READ: How Trump’s proposal to extend tax cuts could affect your finances

By

Aubrey Razon

- Replies 0

President-elect Donald Trump has proposed a plan that could put more money in your pocket. If his proposal moves forward, it could lead to some big changes.

Stay with us, and we’ll explain what it means for you.

The 2017 Tax Cuts & Jobs Act (TCJA) brought notable financial changes, offering tax relief to many taxpayers.

Trump has proposed additional tax cuts for various groups, including tipped workers and senior citizens, alongside the extension of current tax breaks.

However, the clock is ticking on these benefits, with key provisions set to expire at the end of 2025.

If Congress doesn't act to extend them, the Tax Foundation warns that more than 60% of filers could see their taxes increase in 2026.

Let's break down what this could mean for you, especially if you're in the over-60s bracket, planning for retirement, or already enjoying your golden years.

For single filers, the standard deduction could drop from $15,000 in 2025 to $8,350 in 2026, and for joint filers, from $30,000 to $16,700.

If the TCJA is not extended, tax brackets and the standard deduction will revert to pre-2017 levels, potentially leading to smaller deductions and higher taxes for many.

This change alone could shrink the size of your wallet if you're not prepared.

The TCJA bumped the credit to $2,000 per child, but without an extension, it would revert to $1,000.

Some grandparents may contribute to the support of their children and grandchildren, which could influence financial planning.

The TCJA set a $10,000 limit on these deductions, which hit taxpayers in high-tax states hard.

Trump's campaign promise to raise the cap to $20,000 could offer potential relief, though it may face opposition.

However, concerns about the potential impact on the national deficit may complicate the passage of an extension.

Trump's tax cut proposal could be a boon for many, but it's not set in stone.

As we age, financial stability becomes even more crucial. Whether you're planning for retirement or already there, staying informed and prepared for changes is key.

Let's keep our finances as secure as our cherished memories, and continue to enjoy the fruits of our labor well into our retirement years.

How do you feel about the proposed tax changes? Are you concerned about the potential impact on your finances, or do you welcome the possibility of extended tax cuts? Share your thoughts and experiences in the comments below.

Stay with us, and we’ll explain what it means for you.

The 2017 Tax Cuts & Jobs Act (TCJA) brought notable financial changes, offering tax relief to many taxpayers.

Trump has proposed additional tax cuts for various groups, including tipped workers and senior citizens, alongside the extension of current tax breaks.

However, the clock is ticking on these benefits, with key provisions set to expire at the end of 2025.

If Congress doesn't act to extend them, the Tax Foundation warns that more than 60% of filers could see their taxes increase in 2026.

Let's break down what this could mean for you, especially if you're in the over-60s bracket, planning for retirement, or already enjoying your golden years.

President-elect Donald Trump has pledged to extend the Tax Cuts & Jobs Act (TCJA) provisions, which are set to expire at the end of 2025. Image source: M Jahid/Unsplash.

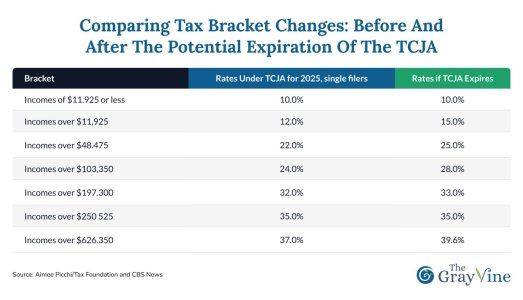

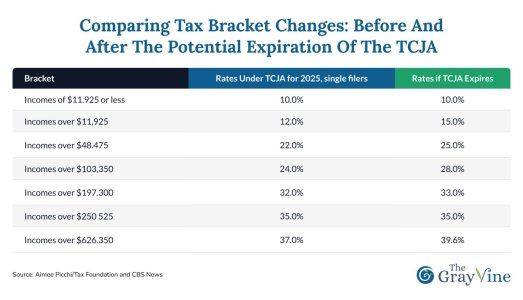

The potential expiration of Trump's tax brackets

The TCJA introduced new tax brackets and nearly doubled the standard deduction, which is the portion of income not subject to tax.For single filers, the standard deduction could drop from $15,000 in 2025 to $8,350 in 2026, and for joint filers, from $30,000 to $16,700.

If the TCJA is not extended, tax brackets and the standard deduction will revert to pre-2017 levels, potentially leading to smaller deductions and higher taxes for many.

This change alone could shrink the size of your wallet if you're not prepared.

The Child Tax Credit

Even if your nest is empty, the Child Tax Credit changes could affect your family.The TCJA bumped the credit to $2,000 per child, but without an extension, it would revert to $1,000.

Some grandparents may contribute to the support of their children and grandchildren, which could influence financial planning.

The SALT Deduction cap

The state and local tax (SALT) deduction cap is another hot-button issue.The TCJA set a $10,000 limit on these deductions, which hit taxpayers in high-tax states hard.

Trump's campaign promise to raise the cap to $20,000 could offer potential relief, though it may face opposition.

The future of Trump's tax cuts

With Republicans holding a majority in both the House and Senate, the likelihood of extending the tax cuts appears favorable.However, concerns about the potential impact on the national deficit may complicate the passage of an extension.

What should you do?

As Duncan Campbell from Baker Tilly suggests, it's wise to prepare as if the TCJA provisions will expire.Trump's tax cut proposal could be a boon for many, but it's not set in stone.

As we age, financial stability becomes even more crucial. Whether you're planning for retirement or already there, staying informed and prepared for changes is key.

Let's keep our finances as secure as our cherished memories, and continue to enjoy the fruits of our labor well into our retirement years.

Key Takeaways

- President-elect Donald Trump has pledged to extend the Tax Cuts & Jobs Act (TCJA) provisions, which are set to expire at the end of 2025, potentially impacting over six in ten filers with tax increases.

- Trump proposes additional tax cuts for various groups including tipped workers and senior citizens, on top of extending the current tax breaks.

- If the TCJA is not extended, the tax brackets and standard deduction will revert to their pre-2017 thresholds, which would result in smaller standard deductions and possible tax increases for many.

- Taxpayers are advised to prepare for the possibility of the TCJA provisions expiring and to plan accordingly to avoid being caught off guard by potential tax changes in 2026.

Last edited: