This map shows if you're paying too much for healthcare: Is your home on the list?

By

Veronica E.

- Replies 0

Healthcare in America can feel like a never-ending maze—confusing, unpredictable, and, for many, overwhelmingly expensive.

Costs vary widely depending on where you live, making it difficult to plan for medical expenses, especially in retirement.

A recent study has shed light on these differences, showing that out-of-pocket costs aren’t just a personal burden—they’re a nationwide issue.

Whether you’re budgeting for routine checkups or managing a chronic condition, understanding these healthcare disparities can make all the difference.

By knowing where your county stands, you can take steps to better navigate the system and make informed financial decisions about your healthcare.

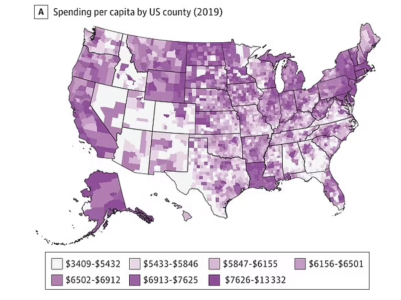

A comprehensive analysis by University of Washington researchers revealed just how much location influences healthcare costs.

Examining over 40 billion insurance claims and nearly a billion facility records, the study found that Americans paid nearly half a trillion dollars in out-of-pocket healthcare expenses in 2019 alone.

The disparities are striking. Depending on the county, some Americans pay up to 10 times more for medical services than others.

Rural communities and certain regions face significantly higher costs, making it harder for residents to access the care they need.

The study’s county-by-county map isn’t just data—it’s a wake-up call about healthcare affordability.

The study identified several spending patterns across the country. Rural states like Alaska, Wyoming, Montana, and the Dakotas reported some of the highest out-of-pocket expenses, with costs ranging from $720 to $2,335 per person.

Meanwhile, Southern states showed lower spending—not because healthcare is more affordable, but because many residents are underinsured and may avoid seeking care altogether.

In the Northeast and Upper Midwest, where private insurance is more common, costs remain high due to deductibles, co-pays, and co-insurance.

Metropolitan areas like Boston, Washington, DC, Miami, Los Angeles, and Seattle also saw significant out-of-pocket spending, largely due to the high cost of healthcare services in these cities.

For those over 65, Medicare provides essential coverage, but it doesn’t eliminate all costs.

The study found that even with Medicare, 11.5% of services were paid for out of pocket, totaling about $276 billion.

And these expenses are only increasing—according to the Kaiser Family Foundation, the average out-of-pocket cost per Medicare beneficiary rose from $900 in 1989 to $1,375 in 2019.

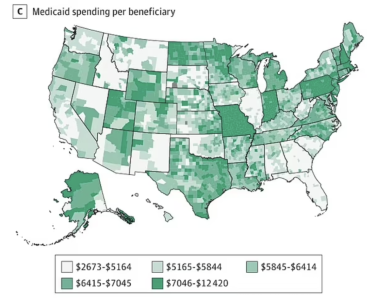

Many Americans rely on Medicaid, but not all states have expanded the program.

In 10 states (Wyoming, Texas, Kansas, Mississippi, Alabama, Georgia, South Carolina, Tennessee, Florida, and Wisconsin), about 2.5 million people fall into a coverage gap—earning too much for traditional Medicaid but not enough to qualify for subsidies on the health insurance exchange.

Without access to affordable coverage, some may delay or forgo necessary care, leading to poorer health outcomes in the long run.

One of the biggest drivers of out-of-pocket costs is healthcare utilization—how often people seek medical care.

Areas with higher rates of doctor visits, preventive screenings, and diagnostic tests tend to see increased spending.

However, for uninsured individuals, essential services can be prohibitively expensive, forcing nearly half of them to skip medical care due to cost concerns.

This data isn’t just about numbers—it’s about real people navigating an often costly healthcare system. Here’s what you can do to take control of your healthcare expenses:

Understanding the wide gaps in healthcare costs across the country is the first step in making informed decisions about your own care. Whether you’re planning for future medical expenses or advocating for better coverage, knowledge is key.

Related articles:

Uncover hidden healthcare costs: how one woman got billed extra for casual doctor’s questions

Elon Musk takes aim at government spending: What it means for Medicare and Medicaid benefits

Have you faced unexpectedly high out-of-pocket healthcare costs? Do you think where you live has impacted your medical expenses? Share your thoughts in the comments below!

Read next: Dietitians won't stop talking about this perfect late-night snack for insulin resistance!

Costs vary widely depending on where you live, making it difficult to plan for medical expenses, especially in retirement.

A recent study has shed light on these differences, showing that out-of-pocket costs aren’t just a personal burden—they’re a nationwide issue.

Whether you’re budgeting for routine checkups or managing a chronic condition, understanding these healthcare disparities can make all the difference.

By knowing where your county stands, you can take steps to better navigate the system and make informed financial decisions about your healthcare.

Healthcare costs vary significantly across counties, highlighting the impact of geography on out-of-pocket expenses. Image Source: Pexels / Total Shape.

The Price of Location: How Geography Impacts Your Wallet

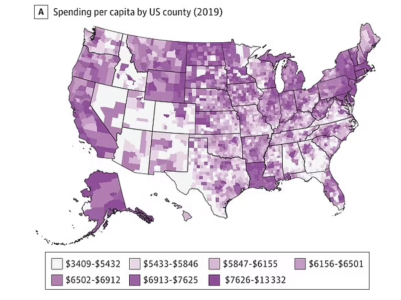

A comprehensive analysis by University of Washington researchers revealed just how much location influences healthcare costs.

Examining over 40 billion insurance claims and nearly a billion facility records, the study found that Americans paid nearly half a trillion dollars in out-of-pocket healthcare expenses in 2019 alone.

The disparities are striking. Depending on the county, some Americans pay up to 10 times more for medical services than others.

Rural communities and certain regions face significantly higher costs, making it harder for residents to access the care they need.

The study’s county-by-county map isn’t just data—it’s a wake-up call about healthcare affordability.

The Highs and Lows of Healthcare Spending

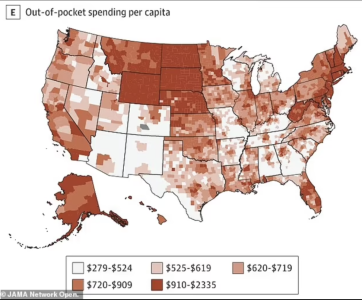

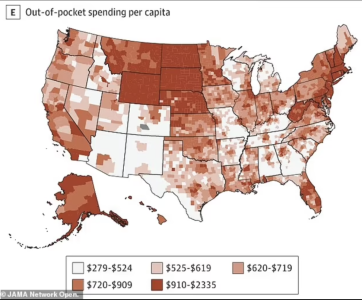

The study identified several spending patterns across the country. Rural states like Alaska, Wyoming, Montana, and the Dakotas reported some of the highest out-of-pocket expenses, with costs ranging from $720 to $2,335 per person.

Meanwhile, Southern states showed lower spending—not because healthcare is more affordable, but because many residents are underinsured and may avoid seeking care altogether.

Rural states faced the highest out-of-pocket costs in 2019, while underinsured Southern counties spent less—often by skipping care. Image Source: Daily Mail / JAMA Network Open.

In the Northeast and Upper Midwest, where private insurance is more common, costs remain high due to deductibles, co-pays, and co-insurance.

Metropolitan areas like Boston, Washington, DC, Miami, Los Angeles, and Seattle also saw significant out-of-pocket spending, largely due to the high cost of healthcare services in these cities.

Medicare’s Role and the Out-of-Pocket Reality

For those over 65, Medicare provides essential coverage, but it doesn’t eliminate all costs.

The study found that even with Medicare, 11.5% of services were paid for out of pocket, totaling about $276 billion.

And these expenses are only increasing—according to the Kaiser Family Foundation, the average out-of-pocket cost per Medicare beneficiary rose from $900 in 1989 to $1,375 in 2019.

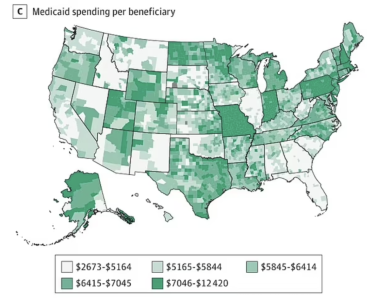

The Medicaid Gap and the Uninsured

Many Americans rely on Medicaid, but not all states have expanded the program.

In 10 states (Wyoming, Texas, Kansas, Mississippi, Alabama, Georgia, South Carolina, Tennessee, Florida, and Wisconsin), about 2.5 million people fall into a coverage gap—earning too much for traditional Medicaid but not enough to qualify for subsidies on the health insurance exchange.

Without access to affordable coverage, some may delay or forgo necessary care, leading to poorer health outcomes in the long run.

Highest healthcare spending per capita in 2019: Nassau, NY ($13,332), Suffolk, NY ($12,689), DC ($12,534). Lowest: Clark, ID ($3,410), Loving, TX ($3,923), Kennedy, TX ($4,027). Image Source: Daily Mail / JAMA Network Open.

Also read: Experts reveal the breakfast secret to a longer life—are you eating it?

The Impact of Healthcare Utilization

One of the biggest drivers of out-of-pocket costs is healthcare utilization—how often people seek medical care.

Areas with higher rates of doctor visits, preventive screenings, and diagnostic tests tend to see increased spending.

However, for uninsured individuals, essential services can be prohibitively expensive, forcing nearly half of them to skip medical care due to cost concerns.

Medicaid spending was lowest in Southeastern states that haven’t expanded access for low-income residents. Image Source: Daily Mail / JAMA Network Open.

A Call to Action: What Can You Do?

This data isn’t just about numbers—it’s about real people navigating an often costly healthcare system. Here’s what you can do to take control of your healthcare expenses:

- Understand your coverage – Review your insurance plan to know what’s covered and what your out-of-pocket costs may be.

- Advocate for change – Support policies that aim to reduce healthcare disparities and expand coverage.

- Plan ahead – Consider healthcare costs in your financial planning, especially as you approach retirement.

Understanding the wide gaps in healthcare costs across the country is the first step in making informed decisions about your own care. Whether you’re planning for future medical expenses or advocating for better coverage, knowledge is key.

Related articles:

Uncover hidden healthcare costs: how one woman got billed extra for casual doctor’s questions

Elon Musk takes aim at government spending: What it means for Medicare and Medicaid benefits

Key Takeaways

- There are significant disparities in out-of-pocket healthcare costs across US counties, with some Americans paying up to 10 times more than others.

- Factors such as fewer healthcare providers in rural areas, high underinsurance rates in Southern states, and reliance on private insurance in the Northeast and Upper Midwest contribute to these disparities.

- Residents in rural states like Alaska, Wyoming, Montana, and the Dakotas experience the highest out-of-pocket healthcare expenses, while Southern states show lower spending, possibly due to people avoiding care because of a lack of insurance.

- Research from the University of Washington School of Medicine indicates that the main driver of healthcare spending differences by county is the rate of healthcare service utilization, significantly impacting insurance and out-of-pocket costs for patients.

Have you faced unexpectedly high out-of-pocket healthcare costs? Do you think where you live has impacted your medical expenses? Share your thoughts in the comments below!

Read next: Dietitians won't stop talking about this perfect late-night snack for insulin resistance!