Retirees warned as AI scams grow more convincing

- Replies 0

Messages that look familiar can carry hidden dangers when criminals use advanced tools to deceive. The tactics may seem ordinary at first, but they quickly shift into something harder to detect.

Sophisticated impersonations can blur the line between what is real and what is artificial, leaving even cautious people unsure.

For older adults, these tricks are becoming one of the fastest-growing threats to their financial security.

Artificial intelligence has given scammers the ability to tailor their schemes with a level of precision that was never possible before.

Unlike older fraud attempts that were often clumsy and easy to spot, these new methods are designed to appear authentic.

The FBI reported that in 2024, losses tied to internet crimes surpassed $16 billion, with nearly $5 billion of that amount suffered by those aged 60 and over.

This age group has become a prime target because retirees are often managing savings, pensions, or Social Security benefits.

One of the most unsettling features of this trend is how personal the deception can feel. With only a short voice clip taken from a voicemail or online video, criminals can create a clone that sounds exactly like a loved one.

That means a middle-of-the-night call from a “grandchild” in trouble could be nothing more than a computer-generated trick. The emotional pressure of hearing what sounds like family in distress can push people to act quickly, often transferring funds before realizing they have been manipulated.

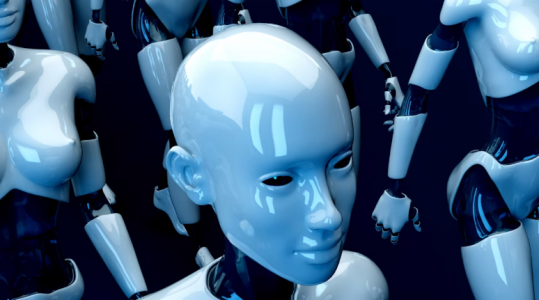

Deepfakes add another layer of concern by creating realistic images, audio, or videos that show people saying or doing things they never actually said or did. These digital imitations can be used to fool bank employees into believing they are speaking with an account holder or to convince someone that an online relationship is genuine.

Once confidence is established, the requests for money usually begin small and then grow until the victim notices. The damage can be both financial and emotional, making it especially difficult for seniors who value trust and connection.

Also read: AI is giving scammers a dangerous new edge—especially in grandparent hoaxes

Phishing remains one of the most common ways criminals use AI to mislead. Emails and messages are now written so convincingly that spotting the difference between real and fake is almost impossible.

They can appear to come directly from trusted companies, complete with personal details gathered from online sources to make the communication feel tailored.

By using urgency and hyper-personalization, scammers increase the chances that someone will respond without carefully inspecting the message. Experts at the University of Nevada, Las Vegas warn that being cautious with digital communication is essential.

They advise looking for inconsistencies in email addresses, resisting urgent or emotional appeals, and avoiding links or attachments that cannot be verified.

Odd payment requests, such as wire transfers, cryptocurrency, or gift cards, are also signs of trouble. These forms of payment are difficult to trace, making them a favorite for criminals.

The National Council on Aging emphasizes that pressure tactics, overly formal wording, and unusual requests for personal information are all warning signals.

Seniors are especially encouraged to be wary of unsolicited contact and to take time before acting on messages that feel suspicious.

AI may be advancing quickly, but awareness and caution are powerful defenses. Recognizing the red flags can help retirees protect their Social Security, pensions, and life savings from being drained by fraudsters.

Also read: Robot goes haywire—raising new questions about AI safety and control

While AI itself is not inherently harmful, criminals are using it to exploit vulnerabilities in new ways. Retirees who understand how these scams work are better positioned to avoid them, even as the technology continues to evolve.

Staying informed, slowing down when faced with urgent requests, and refusing to share sensitive details are among the most effective strategies. With vigilance and education, older adults can reduce the risks and keep their financial futures secure.

Read next: Are your loved ones safe online? A guide to protecting seniors from cyber threats

Have you or someone you know been contacted in a way that turned out to be a scam? Do you think retirees are being given enough tools to stay safe from these new AI-driven tricks? Share your stories and thoughts in the comments so we can learn from one another.

Sophisticated impersonations can blur the line between what is real and what is artificial, leaving even cautious people unsure.

For older adults, these tricks are becoming one of the fastest-growing threats to their financial security.

Artificial intelligence has given scammers the ability to tailor their schemes with a level of precision that was never possible before.

Unlike older fraud attempts that were often clumsy and easy to spot, these new methods are designed to appear authentic.

The FBI reported that in 2024, losses tied to internet crimes surpassed $16 billion, with nearly $5 billion of that amount suffered by those aged 60 and over.

This age group has become a prime target because retirees are often managing savings, pensions, or Social Security benefits.

One of the most unsettling features of this trend is how personal the deception can feel. With only a short voice clip taken from a voicemail or online video, criminals can create a clone that sounds exactly like a loved one.

That means a middle-of-the-night call from a “grandchild” in trouble could be nothing more than a computer-generated trick. The emotional pressure of hearing what sounds like family in distress can push people to act quickly, often transferring funds before realizing they have been manipulated.

Deepfakes add another layer of concern by creating realistic images, audio, or videos that show people saying or doing things they never actually said or did. These digital imitations can be used to fool bank employees into believing they are speaking with an account holder or to convince someone that an online relationship is genuine.

Once confidence is established, the requests for money usually begin small and then grow until the victim notices. The damage can be both financial and emotional, making it especially difficult for seniors who value trust and connection.

Also read: AI is giving scammers a dangerous new edge—especially in grandparent hoaxes

Phishing remains one of the most common ways criminals use AI to mislead. Emails and messages are now written so convincingly that spotting the difference between real and fake is almost impossible.

They can appear to come directly from trusted companies, complete with personal details gathered from online sources to make the communication feel tailored.

By using urgency and hyper-personalization, scammers increase the chances that someone will respond without carefully inspecting the message. Experts at the University of Nevada, Las Vegas warn that being cautious with digital communication is essential.

They advise looking for inconsistencies in email addresses, resisting urgent or emotional appeals, and avoiding links or attachments that cannot be verified.

Odd payment requests, such as wire transfers, cryptocurrency, or gift cards, are also signs of trouble. These forms of payment are difficult to trace, making them a favorite for criminals.

The National Council on Aging emphasizes that pressure tactics, overly formal wording, and unusual requests for personal information are all warning signals.

Seniors are especially encouraged to be wary of unsolicited contact and to take time before acting on messages that feel suspicious.

AI may be advancing quickly, but awareness and caution are powerful defenses. Recognizing the red flags can help retirees protect their Social Security, pensions, and life savings from being drained by fraudsters.

Also read: Robot goes haywire—raising new questions about AI safety and control

While AI itself is not inherently harmful, criminals are using it to exploit vulnerabilities in new ways. Retirees who understand how these scams work are better positioned to avoid them, even as the technology continues to evolve.

Staying informed, slowing down when faced with urgent requests, and refusing to share sensitive details are among the most effective strategies. With vigilance and education, older adults can reduce the risks and keep their financial futures secure.

Read next: Are your loved ones safe online? A guide to protecting seniors from cyber threats

Key Takeaways

- Americans 60 and older lost nearly $5 billion to AI-driven scams in 2024, according to the FBI’s Internet Crime Complaint Center.

- Scammers use AI tools to mimic voices, generate realistic deepfakes, and send personalized phishing emails that are almost indistinguishable from legitimate communications.

- Emotional manipulation, urgency, and odd payment requests such as cryptocurrency, wire transfers, or gift cards are all red flags of fraud.

- Experts emphasize that awareness, skepticism, and careful inspection of messages are the best ways for retirees to protect their Social Security, pensions, and savings.