She thought the texts were scams but soon learned the mistake was costly

- Replies 0

Many people are quick to delete suspicious texts, especially when they claim money is owed or threaten account problems, because so often these messages are nothing more than scams designed to trick consumers.

But ignoring them isn’t always safe and sometimes they turn out to be legitimate, which is exactly what one woman learned the hard way after dismissing messages that she assumed were fake.

With inboxes and phones already overwhelmed by endless spam, phishing attempts, and unwanted calls, it has become normal for people to rely on instinct and simply delete anything that looks suspicious, but in this case, the instinct to delete almost put someone at risk of unexpected consequences.

What seemed like a scam at first eventually became a wake-up call about how difficult it has become to tell the difference between fraud and real communication from businesses.

Ashley, 47, explained that she had been receiving multiple text messages saying that her balance with her toll payment system was running low, but because the messages came with prompts to “pay now” she assumed they were just another scam, and she decided that she was “too smart to fall for that” as she deleted each one, convinced it was not legitimate.

She had always been contacted by email in the past and had no idea that the toll operator even had her phone number, which reinforced her belief that the texts were phony.

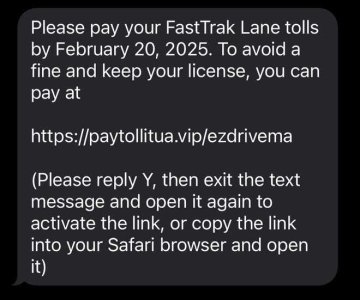

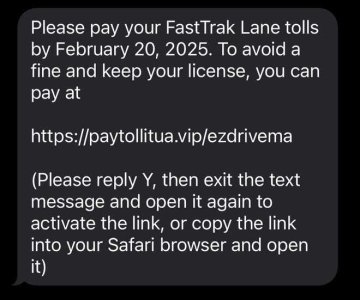

Her caution seemed justified because warnings about phishing texts pretending to be from tolling authorities have been widely circulated since January by agencies including the Federal Trade Commission and the FBI.

And like many other consumers, she had already received countless fake messages from supposed delivery companies, banks, and others, so she had no reason to think this situation was any different until she received an email that stopped her in her tracks.

That message included a bold notice that her account had been deactivated and warned her that using toll roads again would put her in violation, which caused her to panic since she relied on them frequently.

When she logged into her account, she realized the warnings had been real all along.

She discovered that the automatic refill feature tied to her bank card had been disconnected, leaving her account canceled, something she would not have realized without that final email.

Luckily, she had not yet accumulated unpaid balances or fees, but the possibility that she could have been driving without realizing she owed money left her unsettled and thinking about how easy it would have been to end up in a difficult situation.

Also read: These five messages are major RED FLAGS—don’t click, just delete

Ashley admitted that she now questions how legitimate businesses will be able to communicate with customers given the sheer volume of fraud.

“Anytime I get a text message that says ‘you need to send money’ or ‘click on this link’ and I don’t know where it’s from, I automatically delete it,” she said, adding, “I do wonder how businesses are going to be able to communicate with their customers via text.”

According to Michelle Kennedy, Media Relations Manager for The Transportation Corridor Agencies, which operates the toll system in question, the majority of text interactions reported to them are related to scams.

But there are times when account holders who opt in may receive legitimate texts, though these are only sent under specific conditions such as when payment cannot be processed, when replenishment amounts change, or when a card expiration is approaching.

She added that customers can also interact with the system in other ways, including email, phone calls, mailed statements, the official app, or by visiting service centers, meaning there are multiple ways for people to verify their account status without relying solely on text messages.

With scam attacks on mobile devices surging by more than 700% in June alone, the concern is not fading.

The challenge for consumers remains how to protect themselves without overlooking genuine notices that require attention, which makes the situation increasingly confusing.

Cybersecurity experts note that the growing sophistication of scam messages means instinct alone is no longer enough, and more careful verification is necessary.

Leyla Bilge, Global Head of Scam Research at Norton, compared scam detection to navigating a busy street where some doors lead to real businesses and others are traps.

And she advised that just because a text includes a familiar name or even the correct personal details does not mean it is authentic.

She explained that urgent language like “Act now” or “Verify immediately” is a common tactic used by scammers, and consumers should pause to ask themselves if they were expecting such a message in the first place.

Also read: New warning for email users: The scam that tricks you into handing over control

Because if not, it is better to double-check directly through the company’s official app or website rather than clicking links or replying to the message.

Bilge also stressed that people should remain calm, saying, “When people understand how scams operate and feel equipped to verify messages safely, they’re more likely to pause, think, and make the right call—without missing something important.”

Her advice underscores the importance of balancing caution with awareness so that important information is not lost in the shuffle of fraudulent communication.

Ashley’s story ultimately shows how difficult it has become to tell the difference between scams and legitimate alerts.

While she was fortunate to catch the problem before fines accumulated, her case highlights why it is essential for people to know how to verify their accounts safely rather than rely on instinct alone.

With scams continuing to rise and legitimate companies still needing to reach customers, the situation serves as a reminder that careful checking is the only way to avoid both fraud and costly mistakes.

Read next: Got a text about an Amazon refund? Don’t click—it’s a scam

Have you ever deleted a message that later turned out to be important? Do you think it’s still safe for companies to rely on texts, or should they move away from this method entirely? Share your experiences and thoughts in the comments!

But ignoring them isn’t always safe and sometimes they turn out to be legitimate, which is exactly what one woman learned the hard way after dismissing messages that she assumed were fake.

With inboxes and phones already overwhelmed by endless spam, phishing attempts, and unwanted calls, it has become normal for people to rely on instinct and simply delete anything that looks suspicious, but in this case, the instinct to delete almost put someone at risk of unexpected consequences.

What seemed like a scam at first eventually became a wake-up call about how difficult it has become to tell the difference between fraud and real communication from businesses.

Ashley, 47, explained that she had been receiving multiple text messages saying that her balance with her toll payment system was running low, but because the messages came with prompts to “pay now” she assumed they were just another scam, and she decided that she was “too smart to fall for that” as she deleted each one, convinced it was not legitimate.

She had always been contacted by email in the past and had no idea that the toll operator even had her phone number, which reinforced her belief that the texts were phony.

Her caution seemed justified because warnings about phishing texts pretending to be from tolling authorities have been widely circulated since January by agencies including the Federal Trade Commission and the FBI.

She thought the texts were scams but soon learned the mistake was costly. Image Source: Beth Macdonald / Unsplash

And like many other consumers, she had already received countless fake messages from supposed delivery companies, banks, and others, so she had no reason to think this situation was any different until she received an email that stopped her in her tracks.

That message included a bold notice that her account had been deactivated and warned her that using toll roads again would put her in violation, which caused her to panic since she relied on them frequently.

When she logged into her account, she realized the warnings had been real all along.

She discovered that the automatic refill feature tied to her bank card had been disconnected, leaving her account canceled, something she would not have realized without that final email.

Luckily, she had not yet accumulated unpaid balances or fees, but the possibility that she could have been driving without realizing she owed money left her unsettled and thinking about how easy it would have been to end up in a difficult situation.

Also read: These five messages are major RED FLAGS—don’t click, just delete

Ashley admitted that she now questions how legitimate businesses will be able to communicate with customers given the sheer volume of fraud.

“Anytime I get a text message that says ‘you need to send money’ or ‘click on this link’ and I don’t know where it’s from, I automatically delete it,” she said, adding, “I do wonder how businesses are going to be able to communicate with their customers via text.”

Many people are quick to delete suspicious texts, especially when they claim money is owed or threaten account problems. Image Source: Fark.com

According to Michelle Kennedy, Media Relations Manager for The Transportation Corridor Agencies, which operates the toll system in question, the majority of text interactions reported to them are related to scams.

But there are times when account holders who opt in may receive legitimate texts, though these are only sent under specific conditions such as when payment cannot be processed, when replenishment amounts change, or when a card expiration is approaching.

She added that customers can also interact with the system in other ways, including email, phone calls, mailed statements, the official app, or by visiting service centers, meaning there are multiple ways for people to verify their account status without relying solely on text messages.

With scam attacks on mobile devices surging by more than 700% in June alone, the concern is not fading.

The challenge for consumers remains how to protect themselves without overlooking genuine notices that require attention, which makes the situation increasingly confusing.

Cybersecurity experts note that the growing sophistication of scam messages means instinct alone is no longer enough, and more careful verification is necessary.

Leyla Bilge, Global Head of Scam Research at Norton, compared scam detection to navigating a busy street where some doors lead to real businesses and others are traps.

And she advised that just because a text includes a familiar name or even the correct personal details does not mean it is authentic.

She explained that urgent language like “Act now” or “Verify immediately” is a common tactic used by scammers, and consumers should pause to ask themselves if they were expecting such a message in the first place.

Also read: New warning for email users: The scam that tricks you into handing over control

Because if not, it is better to double-check directly through the company’s official app or website rather than clicking links or replying to the message.

Bilge also stressed that people should remain calm, saying, “When people understand how scams operate and feel equipped to verify messages safely, they’re more likely to pause, think, and make the right call—without missing something important.”

Her advice underscores the importance of balancing caution with awareness so that important information is not lost in the shuffle of fraudulent communication.

Ashley’s story ultimately shows how difficult it has become to tell the difference between scams and legitimate alerts.

While she was fortunate to catch the problem before fines accumulated, her case highlights why it is essential for people to know how to verify their accounts safely rather than rely on instinct alone.

With scams continuing to rise and legitimate companies still needing to reach customers, the situation serves as a reminder that careful checking is the only way to avoid both fraud and costly mistakes.

Read next: Got a text about an Amazon refund? Don’t click—it’s a scam

Key Takeaways

- A California woman ignored toll account warnings, thinking they were scams.

- Her account was deactivated after auto-refill stopped, but she avoided large penalties.

- Toll authorities say most reported texts are scams, but some real messages are sent to users who opt in.

- Experts advise verifying messages directly through official apps or websites rather than clicking links.