Social Security benefits could be reassessed for nearly 500,000 recipients—Why is this happening?

- Replies 0

For millions of Americans, Social Security isn’t just a monthly deposit—it’s a lifeline. But what if that lifeline was suddenly cut short, not by a government shutdown or a budget crisis, but by a decades-old student loan?

If you’re one of the nearly 3 million Americans over 62 still carrying federal student loan debt, it’s time to pay close attention.

Starting this June, the government is resuming a controversial practice that could shrink your Social Security check—sometimes by hundreds of dollars a month.

Why Are Social Security Benefits Being Targeted?

Millions of Americans depending on Social Security may begin to have portions of their monthly checks withheld in June if they’ve fallen behind on student loan payments.

About 2.9 million Americans aged 62 and older carry federal student loan balances—a figure that’s surged over 70 percent since 2017, per the USDepartment of Education.

CNBC reports that upwards of 450,000 senior borrowers are in default and could face cuts to their benefits.

What You Need to Know

The Trump administration has reinstated stringent collection actions that were suspended during the COVID-19 relief period.

Under the Treasury Offset Program (TOP), the government may withhold as much as 15 percent of Social Security benefits to cover defaulted federal student loans, but cannot reduce the monthly payment below $750.

"Before the offset begins, a notice of intent to offset will be sent to your last-known address to inform you that the offset and negative credit reporting are scheduled to begin in 65 days," the Federal Student Aid website explains. "The notice may only be sent once, and offsets will continue until your debt is paid or the default status is resolved."

As of May 5, the White House has reactivated these offsets, which include automatic garnishment of Social Security payments.

Also read: Trump’s big shake-up: What it means for your grandkids’ future

"It should be noted that these debt recovery practices are not new and have been in use for over two decades," Tom O’Hare, holistic college advisor at Get College Going, explained to Newsweek. "They were suspended to assist delinquent borrowers during COVID-19 and during the remaining time the former Administration was in office."

A Department of Education representative told CNBC that if you received a warning before the pandemic, you won’t get a new one: "The notice may be sent only once, and borrowers may have received this notice before COVID."

How Does the Government Take Your Benefits?

"A borrower who has failed to pay on their federal student loan is considered in default when the loan delinquency reaches 270 days past due," O’Hare said.

"The loan is generally reassigned from loan servicers to a collection agency that works on behalf of the federal government to either litigate or implement stringent collection recovery practices, including wage garnishment and deduction from Social Security payments."

Borrowers can still get back on track.

"First, reach out to your loan servicer. They can guide you through available options like deferment, forbearance, or creating a flexible repayment plan," Bethany Hubert, financial aid specialist at Earnest, told Newsweek. "Programs like income-driven repayment can adjust your monthly payment to better match your budget."

What People Are Saying

Education Secretary Linda McMahon wrote in the Wall Street Journal: "If you are a student borrower with a federal loan balance and haven't been making payments, you must restart payments now."

Also read: Changes to a major health plan may affect how some get their COVID shots

Mike Pierce, executive director of the Student Borrower Protection Center, commented: "For five million people in default, federal law gives borrowers a way out of default and the right to make loan payments they can afford. Since February, Donald Trump and Linda McMahon have blocked these borrowers' path out of default and are now feeding them into the maw of the government debt collection machine. This is cruel, unnecessary, and will further fan the flames of economic chaos for working families across this country."

What’s Next

Collections resumed on May 5, and benefit seizures could begin with June payments. The Department of Education has not said whether it will revisit the process or issue fresh notices.

If you’re worried your Social Security could be garnished, don’t panic—there are steps you can take to protect yourself:

1. Check Your Loan Status

- Log in to your account at studentaid.gov or call your loan servicer to see if your loans are in default.

- If you’re not sure who your servicer is, the Federal Student Aid Information Center (1-800-433-3243) can help.

2. Contact Your Loan Servicer Immediately

- If you’re in default, reach out to your servicer or the collection agency handling your loan. They can walk you through options to get out of default, such as:

- Loan Rehabilitation: Make nine on-time payments over 10 months to bring your loan current and remove the default from your credit report.

- Loan Consolidation: Combine your loans into a new Direct Consolidation Loan and agree to an income-driven repayment plan.

- Income-Driven Repayment (IDR): These plans can reduce your monthly payment to as little as $0, depending on your income.

3. Request a Hardship Exemption

- If losing part of your Social Security would cause severe financial hardship, you can request a review or appeal the offset. This process can be complicated, but it’s worth pursuing if you’re struggling to pay for basic needs.

Source: KREM 2 News / Youtube.

Resources:

- Federal Student Aid

- Social Security Administration

- Student Borrower Protection Center

Read next: Woman admits to $5M Department of Education fraud scheme involving “straw students”

Have you or someone you know had Social Security benefits reduced because of student loan debt? Do you have tips for navigating the system, or questions about your own situation? Share your story in the comments below!

If you’re one of the nearly 3 million Americans over 62 still carrying federal student loan debt, it’s time to pay close attention.

Starting this June, the government is resuming a controversial practice that could shrink your Social Security check—sometimes by hundreds of dollars a month.

Why Are Social Security Benefits Being Targeted?

Millions of Americans depending on Social Security may begin to have portions of their monthly checks withheld in June if they’ve fallen behind on student loan payments.

About 2.9 million Americans aged 62 and older carry federal student loan balances—a figure that’s surged over 70 percent since 2017, per the USDepartment of Education.

CNBC reports that upwards of 450,000 senior borrowers are in default and could face cuts to their benefits.

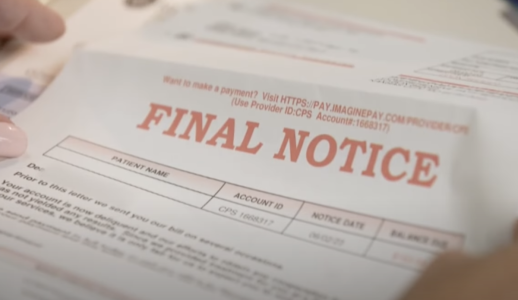

Millions of Americans receiving Social Security could have part of their benefits seized from June if they have defaulted on student loan debts. Image source: KREM 2 News / Youtube.

What You Need to Know

The Trump administration has reinstated stringent collection actions that were suspended during the COVID-19 relief period.

Under the Treasury Offset Program (TOP), the government may withhold as much as 15 percent of Social Security benefits to cover defaulted federal student loans, but cannot reduce the monthly payment below $750.

"Before the offset begins, a notice of intent to offset will be sent to your last-known address to inform you that the offset and negative credit reporting are scheduled to begin in 65 days," the Federal Student Aid website explains. "The notice may only be sent once, and offsets will continue until your debt is paid or the default status is resolved."

As of May 5, the White House has reactivated these offsets, which include automatic garnishment of Social Security payments.

Also read: Trump’s big shake-up: What it means for your grandkids’ future

"It should be noted that these debt recovery practices are not new and have been in use for over two decades," Tom O’Hare, holistic college advisor at Get College Going, explained to Newsweek. "They were suspended to assist delinquent borrowers during COVID-19 and during the remaining time the former Administration was in office."

A Department of Education representative told CNBC that if you received a warning before the pandemic, you won’t get a new one: "The notice may be sent only once, and borrowers may have received this notice before COVID."

How Does the Government Take Your Benefits?

"A borrower who has failed to pay on their federal student loan is considered in default when the loan delinquency reaches 270 days past due," O’Hare said.

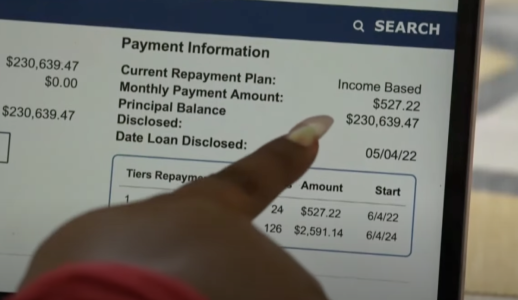

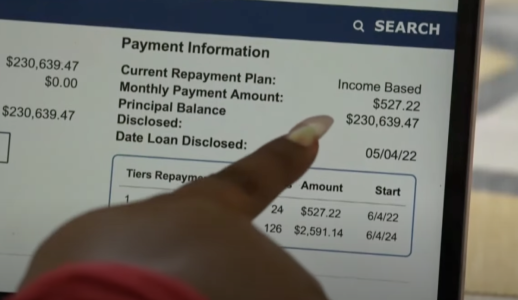

Over 450,000 elderly borrowers are currently in default and may be subject to reductions of up to 15 per cent of their Social Security payments, though payments cannot drop below $750 a month. Image source: KREM 2 News / Youtube.

"The loan is generally reassigned from loan servicers to a collection agency that works on behalf of the federal government to either litigate or implement stringent collection recovery practices, including wage garnishment and deduction from Social Security payments."

Borrowers can still get back on track.

"First, reach out to your loan servicer. They can guide you through available options like deferment, forbearance, or creating a flexible repayment plan," Bethany Hubert, financial aid specialist at Earnest, told Newsweek. "Programs like income-driven repayment can adjust your monthly payment to better match your budget."

What People Are Saying

Education Secretary Linda McMahon wrote in the Wall Street Journal: "If you are a student borrower with a federal loan balance and haven't been making payments, you must restart payments now."

Also read: Changes to a major health plan may affect how some get their COVID shots

Mike Pierce, executive director of the Student Borrower Protection Center, commented: "For five million people in default, federal law gives borrowers a way out of default and the right to make loan payments they can afford. Since February, Donald Trump and Linda McMahon have blocked these borrowers' path out of default and are now feeding them into the maw of the government debt collection machine. This is cruel, unnecessary, and will further fan the flames of economic chaos for working families across this country."

What’s Next

Collections resumed on May 5, and benefit seizures could begin with June payments. The Department of Education has not said whether it will revisit the process or issue fresh notices.

If you’re worried your Social Security could be garnished, don’t panic—there are steps you can take to protect yourself:

1. Check Your Loan Status

- Log in to your account at studentaid.gov or call your loan servicer to see if your loans are in default.

- If you’re not sure who your servicer is, the Federal Student Aid Information Center (1-800-433-3243) can help.

2. Contact Your Loan Servicer Immediately

- If you’re in default, reach out to your servicer or the collection agency handling your loan. They can walk you through options to get out of default, such as:

- Loan Rehabilitation: Make nine on-time payments over 10 months to bring your loan current and remove the default from your credit report.

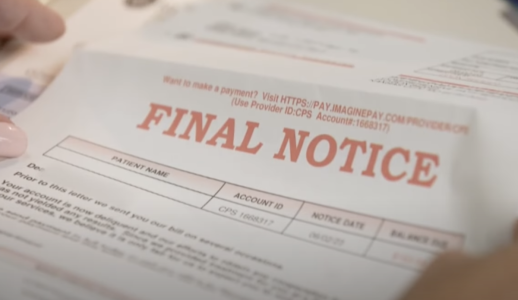

The US government has resumed aggressive debt collection practices, paused during COVID-19, meaning Treasury offsets and automatic garnishment of Social Security benefits have restarted. Image source: KREM 2 News / Youtube.

- Loan Consolidation: Combine your loans into a new Direct Consolidation Loan and agree to an income-driven repayment plan.

- Income-Driven Repayment (IDR): These plans can reduce your monthly payment to as little as $0, depending on your income.

3. Request a Hardship Exemption

- If losing part of your Social Security would cause severe financial hardship, you can request a review or appeal the offset. This process can be complicated, but it’s worth pursuing if you’re struggling to pay for basic needs.

Source: KREM 2 News / Youtube.

Resources:

- Federal Student Aid

- Social Security Administration

- Student Borrower Protection Center

Read next: Woman admits to $5M Department of Education fraud scheme involving “straw students”

Key Takeaways

- Millions of Americans receiving Social Security could have part of their benefits seized from June if they have defaulted on student loan debts.

- Over 450,000 elderly borrowers are currently in default and may be subject to reductions of up to 15 per cent of their Social Security payments, though payments cannot drop below $750 a month.

- The US government has resumed aggressive debt collection practices, paused during COVID-19, meaning Treasury offsets and automatic garnishment of Social Security benefits have restarted.

- Borrowers are advised to contact their loan servicer for options such as deferment, forbearance, or repayment plans, as collections will continue until the debt is paid or default status is resolved.

Have you or someone you know had Social Security benefits reduced because of student loan debt? Do you have tips for navigating the system, or questions about your own situation? Share your story in the comments below!