Subscription cancellations just got harder—why a new consumer rule was blocked

By

Veronica E.

- Replies 0

Have you ever signed up for a free trial and later spent more time than you'd like to admit just trying to cancel it? You're not alone.

Many Americans, especially older adults who remember when canceling meant a simple phone call—not a maze of digital menus—have expressed frustration over how difficult it’s become to unsubscribe.

That’s why a new “click-to-cancel” rule proposed by federal regulators was widely welcomed as a step in the right direction.

But just as it was set to roll out, the rule was unexpectedly blocked in court.

Here's what happened, why it matters, and what you can do to avoid costly traps in the meantime.

The Federal Trade Commission (FTC) introduced the rule to make canceling subscriptions just as simple as signing up for them.

The plan was part of the Biden administration’s “Time Is Money” initiative, aimed at reducing time-wasting processes that frustrate consumers.

If implemented, the rule would have required companies to:

The goal was to reduce the barriers that many consumers face when trying to leave services they no longer want.

The rule didn’t fail because it was unpopular or even challenged on its merit.

Instead, a federal appeals court stopped it due to a technical issue in the rulemaking process.

The FTC had initially determined that the rule would not have a significant economic impact—specifically, over $100 million annually—which would have triggered the need for a detailed cost-benefit analysis.

But an administrative law judge disagreed. The court ruled that the agency hadn’t followed the proper procedure, and as a result, implementation was paused.

In other words: the idea wasn’t the problem—the paperwork was.

Subscription services have become a regular part of daily life.

From streaming TV to food delivery and digital news, many of us have signed up for a “free” trial or monthly membership—only to struggle with canceling it later.

Some companies require phone calls during limited hours, others bury the cancel button behind multiple screens, and a few even ask for written requests by mail.

Without the click-to-cancel rule in place, companies can continue using these time-consuming and often confusing cancellation tactics.

That means more surprise charges, more wasted time, and added stress for those trying to manage budgets—especially retirees or those on fixed incomes.

The blocked rule is just one part of the FTC’s ongoing effort to push back against practices it views as unfair to consumers.

The agency is currently pursuing a case against Amazon, accusing the company of enrolling users in its Prime program without clear consent and making it difficult to cancel.

That case is scheduled for trial next year.

In another major case, the FTC is challenging Meta (Facebook’s parent company) for alleged anti-competitive behavior.

Both lawsuits reflect a broader trend: regulators are trying to hold large companies accountable, but legal hurdles and delays are slowing progress.

Until clearer protections are in place, here are a few simple steps you can take to avoid unwanted charges:

At The GrayVine, we know how valuable your time and money are—especially when it comes to avoiding unnecessary charges.

While this rule may be on hold for now, staying informed can still help you protect yourself from subscription traps.

Read next: Protect yourself: Why you should think twice before agreeing to new terms on banking and payment apps

Have you ever been stuck in a subscription you couldn’t cancel? Or found a company that made it refreshingly easy to opt out? Do you have a tip for avoiding these traps altogether?

We’d love to hear your experiences. Share your advice in the comments—your insight could save another reader time, money, and stress.

Many Americans, especially older adults who remember when canceling meant a simple phone call—not a maze of digital menus—have expressed frustration over how difficult it’s become to unsubscribe.

That’s why a new “click-to-cancel” rule proposed by federal regulators was widely welcomed as a step in the right direction.

But just as it was set to roll out, the rule was unexpectedly blocked in court.

Here's what happened, why it matters, and what you can do to avoid costly traps in the meantime.

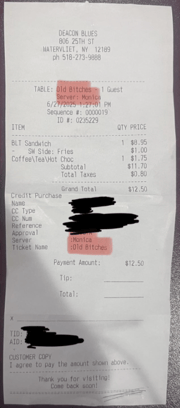

The FTC’s proposed rule would have made canceling subscriptions easier—but for now, the process remains frustrating for many consumers. Image Source: Pexels / JÉSHOOTS.

What was the click-to-cancel rule?

The Federal Trade Commission (FTC) introduced the rule to make canceling subscriptions just as simple as signing up for them.

The plan was part of the Biden administration’s “Time Is Money” initiative, aimed at reducing time-wasting processes that frustrate consumers.

If implemented, the rule would have required companies to:

- Clearly inform you when free trials or discounted offers end

- Get your consent before charging for auto-renewing plans

- Allow you to cancel online in the same number of steps—or fewer—than it took to sign up

The goal was to reduce the barriers that many consumers face when trying to leave services they no longer want.

Also read: Could your next hotel reservation be at risk? What travelers need to know about this growing scam

Why was it blocked?

The rule didn’t fail because it was unpopular or even challenged on its merit.

Instead, a federal appeals court stopped it due to a technical issue in the rulemaking process.

The FTC had initially determined that the rule would not have a significant economic impact—specifically, over $100 million annually—which would have triggered the need for a detailed cost-benefit analysis.

But an administrative law judge disagreed. The court ruled that the agency hadn’t followed the proper procedure, and as a result, implementation was paused.

In other words: the idea wasn’t the problem—the paperwork was.

Also read: Scam alert—why your phone is suddenly getting fake job offers

Why this matters for you

Subscription services have become a regular part of daily life.

From streaming TV to food delivery and digital news, many of us have signed up for a “free” trial or monthly membership—only to struggle with canceling it later.

Some companies require phone calls during limited hours, others bury the cancel button behind multiple screens, and a few even ask for written requests by mail.

Without the click-to-cancel rule in place, companies can continue using these time-consuming and often confusing cancellation tactics.

That means more surprise charges, more wasted time, and added stress for those trying to manage budgets—especially retirees or those on fixed incomes.

Also read: Are you paying for subscriptions you don’t use? Here’s how to take back control

The FTC’s broader battle with Big Tech

The blocked rule is just one part of the FTC’s ongoing effort to push back against practices it views as unfair to consumers.

The agency is currently pursuing a case against Amazon, accusing the company of enrolling users in its Prime program without clear consent and making it difficult to cancel.

That case is scheduled for trial next year.

In another major case, the FTC is challenging Meta (Facebook’s parent company) for alleged anti-competitive behavior.

Both lawsuits reflect a broader trend: regulators are trying to hold large companies accountable, but legal hurdles and delays are slowing progress.

Also read: Free money, gone: "The simple rewards step I forgot to take"

What you can do in the meantime

Until clearer protections are in place, here are a few simple steps you can take to avoid unwanted charges:

- Read the fine print — Before you sign up, check how to cancel. If it’s not obvious, be cautious.

- Set reminders — Use a calendar or phone alert to remind you a few days before a trial or subscription auto-renews.

- Use virtual cards — Some credit cards offer temporary or virtual card numbers for trial offers, which can be disabled easily.

- Review your statements — Check your bank or credit card bills regularly for unfamiliar recurring charges.

- Dispute charges if needed — If you're billed after trying to cancel, contact your card issuer. You may be able to reverse the charge.

At The GrayVine, we know how valuable your time and money are—especially when it comes to avoiding unnecessary charges.

While this rule may be on hold for now, staying informed can still help you protect yourself from subscription traps.

Read next: Protect yourself: Why you should think twice before agreeing to new terms on banking and payment apps

Key Takeaways

- The FTC’s “click-to-cancel” rule, meant to simplify subscription cancellations, was blocked by a federal court due to a procedural issue—not because of opposition to the idea itself.

- The rule would have required companies to clearly disclose auto-renewals, get consent before charging, and allow consumers to cancel as easily as they signed up.

- Without the rule in place, consumers may continue to face confusing and time-consuming cancellation processes that can lead to unexpected charges.

- The FTC is also pursuing major legal cases against Amazon and Meta as part of broader efforts to improve consumer protections in the digital age.

Have you ever been stuck in a subscription you couldn’t cancel? Or found a company that made it refreshingly easy to opt out? Do you have a tip for avoiding these traps altogether?

We’d love to hear your experiences. Share your advice in the comments—your insight could save another reader time, money, and stress.