Several Trump tariffs are back—for now. Here’s what that means for prices and trade

By

Veronica E.

- Replies 0

Tariffs can seem like a topic for policy experts, but they often affect the prices we all pay—especially for imported goods.

And this week, a fast-moving series of court decisions may have a direct impact on your wallet.

A federal trade court ruled on Wednesday that several tariffs introduced during the Trump administration should be voided.

A second ruling from a Washington, DC court echoed that decision the next day.

But by Thursday afternoon, the US Court of Appeals for the Federal Circuit granted the administration’s request to pause those rulings, meaning the tariffs are temporarily back in place.

A closer look at the legal tug-of-war

The legal back-and-forth centers on tariffs introduced under emergency powers, many of which aimed to reduce the trade deficit, promote US manufacturing, or address international issues like fentanyl trafficking.

Although the courts voided several of these tariffs, the administration immediately appealed, and the higher court’s pause means customs officials can continue collecting these duties for now.

Businesses challenging the tariffs have until next Thursday to respond, and the government’s deadline for a reply is June 9.

A request for the Supreme Court to step in could come as soon as the end of the week.

If the legal rulings are allowed to take full effect, the government could be required to refund previously collected tariffs—a decision that would affect billions of dollars in import taxes.

Also read: Act fast: How tariff changes could affect your online shopping and the loophole to save money!

What tariffs are being challenged?

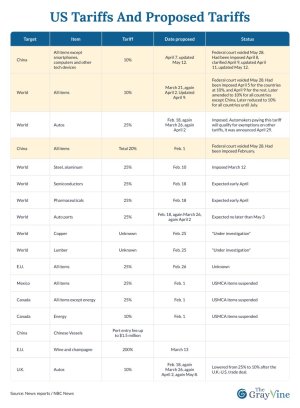

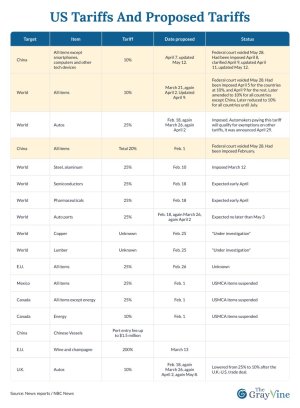

Here are the tariffs that were struck down but are currently reinstated:

Also read: One major industry just dodged Trump’s global tariff—Here’s why it matters to you.

What tariffs remain in place?

These tariffs were not affected by the recent rulings and continue to apply:

Also read: Tariff trouble? Why a growing boycott from Canada could cost American tourism $6 billion

How it affects prices—and your budget

Tariffs often lead to higher costs for importers, who may pass those costs on to consumers.

That means everything from vehicles to electronics to everyday household items could be impacted.

And for retirees or anyone living on a fixed income, those small increases can add up.

If courts ultimately overturn these tariffs and order refunds, some price relief may follow—but that would likely take time to reach store shelves.

What’s next

Here are the key dates to watch:

Whether you're for or against tariffs, it's clear that trade policy can affect all of us—and staying informed helps everyone make better decisions.

Read next: SNL cold open features Trump parody addressing tariff reversal and economic fallout

Have you noticed prices rising on imported goods lately? Do you think trade policies like these tariffs help American industries, or do they strain your household budget? We’d love to hear your thoughts. Share your experience in the comments and help keep the conversation going.

And this week, a fast-moving series of court decisions may have a direct impact on your wallet.

A federal trade court ruled on Wednesday that several tariffs introduced during the Trump administration should be voided.

A second ruling from a Washington, DC court echoed that decision the next day.

But by Thursday afternoon, the US Court of Appeals for the Federal Circuit granted the administration’s request to pause those rulings, meaning the tariffs are temporarily back in place.

Recent court rulings have put key import tariffs back in the spotlight, with potential effects on consumer prices and trade policy. Image Source: YouTube / ABC News (Australia).

A closer look at the legal tug-of-war

The legal back-and-forth centers on tariffs introduced under emergency powers, many of which aimed to reduce the trade deficit, promote US manufacturing, or address international issues like fentanyl trafficking.

Although the courts voided several of these tariffs, the administration immediately appealed, and the higher court’s pause means customs officials can continue collecting these duties for now.

Businesses challenging the tariffs have until next Thursday to respond, and the government’s deadline for a reply is June 9.

A request for the Supreme Court to step in could come as soon as the end of the week.

If the legal rulings are allowed to take full effect, the government could be required to refund previously collected tariffs—a decision that would affect billions of dollars in import taxes.

Also read: Act fast: How tariff changes could affect your online shopping and the loophole to save money!

What tariffs are being challenged?

Here are the tariffs that were struck down but are currently reinstated:

- 10% universal baseline tariff on a broad range of imported goods

- 20% duties on Chinese goods, tied to efforts to reduce fentanyl trafficking, and 25% on some Canadian and Mexican goods not meeting USMCA rules

- 10% “reciprocal” tariff on Chinese goods, intended to match China's tariffs on US products (announced April 9)

- De minimis tariffs on Chinese imports valued under $800

Also read: One major industry just dodged Trump’s global tariff—Here’s why it matters to you.

What tariffs remain in place?

These tariffs were not affected by the recent rulings and continue to apply:

- 25% on auto imports, except for those that meet USMCA content requirements

- 25% on auto parts, with exemptions for compliant parts

- 25% on steel, aluminum, and related articles, which remain a central part of trade and manufacturing policy

Take a look at the current status of US tariffs and proposed tariffs as legal and policy decisions continue to unfold. Image Source: News reports/ NBC News.

Also read: Tariff trouble? Why a growing boycott from Canada could cost American tourism $6 billion

How it affects prices—and your budget

Tariffs often lead to higher costs for importers, who may pass those costs on to consumers.

That means everything from vehicles to electronics to everyday household items could be impacted.

And for retirees or anyone living on a fixed income, those small increases can add up.

If courts ultimately overturn these tariffs and order refunds, some price relief may follow—but that would likely take time to reach store shelves.

What’s next

Here are the key dates to watch:

- Businesses have until next Thursday to respond in court

- The administration’s reply is due by June 9

- The Supreme Court may be asked to weigh in

- If the tariffs are permanently voided, the US government may need to refund collected import taxes, even if the tariffs are later re-imposed under different legal authority

Whether you're for or against tariffs, it's clear that trade policy can affect all of us—and staying informed helps everyone make better decisions.

Read next: SNL cold open features Trump parody addressing tariff reversal and economic fallout

Key Takeaways

- Several Trump-era tariffs were briefly voided by two federal courts but were reinstated after a higher court granted a temporary pause on the rulings.

- The challenged tariffs include baseline import duties, fentanyl-related tariffs, reciprocal tariffs on Chinese goods, and de minimis tariffs on low-value imports.

- Businesses have until next Thursday to respond; the administration’s reply is due by June 9.

- If the rulings stand, the government may be required to refund collected import duties, which could affect prices and trade policy going forward.

Have you noticed prices rising on imported goods lately? Do you think trade policies like these tariffs help American industries, or do they strain your household budget? We’d love to hear your thoughts. Share your experience in the comments and help keep the conversation going.