant changes to their tax bills that could affect household budgets and corporate expenses alike.

The news comes as lawmakers have passed a new provision aimed at easing financial pressures for millions of residents.

Many are now exploring how these changes could impact their annual expenses and overall planning.

Property tax savings for homeowners

Under the new law, homeowners in Texas could save as much as $938 this year thanks to increased exemptions and funding set aside by the state.

The provision raises the standard property tax exemption from $100,000 to $140,000, lowering the taxable value of homes and reducing bills for roughly 5.7 million homesteads.

Seniors and those with disabilities see an even larger increase, from $110,000 to $160,000, with an estimated average annual saving of $454.30. Homeowners over 65 may combine the new exemption with existing benefits to save as much as $938.72 annually.

Business tax relief under the November provision

Local businesses are also benefitting from the law, which increases the deductible limit on equipment such as computers from $2,500 to $125,000.

According to Sen. Paul Bettencourt (R-Houston), this change could save business owners around $2,499 per year on average.

The tax break is designed to encourage investment in new equipment while helping small and medium-sized companies reduce their annual tax burdens.

Many business owners are reviewing their upcoming expenses and planning how to allocate the expected savings effectively.

Read also: Are retirees really getting the tax breaks Trump promised? Here’s what’s actually changing

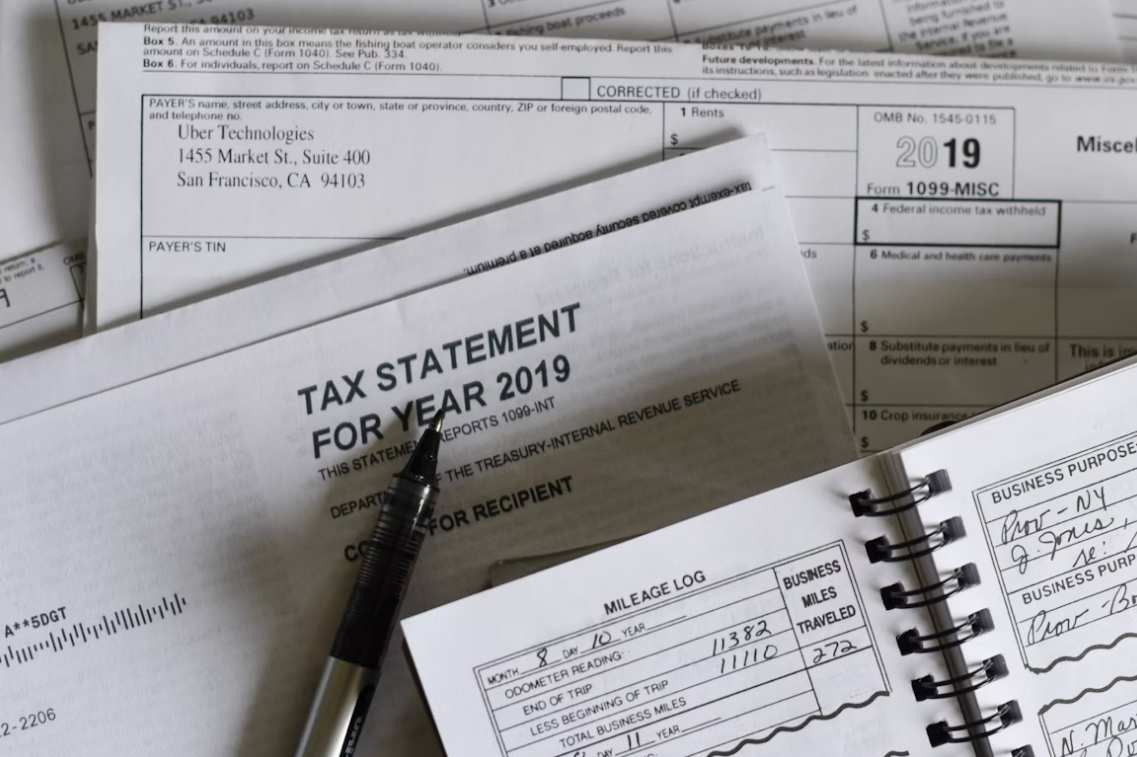

Budgeting and consumer planning

A recent study by Talker Research found that a majority of Americans plan their tax refund spending months in advance, with 77% intending to use refunds for necessities such as rent, groceries, and credit card debt.

The average expected refund is about $1,700, with some families anticipating more due to higher earnings or changes in withholding, while others expect less due to factors like back taxes or new financial responsibilities. This focus on planning highlights how tax relief measures can impact broader household budgeting and spending habits.

Read also: Tax refunds may be getting bigger in 2026, according to new research

Concerns and potential local impact

Despite the benefits for homeowners and businesses, some local officials have expressed concerns about lost revenue and the potential need to increase rates to compensate.

McLennan County Commissioner Jim Smith warned that recouping lost funds could make local governments appear unsympathetic to taxpayers.

The law’s impact will require careful management to balance savings for residents with the fiscal needs of municipalities. State and local officials are closely monitoring the rollout to ensure that the benefits are delivered without creating unintended financial pressures.

Read next:

- With IRS Direct File now closed, these free tax options are worth a look

- New state tax program lets you settle back taxes with no penalties or interest

For homeowners and business owners in Texas, this tax cut could provide noticeable relief in 2025. Will you be using the new exemptions or deductions to plan your budget? It’s a good time to review your tax situation and make adjustments if needed. Share your thoughts or experiences with these new tax changes in the comments below.