The shocking truth about Social Security taxes in 2025 – Find out how much money you could lose!

- Replies 0

As we age, planning for the future becomes crucial–especially when it comes to our retirement. After working hard for years, it’s finally time to experience the sweet feeling of rest and relaxation.

In the golden years of retirement, the last thing anyone wants is an unexpected financial curveball. Yet, as we approach 2025, it's crucial to shine a light on a topic that could impact the wallets of many retirees: Social Security taxes.

Social Security serves as a financial lifeline for many Americans post-retirement.

However, the notion that these benefits are entirely tax-free is, unfortunately, a misconception for some. While many states choose not to tax Social Security benefits, the federal government may take a slice of your pie under certain conditions.

As we edge closer to 2025, it's essential to grasp how the Internal Revenue Service (IRS) determines the taxability of your Social Security benefits.

The formula hinges on what's known as your “combined income,” which includes:

1. Your adjusted gross income (AGI) – the total of all your income streams, minus IRS-approved deductions.

2. Non-taxable interest – bonds must be included since they are resources available to you, even if they are not taxed directly

3. Half of your Social Security benefits – 50% of your benefits are thrown into this mix.

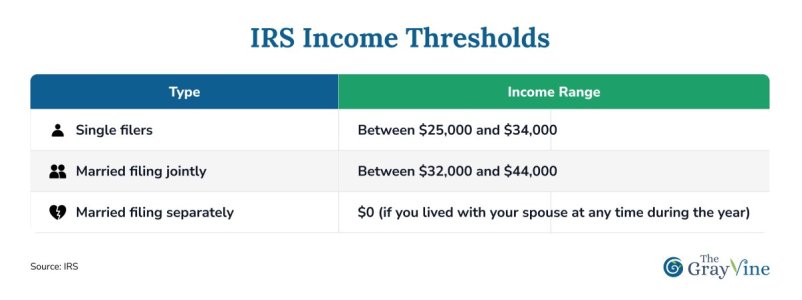

Once you've summed up these figures, you'll need to measure them against the IRS's income thresholds.

These thresholds are the financial guardrails intended to shield lower-income retirees from taxes and ensure that only those with more substantial incomes contribute a portion of their benefits back to the government.

Here's a quick rundown of the current thresholds:

For those with other filing statuses, such as the head of the household or qualifying widow(er), it is advised to follow the threshold for single filers.

If your combined income falls below the lower threshold, you can breathe easy—your benefits won't be taxed. Land between the two markers, and you'll see taxes on up to 50% of your benefits.

However, if you exceed the upper threshold, up to 85% of your benefits could be subject to taxation.

Effects of Other Deductions and Credits

Tax calculations are rarely straightforward, and this is no exception.

Your unique financial situation can significantly influence the taxability of your Social Security benefits. For instance, hefty medical expenses that chew through a percentage of your AGI may unlock a special deduction, reducing your taxable income.

Generosity can also be financially savvy. Qualified charitable contributions, particularly from tax-advantaged retirement accounts, can lower your tax bill.

It's worth taking the time to explore all the tax exemptions and credits available to you to get a clear picture of your obligations.

Navigating Exceptions and Special Cases

Every individual's financial landscape is distinct, and the federal government acknowledges this in its approach to taxing benefits.

For those receiving benefits due to a disability, a variety of exemptions may apply, potentially easing the tax burden to accommodate medical expenses.

Moreover, certain types of non-taxable income or unique situations, like receiving lump-sum benefit payments, may follow different taxation rules.

When in doubt, it's wise to seek guidance from an IRS representative or a tax advisor to steer clear of any missteps. You can follow the steps provided by the IRS website to achieve this.

While on the subject of tax benefits and making our lives easier as we approach retirement, it’s helpful for us to learn little tips and tricks when it comes to Social Security. Learn more about keeping your Social Security income tax-free in this story!

At The GrayVine, we're more than just a community–we're a collective wealth of wisdom. By sharing our knowledge, we can all approach the future with confidence, ensuring that our retirement years are as golden as they should be.

Have you started planning for the potential tax on your Social Security benefits? Do you have tips or strategies that have worked for you? Or perhaps you have questions about how to navigate this complex topic? We invite you to share your insights, experiences, and queries in the comments below!

In the golden years of retirement, the last thing anyone wants is an unexpected financial curveball. Yet, as we approach 2025, it's crucial to shine a light on a topic that could impact the wallets of many retirees: Social Security taxes.

Social Security serves as a financial lifeline for many Americans post-retirement.

However, the notion that these benefits are entirely tax-free is, unfortunately, a misconception for some. While many states choose not to tax Social Security benefits, the federal government may take a slice of your pie under certain conditions.

As we edge closer to 2025, it's essential to grasp how the Internal Revenue Service (IRS) determines the taxability of your Social Security benefits.

Social Security benefits may be subject to federal taxes, with up to 50% taxable for certain income thresholds, and up to 85% for higher earners. Image source: Pexels.

The formula hinges on what's known as your “combined income,” which includes:

1. Your adjusted gross income (AGI) – the total of all your income streams, minus IRS-approved deductions.

2. Non-taxable interest – bonds must be included since they are resources available to you, even if they are not taxed directly

3. Half of your Social Security benefits – 50% of your benefits are thrown into this mix.

Once you've summed up these figures, you'll need to measure them against the IRS's income thresholds.

These thresholds are the financial guardrails intended to shield lower-income retirees from taxes and ensure that only those with more substantial incomes contribute a portion of their benefits back to the government.

Here's a quick rundown of the current thresholds:

For those with other filing statuses, such as the head of the household or qualifying widow(er), it is advised to follow the threshold for single filers.

If your combined income falls below the lower threshold, you can breathe easy—your benefits won't be taxed. Land between the two markers, and you'll see taxes on up to 50% of your benefits.

However, if you exceed the upper threshold, up to 85% of your benefits could be subject to taxation.

Effects of Other Deductions and Credits

Tax calculations are rarely straightforward, and this is no exception.

Your unique financial situation can significantly influence the taxability of your Social Security benefits. For instance, hefty medical expenses that chew through a percentage of your AGI may unlock a special deduction, reducing your taxable income.

Generosity can also be financially savvy. Qualified charitable contributions, particularly from tax-advantaged retirement accounts, can lower your tax bill.

It's worth taking the time to explore all the tax exemptions and credits available to you to get a clear picture of your obligations.

The taxation is determined by the IRS using combined income, which includes adjusted gross income, non-taxable interest, and half of Social Security benefits. Image source: Pexels.

Navigating Exceptions and Special Cases

Every individual's financial landscape is distinct, and the federal government acknowledges this in its approach to taxing benefits.

For those receiving benefits due to a disability, a variety of exemptions may apply, potentially easing the tax burden to accommodate medical expenses.

Moreover, certain types of non-taxable income or unique situations, like receiving lump-sum benefit payments, may follow different taxation rules.

When in doubt, it's wise to seek guidance from an IRS representative or a tax advisor to steer clear of any missteps. You can follow the steps provided by the IRS website to achieve this.

While on the subject of tax benefits and making our lives easier as we approach retirement, it’s helpful for us to learn little tips and tricks when it comes to Social Security. Learn more about keeping your Social Security income tax-free in this story!

At The GrayVine, we're more than just a community–we're a collective wealth of wisdom. By sharing our knowledge, we can all approach the future with confidence, ensuring that our retirement years are as golden as they should be.

Key Takeaways

- Social Security benefits may be subject to federal taxes, with up to 50% taxable for certain income thresholds, and up to 85% for higher earners.

- The taxation is determined by the IRS using combined income, which includes adjusted gross income, non-taxable interest, and half of Social Security benefits.

- There are specific thresholds for different filing statuses, with protections in place to avoid taxing lower-income retirees.

- Deductions, credits, and exemptions can influence the taxability of Social Security benefits, and special rules apply for disability recipients and other specific cases. Consulting with a tax advisor is recommended for clarity on individual situations.

Have you started planning for the potential tax on your Social Security benefits? Do you have tips or strategies that have worked for you? Or perhaps you have questions about how to navigate this complex topic? We invite you to share your insights, experiences, and queries in the comments below!