Your 2025 Social Security check could soar—are you eligible?

By

Aubrey Razon

- Replies 4

Big changes are coming to your Social Security checks in 2025! This adjustment could mean a major boost for your wallet.

Stay tuned to find out how this affects you and your future.

The COLA is a safeguard designed to protect the buying power of Social Security benefits against inflation. When the cost of living rises, so do your benefits, ensuring that you can maintain your standard of living.

For 2025, the COLA has been announced at 2.5%, a moderate uptick that promises to bring a little extra comfort to retirees across the nation.

This increase will affect various types of Social Security benefits, including full retirement, disability retirement, delayed retirement, and early retirement.

The adjustment is calculated based on your current benefits, meaning that the more you receive now, the greater the dollar amount of your increase will be.

To give you a clearer picture of what to expect, let's break down the numbers.

Here's a comparison of the maximum payments for different Social Security categories, showing the changes from 2024 to 2025:

These figures represent the maximum possible payments, and your personal increase will depend on your individual circumstances, such as your earnings record and the age at which you started receiving benefits.

For those who have delayed retirement, the news is particularly sweet, with the maximum payment reaching a robust $5,180.

It's a reward for those who have waited to tap into their Social Security benefits, and it's a testament to the power of patience.

The beauty of the COLA is that it's automatic—there's no need to apply or fill out any paperwork.

Starting in January 2025, you should see the increase reflected in your Social Security deposits.

However, it's crucial to keep your details current with the Social Security Administration.

A change of address or a new bank account can lead to delays, so make sure your information is up to date, especially if you've recently moved or switched banks.

For those who like to keep a close eye on their finances, the “My Social Security” online account is an invaluable resource.

It allows you to check your payment history and confirm the new benefit amount, giving you peace of mind that everything is in order.

Direct deposit is the way to go for a smooth experience. It's secure, fast, and eliminates the potential headaches that come with physical checks.

If you haven't set up direct deposit yet, now's the time to consider it.

The 2025 COLA increase is more than just a boost to your monthly budget—it's a reminder of the importance of financial planning. You can read about the finalized payment schedule of Social Security benefits here.

As we age, our needs and expenses can change, and staying on top of these adjustments ensures that we can enjoy our retirement years with fewer financial worries.

Remember, while the COLA increase is a welcome change, it's just one piece of the retirement puzzle. Let's use it as a stepping stone to a secure and fulfilling future.

Here's to your health, happiness, and financial resilience in 2025 and beyond!

Have you already started thinking about how the 2025 COLA increase will affect your life? Do you have tips for fellow retirees on how to manage the extra funds? Share your insights and experiencesin the comments below.

Stay tuned to find out how this affects you and your future.

The COLA is a safeguard designed to protect the buying power of Social Security benefits against inflation. When the cost of living rises, so do your benefits, ensuring that you can maintain your standard of living.

For 2025, the COLA has been announced at 2.5%, a moderate uptick that promises to bring a little extra comfort to retirees across the nation.

This increase will affect various types of Social Security benefits, including full retirement, disability retirement, delayed retirement, and early retirement.

The adjustment is calculated based on your current benefits, meaning that the more you receive now, the greater the dollar amount of your increase will be.

To give you a clearer picture of what to expect, let's break down the numbers.

Here's a comparison of the maximum payments for different Social Security categories, showing the changes from 2024 to 2025:

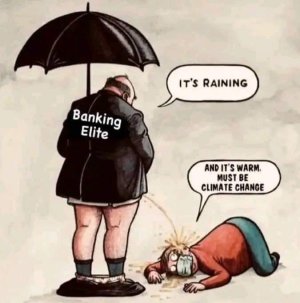

The increase for full retirement or disability retirement benefits will reach a maximum of $4,018 per month, and $5,180 for those who have delayed retirement. Image source: The GrayVine.

For those who have delayed retirement, the news is particularly sweet, with the maximum payment reaching a robust $5,180.

It's a reward for those who have waited to tap into their Social Security benefits, and it's a testament to the power of patience.

The beauty of the COLA is that it's automatic—there's no need to apply or fill out any paperwork.

Starting in January 2025, you should see the increase reflected in your Social Security deposits.

However, it's crucial to keep your details current with the Social Security Administration.

A change of address or a new bank account can lead to delays, so make sure your information is up to date, especially if you've recently moved or switched banks.

For those who like to keep a close eye on their finances, the “My Social Security” online account is an invaluable resource.

It allows you to check your payment history and confirm the new benefit amount, giving you peace of mind that everything is in order.

Direct deposit is the way to go for a smooth experience. It's secure, fast, and eliminates the potential headaches that come with physical checks.

If you haven't set up direct deposit yet, now's the time to consider it.

The 2025 COLA increase is more than just a boost to your monthly budget—it's a reminder of the importance of financial planning. You can read about the finalized payment schedule of Social Security benefits here.

As we age, our needs and expenses can change, and staying on top of these adjustments ensures that we can enjoy our retirement years with fewer financial worries.

Remember, while the COLA increase is a welcome change, it's just one piece of the retirement puzzle. Let's use it as a stepping stone to a secure and fulfilling future.

Here's to your health, happiness, and financial resilience in 2025 and beyond!

Key Takeaways

- In 2025, there will be a 2.5% COLA increase to Social Security benefits for retirees in the United States, to assist with the rising cost of living.

- Various groups of Social Security beneficiaries will see different increases to their maximum monthly payments, based on the type of benefit they receive.

- The increase for full retirement or disability retirement benefits will reach a maximum of $4,018 per month, and $5,180 for those who have delayed retirement.

- The Social Security COLA adjustment is automatic, with no need for a specific application, and beneficiaries can verify the correct increase by using online tools such as “My Social Security” account.

Last edited: