When affection turns to fraud: A retiree’s $47,000 heartbreak

By

Veronica E.

- Replies 0

The search for connection is something many people share, especially later in life.

Online spaces can feel like safe places to strike up conversations and meet new friends, but they also come with risks that aren’t always easy to see.

For one Florida retiree, what seemed like a promising relationship turned into a painful and costly lesson.

Thousands of dollars disappeared before the truth was uncovered, and the experience left behind more than financial loss.

His story is one of many that highlight how romance scams are growing—and why awareness is the best protection.

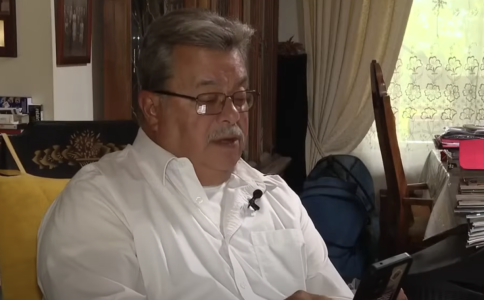

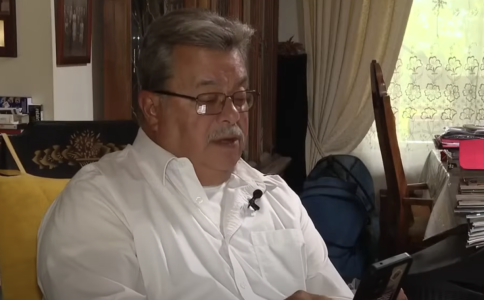

David Cruz, a 70-year-old retiree from Port Richey, Florida, thought he had found companionship when he accepted a friend request from a woman calling herself Bonnie Fleck.

She said she was an interior decorator from Indianapolis, and their conversations quickly became part of his daily routine.

They exchanged messages, phone calls, and what appeared to be video chats, which seemed to make the connection even more real.

But soon, Bonnie told David about a lucrative overseas job that required help with paperwork and travel expenses.

Trusting her, he began sending money—first $5,000, then more over time, eventually totaling $47,000 through wire transfers and even Bitcoin.

As the requests for money kept coming, David began to suspect something wasn’t right.

He reached out to the Pasco County Sheriff’s Office, who traced the supposed Indianapolis account to Nigeria.

Even the video chats turned out to be AI-generated fakes.

“At 70 years old and only having a very low income in Social Security, I felt I was going to lose everything that I have, that I worked my whole life for,” he said.

The emotional strain was as heavy as the financial hit.

“Depression, of course. Lost any self-worth, feelings of not realizing this sooner.”

His advice for others is straightforward: “If you start to feel something is not right, go with your gut. Don’t go just with your heart. Because your heart may be lying to you.”

David’s experience is far from rare.

The Federal Trade Commission reported that Americans lost more than $1.3 billion to romance scams in 2022, with older adults making up a significant share of victims.

Scammers know loneliness can make people vulnerable, and they use flattery, attention, and false intimacy to build trust.

Once they establish emotional connections, they invent urgent problems—medical emergencies, legal fees, or travel needs—and ask for money in hard-to-trace ways.

Cryptocurrency, wire transfers, and gift cards are among the most common payment requests.

Protecting against romance scams starts with a healthy dose of caution:

Falling victim to a romance scam is not a sign of foolishness—it’s proof of how skilled scammers have become at manipulation.

Victims often feel shame, but silence only allows scams to continue.

Seeking support from loved ones or counseling can help restore confidence and reduce isolation.

Financial losses may be difficult to recover, but emotional recovery is equally important.

Read next: Are your loved ones safe online? A guide to protecting seniors from cyber threats

Have you ever received a suspicious online message that didn’t feel right? Do you know someone who has dealt with a romance scam, or do you have tips for spotting one early? Sharing your story may help protect someone else from going through the same experience.

At The GrayVine, we believe in learning from one another and building safer communities together.

Online spaces can feel like safe places to strike up conversations and meet new friends, but they also come with risks that aren’t always easy to see.

For one Florida retiree, what seemed like a promising relationship turned into a painful and costly lesson.

Thousands of dollars disappeared before the truth was uncovered, and the experience left behind more than financial loss.

His story is one of many that highlight how romance scams are growing—and why awareness is the best protection.

A Florida retiree shared his story after losing $47,000 to an online romance scam, hoping to warn others about the growing threat. Image Source: YouTube / FOX 13 Tampa Bay.

A hopeful start that turned into heartbreak

David Cruz, a 70-year-old retiree from Port Richey, Florida, thought he had found companionship when he accepted a friend request from a woman calling herself Bonnie Fleck.

She said she was an interior decorator from Indianapolis, and their conversations quickly became part of his daily routine.

They exchanged messages, phone calls, and what appeared to be video chats, which seemed to make the connection even more real.

But soon, Bonnie told David about a lucrative overseas job that required help with paperwork and travel expenses.

Trusting her, he began sending money—first $5,000, then more over time, eventually totaling $47,000 through wire transfers and even Bitcoin.

Also read: Beware the love trap: USPS reveals how romance scams could cost you more than heartache

When the truth came out

As the requests for money kept coming, David began to suspect something wasn’t right.

He reached out to the Pasco County Sheriff’s Office, who traced the supposed Indianapolis account to Nigeria.

Even the video chats turned out to be AI-generated fakes.

“At 70 years old and only having a very low income in Social Security, I felt I was going to lose everything that I have, that I worked my whole life for,” he said.

The emotional strain was as heavy as the financial hit.

“Depression, of course. Lost any self-worth, feelings of not realizing this sooner.”

His advice for others is straightforward: “If you start to feel something is not right, go with your gut. Don’t go just with your heart. Because your heart may be lying to you.”

Also read: This online scam completely drained her bank account—Here’s how you can avoid the same disaster

Why romance scams are rising

David’s experience is far from rare.

The Federal Trade Commission reported that Americans lost more than $1.3 billion to romance scams in 2022, with older adults making up a significant share of victims.

Scammers know loneliness can make people vulnerable, and they use flattery, attention, and false intimacy to build trust.

Once they establish emotional connections, they invent urgent problems—medical emergencies, legal fees, or travel needs—and ask for money in hard-to-trace ways.

Cryptocurrency, wire transfers, and gift cards are among the most common payment requests.

Also read: Amazon warns Prime customers of rise in scam attempts: What to know and how to stay safe

How to protect yourself and loved ones

Protecting against romance scams starts with a healthy dose of caution:

- Be wary of strangers online. If someone you’ve never met professes love or asks for money, it’s a red flag.

- Never send money to someone you haven’t met in person. No matter how convincing the story is, don’t send funds through cash, wire transfers, gift cards, or cryptocurrency.

- Verify their identity. Run a reverse image search on profile photos to see if they appear under other names.

- Talk to someone you trust. Friends, family, or law enforcement may notice red flags you miss.

- Report suspicious activity. Victims are encouraged to contact the Federal Trade Commission or the FBI’s Internet Crime Complaint Center (IC3).

Also read: $745 million lost—and growing: How older adults are being targeted by scams

Healing after the scam

Falling victim to a romance scam is not a sign of foolishness—it’s proof of how skilled scammers have become at manipulation.

Victims often feel shame, but silence only allows scams to continue.

Seeking support from loved ones or counseling can help restore confidence and reduce isolation.

Financial losses may be difficult to recover, but emotional recovery is equally important.

Read next: Are your loved ones safe online? A guide to protecting seniors from cyber threats

Key Takeaways

- A 70-year-old Florida retiree lost $47,000 after falling victim to a romance scam involving fake online profiles and AI-generated video calls.

- The scammer, posing as an interior decorator, persuaded him to send money for supposed overseas job expenses, later traced by authorities to Nigeria.

- Romance scams are increasing, with the FTC reporting more than $1.3 billion in losses in 2022, especially affecting older adults.

- Experts advise never sending money to online-only connections, verifying identities through image searches, discussing concerns with trusted people, and reporting scams to the FTC or FBI’s IC3.

Have you ever received a suspicious online message that didn’t feel right? Do you know someone who has dealt with a romance scam, or do you have tips for spotting one early? Sharing your story may help protect someone else from going through the same experience.

At The GrayVine, we believe in learning from one another and building safer communities together.