Savings idea: Could the “100 envelope challenge” be the secret to saving big?

- Replies 0

If you’ve spent any time online lately—especially on social media—you may have stumbled across the “100 Envelope Challenge.”

It’s a trend that promises to make saving money fun, fast, and surprisingly simple. But is it really the magic bullet for building your nest egg, or just another internet fad destined to fizzle out?

At The GrayVine, we’re all about separating fact from fiction, especially when it comes to your hard-earned dollars. Let’s take a closer look at what the 100 Envelope Challenge is, how it works, and whether it’s a smart move for your financial future.

What Exactly Is the 100 Envelope Challenge?

At its core, the 100 Envelope Challenge is a creative twist on the classic envelope budgeting method—a system that’s been helping people manage their money for generations. Here’s how the challenge works:

Why Is This Challenge So Popular?

The 100 Envelope Challenge has taken off on social media platforms, where users share their progress and celebrate their savings. But the appeal goes beyond social media hype. Here’s why so many people are giving it a try:

The Pros: Why the 100 Envelope Challenge Might Work for You

1. Gamifies Saving: Turning saving into a daily challenge can make it feel less like a chore and more like a fun project. This can be especially helpful if you’ve struggled to stick to traditional savings plans in the past.

2. Builds Consistency: Saving every day, even small amounts, helps you develop a regular savings habit. Over time, these habits can lead to bigger financial wins.

3. Encourages Mindful Spending: Knowing you need to set aside money each day may make you think twice before making impulse purchases.

4. Customizable: If $5,050 is too ambitious, you can adjust the challenge to fit your budget. Try numbering envelopes 1 to 50, or use smaller increments.

5. Great for Visual Learners: If you like to see your progress, this method offers a clear, physical representation of your growing savings.

Source: @hermoneymastery / Tiktok.

The Cons: What to Watch Out For

Of course, no savings method is perfect. Here are some potential pitfalls to consider before diving in:

1. Requires a Lot of Cash: In our increasingly cashless world, withdrawing and handling large amounts of cash can be inconvenient—and potentially risky. By the end of the challenge, you’ll have over $5,000 in your home, which could be a security concern.

2. Not Always Realistic: For many, setting aside up to $100 in a single day isn’t feasible, especially on a fixed income. The challenge can be modified, but it’s important to be honest about what you can afford.

3. Temptation to Dip In: Having envelopes full of cash at home can be tempting. It’s easy to “borrow” from your savings for unexpected expenses or little splurges.

4. Missed Interest: Money saved in envelopes isn’t earning interest. In today’s high-yield savings account environment, you could be missing out on extra earnings.

5. Can Be Discouraging: Life happens. If you miss a day or can’t keep up, it’s easy to feel like you’ve failed. Remember, any amount saved is a win!

Smart Ways to Make the Challenge Work for You

If you’re intrigued by the 100 Envelope Challenge but want to avoid the downsides, here are some tips to tailor it to your needs:

How Does It Compare to Other Savings Methods?

The 100 Envelope Challenge isn’t the only way to save. Here are a few alternatives you might consider:

Have you tried the 100 Envelope Challenge or another creative savings method? What worked (or didn’t) for you? Do you have tips for making saving money more fun and less stressful? Share your stories and advice in the comments below!

It’s a trend that promises to make saving money fun, fast, and surprisingly simple. But is it really the magic bullet for building your nest egg, or just another internet fad destined to fizzle out?

At The GrayVine, we’re all about separating fact from fiction, especially when it comes to your hard-earned dollars. Let’s take a closer look at what the 100 Envelope Challenge is, how it works, and whether it’s a smart move for your financial future.

What Exactly Is the 100 Envelope Challenge?

At its core, the 100 Envelope Challenge is a creative twist on the classic envelope budgeting method—a system that’s been helping people manage their money for generations. Here’s how the challenge works:

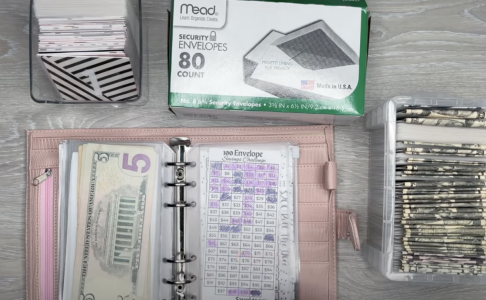

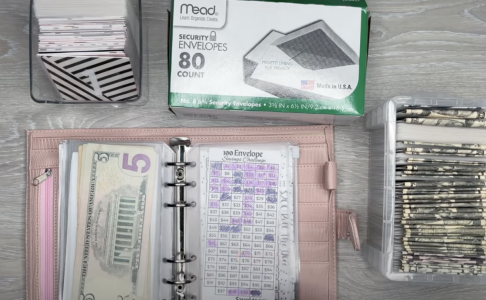

- Step 1: Label 100 envelopes with the numbers 1 through 100.

- Step 2: Each day, pick an envelope at random (or go in order, if you prefer).

- Step 3: Place the amount of cash that matches the envelope’s number inside. For example, if you pick envelope #32, you tuck away $32.

- Step 4: Repeat daily until all envelopes are filled.

The 100 envelope challenge is a viral money-saving method where you put a specific cash amount (from $1 to $100) into numbered envelopes each day, with the potential to save $5,050 over 100 days. Image source: Happy2planwithDesiree / Youtube.

Why Is This Challenge So Popular?

The 100 Envelope Challenge has taken off on social media platforms, where users share their progress and celebrate their savings. But the appeal goes beyond social media hype. Here’s why so many people are giving it a try:

- It’s Visual and Tangible: Watching your envelopes fill up with cash is satisfying and motivating, especially for those of us who like to see our progress in real time.

- It Turns Saving Into a Game: The element of chance—never knowing which envelope you’ll pick next—adds a sense of excitement and accomplishment.

- It Breaks Down a Big Goal: Saving over $5,000 might seem daunting, but breaking it into daily steps makes it feel manageable.

The Pros: Why the 100 Envelope Challenge Might Work for You

1. Gamifies Saving: Turning saving into a daily challenge can make it feel less like a chore and more like a fun project. This can be especially helpful if you’ve struggled to stick to traditional savings plans in the past.

2. Builds Consistency: Saving every day, even small amounts, helps you develop a regular savings habit. Over time, these habits can lead to bigger financial wins.

3. Encourages Mindful Spending: Knowing you need to set aside money each day may make you think twice before making impulse purchases.

4. Customizable: If $5,050 is too ambitious, you can adjust the challenge to fit your budget. Try numbering envelopes 1 to 50, or use smaller increments.

5. Great for Visual Learners: If you like to see your progress, this method offers a clear, physical representation of your growing savings.

Source: @hermoneymastery / Tiktok.

The Cons: What to Watch Out For

Of course, no savings method is perfect. Here are some potential pitfalls to consider before diving in:

1. Requires a Lot of Cash: In our increasingly cashless world, withdrawing and handling large amounts of cash can be inconvenient—and potentially risky. By the end of the challenge, you’ll have over $5,000 in your home, which could be a security concern.

2. Not Always Realistic: For many, setting aside up to $100 in a single day isn’t feasible, especially on a fixed income. The challenge can be modified, but it’s important to be honest about what you can afford.

3. Temptation to Dip In: Having envelopes full of cash at home can be tempting. It’s easy to “borrow” from your savings for unexpected expenses or little splurges.

4. Missed Interest: Money saved in envelopes isn’t earning interest. In today’s high-yield savings account environment, you could be missing out on extra earnings.

5. Can Be Discouraging: Life happens. If you miss a day or can’t keep up, it’s easy to feel like you’ve failed. Remember, any amount saved is a win!

Smart Ways to Make the Challenge Work for You

If you’re intrigued by the 100 Envelope Challenge but want to avoid the downsides, here are some tips to tailor it to your needs:

- Go Digital: Instead of using cash, transfer the daily amount into a dedicated savings account. You can track your progress with a spreadsheet or a simple notebook.

- Adjust the Numbers: If $5,050 is too much, try envelopes numbered 1 to 50, or use increments of 50 cents instead of $1.

- Set a Clear Goal: Decide what you’re saving for—an emergency fund, a special purchase, or a family trip. Having a purpose can keep you motivated.

- Find an Accountability Buddy: Invite a friend or family member to join you. Checking in with each other can help you stay on track.

- Automate Where Possible: Use banking apps that round up your purchases and save the spare change, or set up automatic transfers to your savings account.

https://www.tiktok.com/@mercedxo/video/7462551953579478315

Source: @mercedxo / Tiktok.

Source: @mercedxo / Tiktok.

How Does It Compare to Other Savings Methods?

The 100 Envelope Challenge isn’t the only way to save. Here are a few alternatives you might consider:

- Traditional Envelope Budgeting: Allocate cash for specific expenses (groceries, gas, entertainment) in separate envelopes each month. When the envelope is empty, you stop spending in that category.

- 52-Week Challenge: Save $1 the first week, $2 the second week, and so on. By the end of the year, you’ll have $1,378.

- Automatic Transfers: Set up a recurring transfer from your checking to your savings account. Even $5 or $10 a week adds up over time.

- High-Yield Savings Accounts: Let your money work for you by earning interest while you save.

Key Takeaways

- The 100 envelope challenge is a viral money-saving method where you put a specific cash amount (from $1 to $100) into numbered envelopes each day, with the potential to save $5,050 over 100 days.

- The challenge aims to gamify and simplify saving money, making it more approachable and motivating, especially for people who prefer visual or tangible budgeting tools.

- Downsides include the difficulty of keeping large amounts of cash at home, risk of theft or misplacing money, and the challenge of managing daily cash contributions without impacting your regular budget or cash flow.

- Experts suggest customising the challenge to suit your personal budget, considering digital alternatives (such as a high-yield savings account), and remembering that not every savings method works for everyone – it's important to find what best fits your lifestyle.

Have you tried the 100 Envelope Challenge or another creative savings method? What worked (or didn’t) for you? Do you have tips for making saving money more fun and less stressful? Share your stories and advice in the comments below!