Tax nightmare: Shocking IRS bill leaves victim in “deep pit”

- Replies 0

Tax season is a time of anticipation, whether you're expecting a refund or bracing for a bill.

But what happens when that bill includes money you never even saw?

It may sound unbelievable, but for some taxpayers, unexpected tax liabilities are turning into financial nightmares.

Imagine discovering you owe tens of thousands of dollars in taxes for money you never received.

That’s the harsh reality one retiree is facing after scammers drained over $280,000 from his retirement savings.

Instead of receiving help, he was hit with a $60,000 tax bill from the IRS, treating the stolen funds as taxable income.

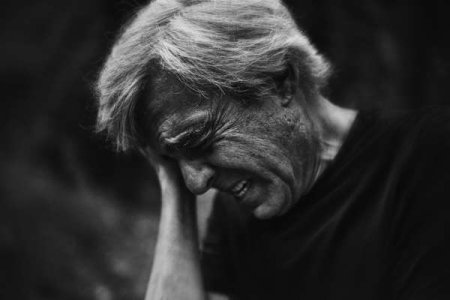

"It was like my heart sank and I felt like I was in a deep pit," he recalled, grappling with the financial devastation and the unexpected burden of owing taxes on money he never even saw.

Despite having his retirement account wiped out by fraudsters, this individual is still being taxed on the stolen amount, creating financial distress at a time when he should be focused on stability.

Adding to the burden, he fears, "the possibility of my Medicare Part B jumping because of this phantom income."

Without protections in place, retirees and others who fall victim to similar scams are left with few options to fight back.

However, this protection was removed under a past administration, leaving those in similar situations without a way to offset their losses.

Without proof of theft recognized by the IRS, victims are left responsible for paying taxes on money they never saw.

A 2014 report from the Senate Aging Committee highlighted this issue, stating that many Americans in this situation "can no longer deduct those losses and are often obligated to pay taxes on money that has been stolen."

This change has disproportionately affected retirees and individuals with fixed incomes who are unable to recover from such losses.

While lawmakers debate potential changes, those currently caught in these situations remain in financial limbo, hoping for relief.

Already, nearly 8 million refunds have been issued, averaging about $2,065.

For taxpayers eager to receive their refunds quickly, the IRS recommends filing electronically and ensuring all deadlines are met.

This comes as the agency recently cut nearly 6,000 jobs.

If you suspect fraudulent activity or want to learn how to better protect your benefits, check out insider tips from the US government on handling suspected fraud.

Stay informed, stay secure, and take action to protect what’s yours.

Have you or someone you know been affected by a similar situation? What measures do you take to safeguard your financial information? Share your stories and tips in the comments below. Your insights could help a fellow reader avoid a financial disaster.

Have you or someone you know been affected by a similar situation? What measures do you take to safeguard your financial information? Share your stories and tips in the comments below. Your insights could help a fellow reader avoid a financial disaster.

Read more: This "IRS $1,400 rebate" text could be a trap—here’s how to spot and avoid the latest scam!

But what happens when that bill includes money you never even saw?

It may sound unbelievable, but for some taxpayers, unexpected tax liabilities are turning into financial nightmares.

Imagine discovering you owe tens of thousands of dollars in taxes for money you never received.

That’s the harsh reality one retiree is facing after scammers drained over $280,000 from his retirement savings.

Instead of receiving help, he was hit with a $60,000 tax bill from the IRS, treating the stolen funds as taxable income.

"It was like my heart sank and I felt like I was in a deep pit," he recalled, grappling with the financial devastation and the unexpected burden of owing taxes on money he never even saw.

The costly consequence of phantom income

Phantom income refers to money that appears on paper but was never actually received by the taxpayer.Despite having his retirement account wiped out by fraudsters, this individual is still being taxed on the stolen amount, creating financial distress at a time when he should be focused on stability.

Adding to the burden, he fears, "the possibility of my Medicare Part B jumping because of this phantom income."

Without protections in place, retirees and others who fall victim to similar scams are left with few options to fight back.

A vanishing tax protection

There was once a safeguard for victims of fraud—an IRS provision that allowed taxpayers to deduct stolen money as a theft loss.However, this protection was removed under a past administration, leaving those in similar situations without a way to offset their losses.

Without proof of theft recognized by the IRS, victims are left responsible for paying taxes on money they never saw.

A 2014 report from the Senate Aging Committee highlighted this issue, stating that many Americans in this situation "can no longer deduct those losses and are often obligated to pay taxes on money that has been stolen."

This change has disproportionately affected retirees and individuals with fixed incomes who are unable to recover from such losses.

Is change coming?

There is hope on the horizon as Congress is working on new legislation that could restore protections for victims of financial scams.While lawmakers debate potential changes, those currently caught in these situations remain in financial limbo, hoping for relief.

IRS filing season underway

The IRS kicked off the 2025 tax season on January 27, with more than 140 million individual tax returns expected before the April 15 deadline.Already, nearly 8 million refunds have been issued, averaging about $2,065.

For taxpayers eager to receive their refunds quickly, the IRS recommends filing electronically and ensuring all deadlines are met.

This comes as the agency recently cut nearly 6,000 jobs.

Protect yourself from financial scams

Financial scams can happen to anyone, but taking proactive steps can help safeguard your personal information and retirement savings.If you suspect fraudulent activity or want to learn how to better protect your benefits, check out insider tips from the US government on handling suspected fraud.

Stay informed, stay secure, and take action to protect what’s yours.

Key Takeaways

- A man had over $280,000 stolen from his retirement account by scammers.

- The IRS is additionally demanding $60,000 in taxes for the stolen income perceived as valid.

- Victims such as the Atlanta man are often taxed on 'phantom income', a problem exacerbated since the removal of certain IRS protections.

- New legislation is being considered to protect victims of scams, but currently many with stolen money still face tax debts.

Read more: This "IRS $1,400 rebate" text could be a trap—here’s how to spot and avoid the latest scam!