Protect your retirement! Beware of these 6 Social Security scams on the rise in 2025

By

Veronica E.

- Replies 0

Retirement should be a time to enjoy the rewards of your hard work—not a time to worry about financial threats.

But with Social Security scams becoming more sophisticated, it's crucial to stay informed.

Scammers are finding new ways to exploit retirees, using fear tactics and deception to steal personal information and hard-earned benefits.

In 2024 alone, there were 265,975 reported government fraud cases, with Social Security impersonation at the top of the list.

The financial toll? A staggering $577 million lost to these scams.

The good news? Awareness is your best defense.

By recognizing these schemes early, you can protect yourself and your loved ones from becoming a target.

Here are six Social Security scams making the rounds in 2025—and how to avoid them.

You get a call claiming your Social Security number (SSN) has been suspended, or worse, that your benefits are at risk.

The scammer might sound official, warning of fines or even legal action if you don’t confirm your SSN or make an immediate payment.

But here’s the truth: Social Security will never suspend your number or threaten you over the phone.

If you get a call like this, hang up and report it.

Mistakes happen, and the Social Security Administration (SSA) may occasionally issue overpayments.

However, they will never demand repayment via gift cards, Venmo, cryptocurrency, or wire transfers.

If anyone insists on one of these untraceable payment methods, it’s a scam.

Always verify any overpayment claims directly with the SSA.

Scammers often pose as SSA representatives, asking you to "confirm" your SSN, bank details, or other personal information.

They may say your benefits are in jeopardy if you don’t comply. But remember, the SSA won’t call, email, or text you asking for sensitive details out of the blue.

If you're unsure, contact the SSA directly using their official website or phone number.

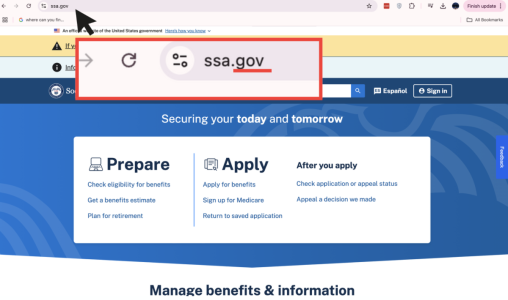

Some scams involve fraudulent websites that look just like the SSA’s official site.

These sites trick people into entering personal details, which are then stolen.

Always double-check website addresses—legitimate SSA sites will always end in ".gov."

If the URL looks suspicious, don’t enter any information.

Last year, scammers circulated false claims about a $600 Social Security benefit increase, tricking people into revealing their SSN.

The reality? Cost-of-living adjustments (COLA) happen automatically—you don’t need to take any action or provide additional information to receive them.

You receive an email urging you to download a “security update” for your Social Security account.

Sounds important, right? Unfortunately, this is a scam designed to infect your device with malware and steal your personal information.

The SSA never asks recipients to download anything. If you receive such a request, delete it immediately.

Maria-Kristina Hayden, CEO of cybersecurity firm OUTFOXM, offers this essential advice:

Keep records of any suspicious calls, texts, or emails. Your report can help prevent others from falling victim.

Staying informed is your best defense against Social Security scams. By recognizing the warning signs and knowing how to respond, you can protect yourself and your hard-earned benefits. If something feels off, trust your instincts—verify before you act.

Read next: Stop getting duped: The secret trick to outsmarting skimming scams revealed!

At The GrayVine, we believe that staying informed is the best way to stay protected. Have you or a loved one encountered a Social Security scam? Share your experience in the comments below—your story might help someone else avoid a costly mistake!

But with Social Security scams becoming more sophisticated, it's crucial to stay informed.

Scammers are finding new ways to exploit retirees, using fear tactics and deception to steal personal information and hard-earned benefits.

In 2024 alone, there were 265,975 reported government fraud cases, with Social Security impersonation at the top of the list.

The financial toll? A staggering $577 million lost to these scams.

The good news? Awareness is your best defense.

Scammers are getting smarter, but you can stay one step ahead. Image Source: Pexels / Tara Winstead.

By recognizing these schemes early, you can protect yourself and your loved ones from becoming a target.

Here are six Social Security scams making the rounds in 2025—and how to avoid them.

1. Suspended SSN or Benefits Threats

You get a call claiming your Social Security number (SSN) has been suspended, or worse, that your benefits are at risk.

The scammer might sound official, warning of fines or even legal action if you don’t confirm your SSN or make an immediate payment.

But here’s the truth: Social Security will never suspend your number or threaten you over the phone.

If you get a call like this, hang up and report it.

2. Excess Payment Collection

Mistakes happen, and the Social Security Administration (SSA) may occasionally issue overpayments.

However, they will never demand repayment via gift cards, Venmo, cryptocurrency, or wire transfers.

If anyone insists on one of these untraceable payment methods, it’s a scam.

Always verify any overpayment claims directly with the SSA.

Also read: Retiree loses $280,000 in costly scam—are your finances safe?

3. Requests for Information Updates

Scammers often pose as SSA representatives, asking you to "confirm" your SSN, bank details, or other personal information.

They may say your benefits are in jeopardy if you don’t comply. But remember, the SSA won’t call, email, or text you asking for sensitive details out of the blue.

If you're unsure, contact the SSA directly using their official website or phone number.

4. Fake Benefits Applications

Some scams involve fraudulent websites that look just like the SSA’s official site.

These sites trick people into entering personal details, which are then stolen.

Always double-check website addresses—legitimate SSA sites will always end in ".gov."

If the URL looks suspicious, don’t enter any information.

Also read: This "IRS $1,400 rebate" text could be a trap—here’s how to spot and avoid the latest scam!

5. Cost-of-Living Adjustments (COLA) Misinformation

Last year, scammers circulated false claims about a $600 Social Security benefit increase, tricking people into revealing their SSN.

The reality? Cost-of-living adjustments (COLA) happen automatically—you don’t need to take any action or provide additional information to receive them.

6. Fake Downloads

You receive an email urging you to download a “security update” for your Social Security account.

Sounds important, right? Unfortunately, this is a scam designed to infect your device with malware and steal your personal information.

The SSA never asks recipients to download anything. If you receive such a request, delete it immediately.

Also read: Protect Your SSN Now: How to Safeguard Your Most Valuable Asset!

How to Protect Yourself

Maria-Kristina Hayden, CEO of cybersecurity firm OUTFOXM, offers this essential advice:

- The SSA only accepts payments through Pay.gov, online bill pay, or check/money order—never through gift cards or digital payment apps.

- Scammers can fake caller ID, so don’t trust a number just because it looks legitimate.

- Never click on links or download attachments from unknown sources.

- If a call, email, or message pressures you to act immediately, take a step back—it’s likely a scam.

Keep records of any suspicious calls, texts, or emails. Your report can help prevent others from falling victim.

Staying informed is your best defense against Social Security scams. By recognizing the warning signs and knowing how to respond, you can protect yourself and your hard-earned benefits. If something feels off, trust your instincts—verify before you act.

Read next: Stop getting duped: The secret trick to outsmarting skimming scams revealed!

Key Takeaways

- Social Security scams are increasing, with impersonation of the Social Security Administration (SSA) being a common tactic used by fraudsters.

- Scammers use various methods such as false claims of suspended Social Security numbers, fake overpayment collection, phishing for information updates, and bogus benefits applications to deceive individuals.

- The public is advised to be wary of any unusual payment requests, suspicious calls, emails, or texts, and to always verify the legitimacy of communication that claims to be from the SSA.

- To protect oneself from these scams, it is recommended to question any strong emotional reactions to communications, avoid clicking on suspicious links, and report any encountered scams to the authorities.

At The GrayVine, we believe that staying informed is the best way to stay protected. Have you or a loved one encountered a Social Security scam? Share your experience in the comments below—your story might help someone else avoid a costly mistake!