The smart way to stay on top of your finances with irregular income

- Replies 0

Dreaming of independence can be thrilling, but the reality of navigating that freedom often proves to be far more complicated than people expect.

The desire to be your own boss, set your own schedule, and chase your own vision carries with it a mixture of opportunity and risk.

While the wins can feel incredibly rewarding, the financial uncertainty can just as easily bring stress and doubt. The challenge lies in finding practical ways to manage money when the future is not predictable.

Jessica Moorhouse knows firsthand what it means to live with this delicate balance every single day.

As an accredited financial counselor, popular speaker, and television personality, she has built her own career on self-employment and understands how irregular income demands a different approach to financial planning.

She explained that the biggest hurdle for entrepreneurs and freelancers is managing the unpredictability of earnings while still covering regular bills and expenses.

“Sometimes you’ll be working around the clock because there’s high demand for your services or products, and sometimes you’ll have weeks or months with low or no income,” she said.

One of her key recommendations for anyone in this position is to prioritize building a substantial emergency fund.

Moorhouse suggests saving six to nine months of living expenses while also considering business costs that need to be covered.

She believes that cultivating what she calls an “abundance mindset” helps people approach money with a more constructive perspective, encouraging them to see solutions rather than limits.

This financial cushion, she explained, offers peace of mind and a safety net when inevitable slowdowns occur.

Also read: 9 hidden Social Security costs that could surprise you in retirement

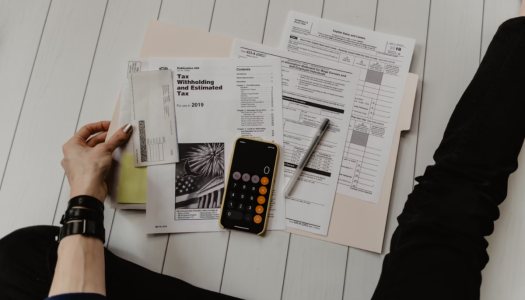

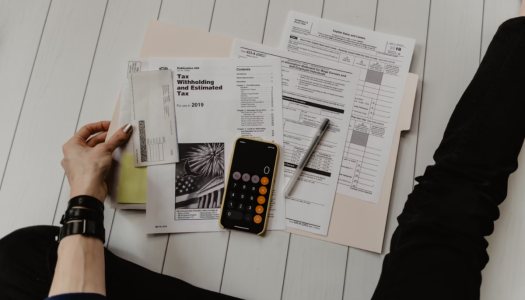

Organization is another cornerstone of her approach, particularly when income fluctuates in unpredictable cycles.

Moorhouse stresses the importance of tracking both income and expenses carefully, using tools such as spreadsheets to map out cash flow.

“The key is to have a decent buffer account so you still have cash on hand when you’re waiting to be paid or business is slow, or at the very least some form of credit, like a line of credit, that you can lean on when you need to,” she said.

By creating systems to manage unpredictability, freelancers and entrepreneurs can reduce stress and gain more control over their finances.

Over time, recognizing patterns becomes crucial in learning how to prepare for both high-demand and low-demand periods.

Moorhouse advises identifying busy seasons where work may be overwhelming, alongside slower stretches when income is scarce.

“This will give you a better sense of what to expect and provide ideas on how to build in some fail-safes with your business,” she said.

She also cautioned that consistently late-paying clients may require deposits, penalties, or, in some cases, ending the relationship altogether to maintain financial stability.

Also read: Protect your 401(k) savings—these hidden fees could drain your retirement funds

For those thinking of leaving traditional employment behind, Moorhouse is clear that preparation makes all the difference.

She emphasized building a strong financial cushion before making the leap, targeting the same amount recommended for an emergency fund.

“The easiest and quickest way, of course, is to find low-interest credit you can lean on when needed,” she said.

“But if you want to avoid debt, the key is to steadily put cash aside into a savings account until you reach your cushion goal. That’s what I did before leaving my last job, and it gave me a great sense of security during my first year on my own.”

Read next: How much emergency savings is enough? Experts say this number is growing—and here’s how to prepare

Have you ever faced the uncertainty of irregular income, and how did you adapt your financial habits to stay afloat? Join the conversation below and share your own strategies so others navigating the same challenges can learn from your experience.

The desire to be your own boss, set your own schedule, and chase your own vision carries with it a mixture of opportunity and risk.

While the wins can feel incredibly rewarding, the financial uncertainty can just as easily bring stress and doubt. The challenge lies in finding practical ways to manage money when the future is not predictable.

Jessica Moorhouse knows firsthand what it means to live with this delicate balance every single day.

As an accredited financial counselor, popular speaker, and television personality, she has built her own career on self-employment and understands how irregular income demands a different approach to financial planning.

She explained that the biggest hurdle for entrepreneurs and freelancers is managing the unpredictability of earnings while still covering regular bills and expenses.

“Sometimes you’ll be working around the clock because there’s high demand for your services or products, and sometimes you’ll have weeks or months with low or no income,” she said.

The smart way to stay on top of your finances with irregular income. Image source: Kelly Sikkema / Unsplash

One of her key recommendations for anyone in this position is to prioritize building a substantial emergency fund.

Moorhouse suggests saving six to nine months of living expenses while also considering business costs that need to be covered.

She believes that cultivating what she calls an “abundance mindset” helps people approach money with a more constructive perspective, encouraging them to see solutions rather than limits.

This financial cushion, she explained, offers peace of mind and a safety net when inevitable slowdowns occur.

Also read: 9 hidden Social Security costs that could surprise you in retirement

Organization is another cornerstone of her approach, particularly when income fluctuates in unpredictable cycles.

Moorhouse stresses the importance of tracking both income and expenses carefully, using tools such as spreadsheets to map out cash flow.

“The key is to have a decent buffer account so you still have cash on hand when you’re waiting to be paid or business is slow, or at the very least some form of credit, like a line of credit, that you can lean on when you need to,” she said.

By creating systems to manage unpredictability, freelancers and entrepreneurs can reduce stress and gain more control over their finances.

Over time, recognizing patterns becomes crucial in learning how to prepare for both high-demand and low-demand periods.

Moorhouse advises identifying busy seasons where work may be overwhelming, alongside slower stretches when income is scarce.

“This will give you a better sense of what to expect and provide ideas on how to build in some fail-safes with your business,” she said.

She also cautioned that consistently late-paying clients may require deposits, penalties, or, in some cases, ending the relationship altogether to maintain financial stability.

Also read: Protect your 401(k) savings—these hidden fees could drain your retirement funds

For those thinking of leaving traditional employment behind, Moorhouse is clear that preparation makes all the difference.

She emphasized building a strong financial cushion before making the leap, targeting the same amount recommended for an emergency fund.

“The easiest and quickest way, of course, is to find low-interest credit you can lean on when needed,” she said.

“But if you want to avoid debt, the key is to steadily put cash aside into a savings account until you reach your cushion goal. That’s what I did before leaving my last job, and it gave me a great sense of security during my first year on my own.”

Read next: How much emergency savings is enough? Experts say this number is growing—and here’s how to prepare

Key Takeaways

- Jessica Moorhouse, a financial counselor and expert, shared strategies for managing money when income is irregular, highlighting the unpredictability that self-employed people often face.

- She recommended building a robust emergency fund of six to nine months’ expenses, along with adopting an “abundance mindset” to stay solutions-focused.

- Moorhouse stressed the importance of organization, cash flow tracking, and spotting income patterns to prepare for both high-demand and low-demand cycles.

- She also emphasized creating a financial cushion before leaving traditional work, explaining how this provided her security during her first year of full-time self-employment.